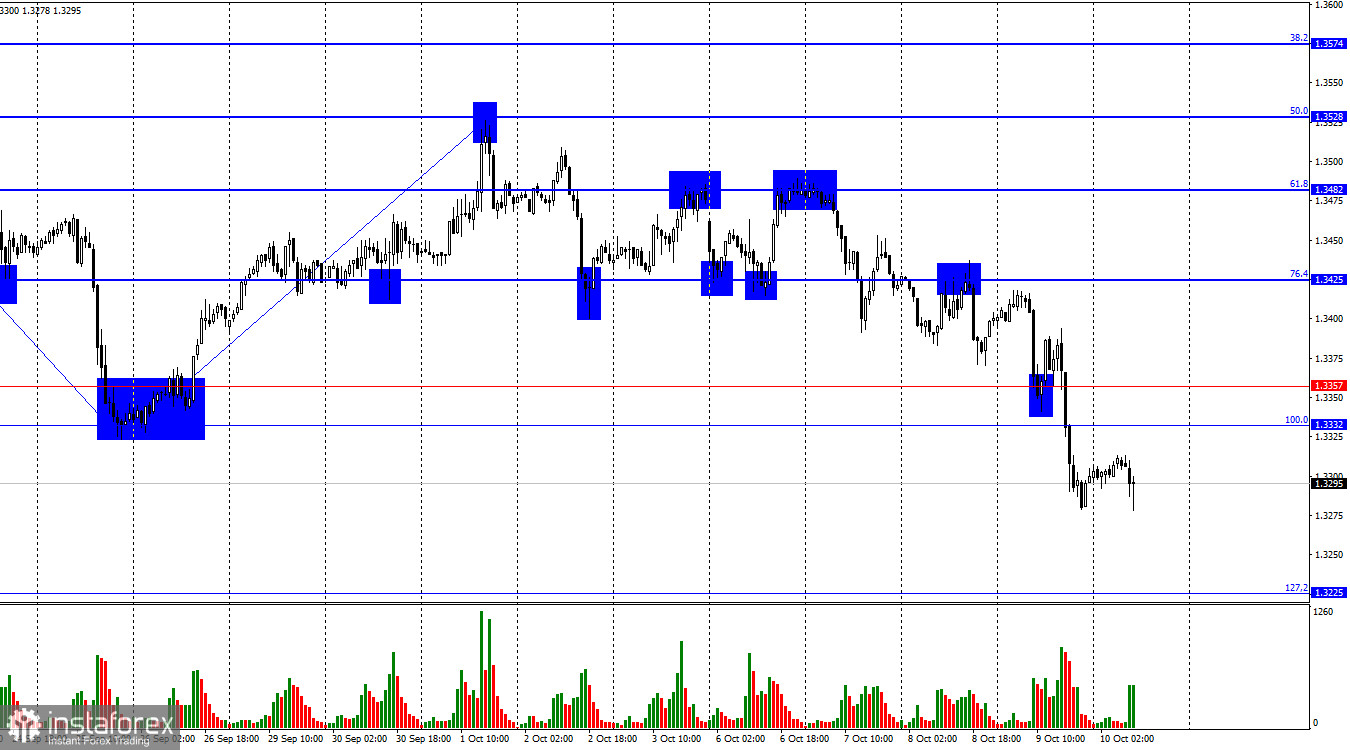

On the hourly chart, the GBP/USD pair on Thursday consolidated below the support level of 1.3332–1.3357, which allows us to expect a continued decline toward the next Fibonacci level of 127.2% – 1.3225. Consolidation above the 1.3332–1.3357 zone would work in favor of the British pound and some growth toward the 76.4% retracement level at 1.3425.

