American Dollar Strengthens Against All Currencies

The reason was the latest statements from U.S. Federal Reserve representatives, who indicated that, given the current government shutdown, further reductions in interest rates would be inappropriate.

Against the backdrop of budgetary turmoil in Washington, where uncertainty about the future of fiscal policy continues to grow, such rhetoric from the U.S. central bank came as unexpected and, essentially, counterproductive under current circumstances.

Traders who had expected a more flexible stance from the Fed reacted by selling euros and moving into dollar-denominated assets they considered more reliable.

However, the long-term consequences of this move remain unclear. The strengthening of the dollar will undoubtedly put pressure on American exporters, whose products will become less competitive in the global market.

On the other hand, this same development is likely to help reduce inflationary pressure, as imported goods will become cheaper for American consumers.

Today, there is no statistical data from the Eurozone, so the euro may get a chance for a slight correction. However, this potential rebound should not be overestimated. The lack of fundamental drivers does not guarantee sustainable growth.

Instead, it is a matter of technical necessity—a temporary breather after a strong downward movement.

Market players may try to take profits after successful euro shorts, potentially pushing the exchange rate upward temporarily.

Nevertheless, the long-term prospects for the European currency remain bleak. The looming threat of recession, political crisis, and geopolitical instability creates an unfavorable environment for the euro.

Any negative news from the region could again collapse the exchange rate, offsetting all attempts at correction.

There is also no statistical data from the UK today, so the pound has every chance to continue falling toward new monthly lows.

If data aligns with analysts' expectations, it is advisable to rely on the Mean Reversion strategy. If data significantly exceeds or falls short of expectations, using the Momentum strategy is recommended.

Momentum Strategy (Breakout Strategy):

EUR/USD

- Buying on a breakout above 1.1580 may lead to euro growth toward 1.1611 and 1.1655

- Selling on a breakout below 1.1555 may result in a decline toward 1.1520 and 1.1489

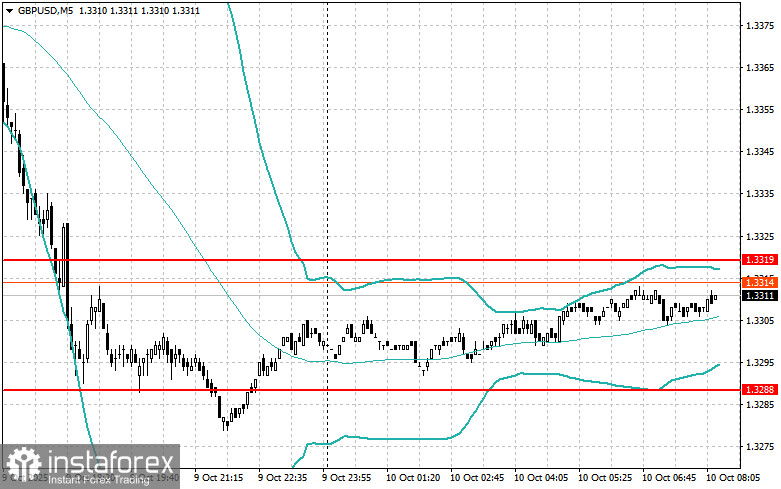

GBP/USD

- Buying on a breakout above 1.3310 may lead to pound growth toward 1.3330 and 1.3360

- Selling on a breakout below 1.3295 may result in a drop toward 1.3270 and 1.3225

USD/JPY

- Buying on a breakout above 152.90 may lead to dollar growth toward 153.20 and 153.60

- Selling on a breakout below 152.60 may result in dollar declines toward 152.30 and 152.00

Mean Reversion Strategy:

EUR/USD

- Will look to sell after a failed breakout above 1.1583 with a return below this level

- Will look to buy after a failed breakout below 1.1556 with a return to this level

GBP/USD

- Will look to sell after a failed breakout above 1.3319 with a return below this level

- Will look to buy after a failed breakout below 1.3288 with a return to this level

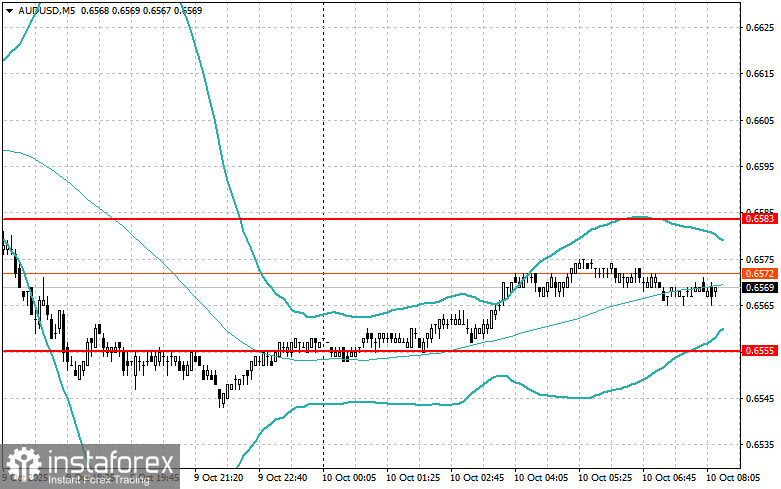

AUD/USD

- Will look to sell after a failed breakout above 0.6583 with a return below this level

- Will look to buy after a failed breakout below 0.6555 with a return to this level

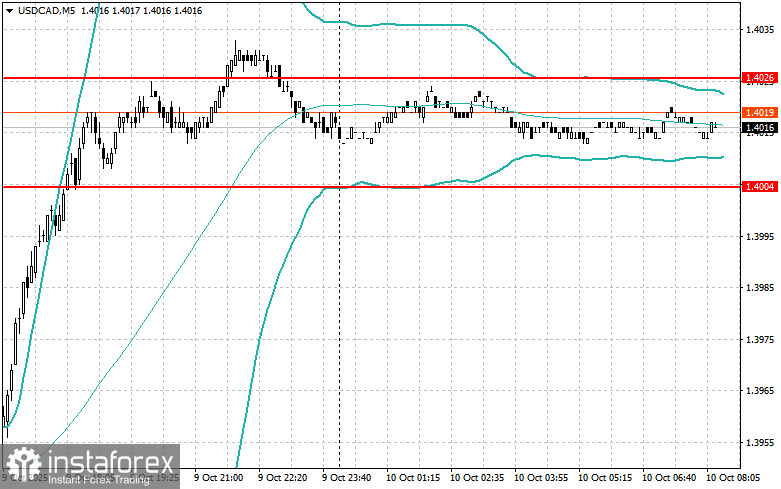

USD/CAD

- Will look to sell after a failed breakout above 1.4026 with a return below this level

- Will look to buy after a failed breakout below 1.4004 with a return to this level

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română