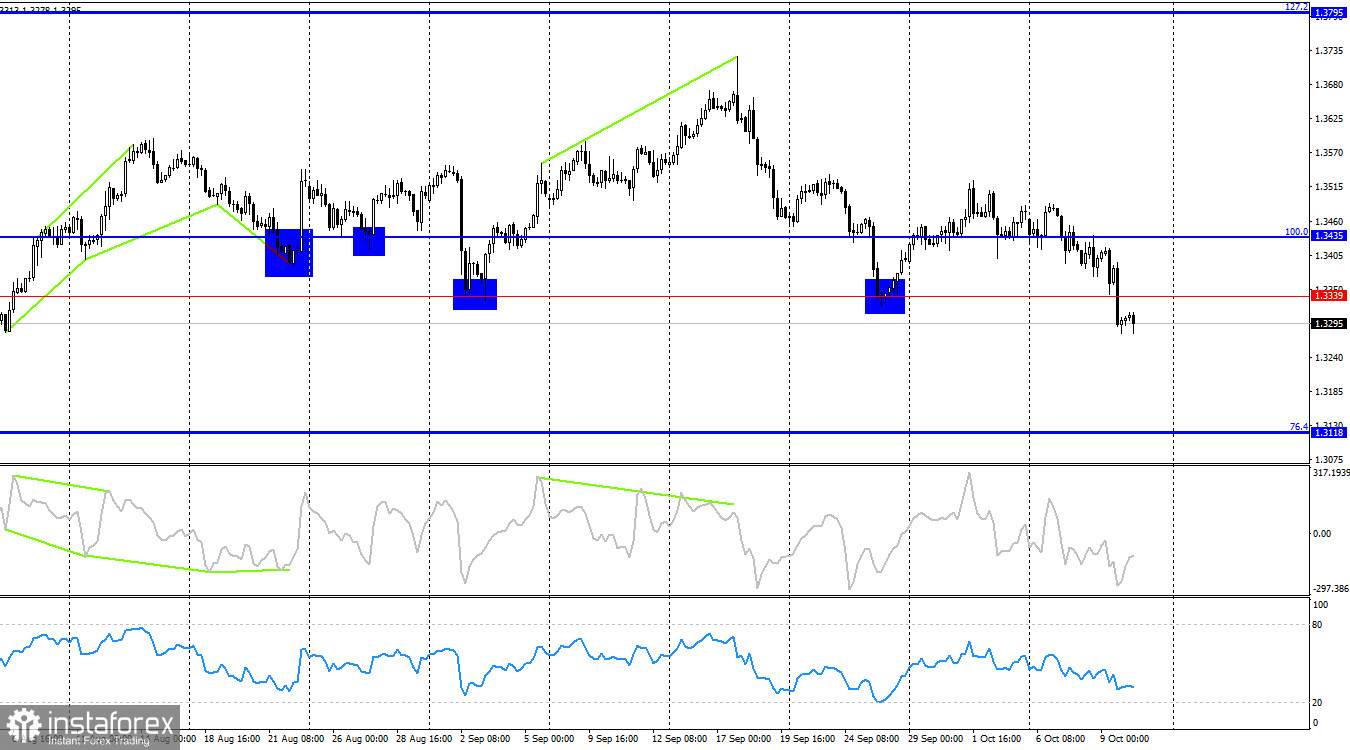

The wave situation remains bearish. The last completed upward wave did not break the previous peak, while the last downward wave did not break the previous low. The news background over recent weeks has been negative for the US dollar, but bullish traders are not yet taking advantage of the opportunities to go on the offensive. To cancel the bearish trend, the pair needs to rise above the 1.3528 level; for now, the bears are leading the charge.

On Wednesday, the FOMC minutes were released in the US, and on Thursday Jerome Powell delivered a speech. Although these events were opposite in meaning, the bears continued their attack almost without pause. Let me remind you that the FOMC minutes overall showed the Committee's readiness to keep voting for monetary policy easing – but not at an aggressive pace. At the same time, Jerome Powell made it clear yesterday that the Fed will make decisions solely based on economic data. If the state of the economy and labor market does not require stimulus, the easing process will be halted. The problem is that it is currently impossible to understand the state of the US labor market, since the latest Nonfarm Payrolls report has been delayed until the government shutdown ends. When that will happen is unknown, so theoretically the report may not be published for quite a while, and its value could be significantly distorted due to the Bureau of Labor Statistics being "on leave" since October 1. In my view, the current dollar growth does not match the news background, but the bears have gathered momentum and are difficult to stop for now.

On the 4-hour chart, the pair consolidated below the 1.3339–1.3435 zone, which allows us to expect a continued decline toward the 76.4% retracement level at 1.3118. Consolidation above 1.3339 would favor the pound and some upward movement. No emerging divergences are observed today on any indicators, while further US dollar growth remains in serious doubt.

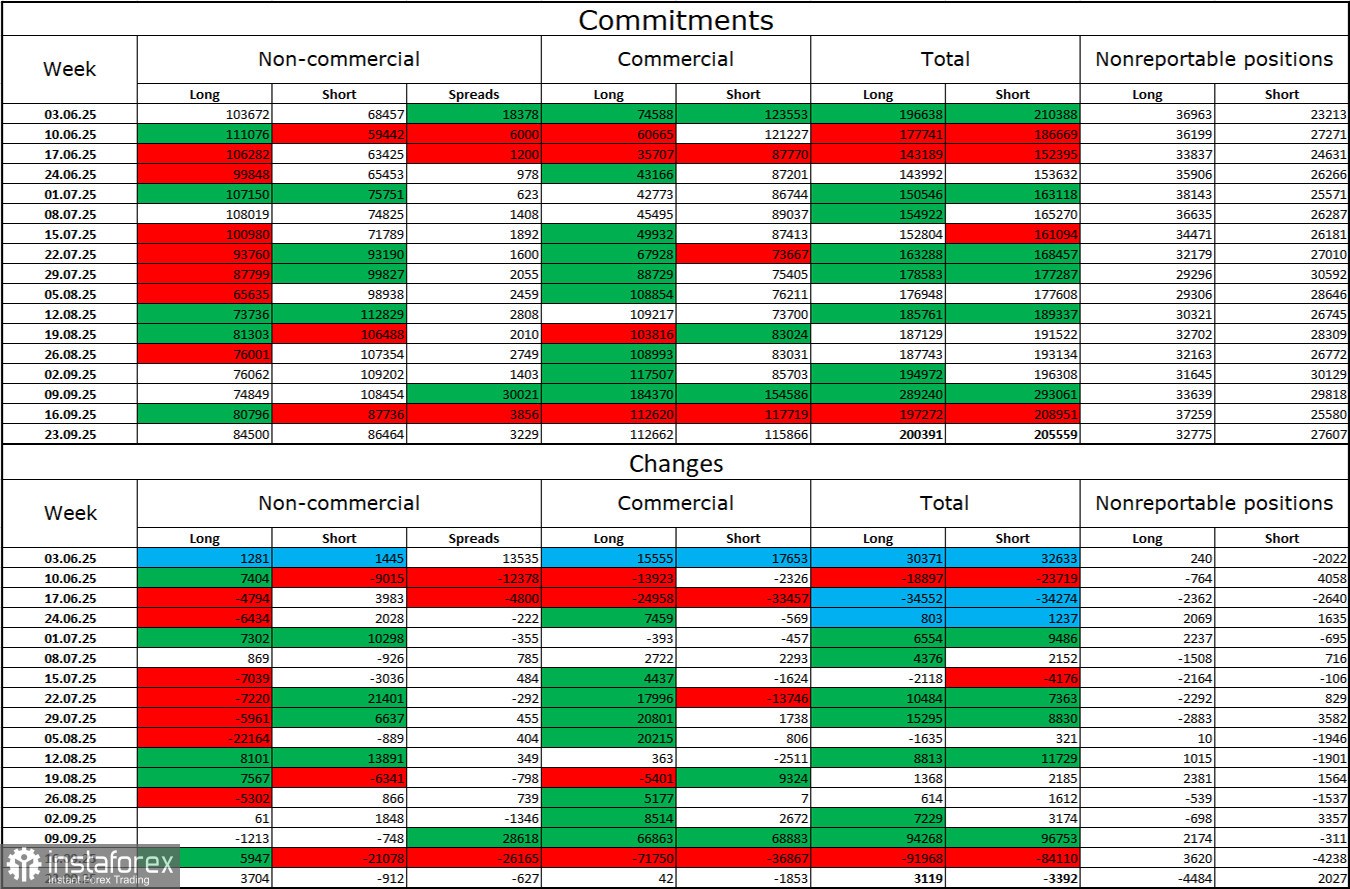

Commitments of Traders (COT) Report:

The sentiment of the "Non-commercial" trader category became more bullish over the last reporting week. The number of long positions held by speculators increased by 3,704, while the number of short positions decreased by 912. The gap between long and short positions now stands at roughly 85,000 versus 86,000. Bullish traders are once again tipping the scales in their favor.

In my opinion, the pound still faces prospects of decline, but with each passing month the US dollar looks weaker and weaker. Whereas earlier traders worried about Donald Trump's protectionist policies without knowing what results they might bring, now they may be worried about the consequences of those policies: a possible recession, the constant introduction of new tariffs, Trump's clashes with the Fed, as a result of which the regulator could become "politically controlled" by the White House. Thus, the pound now looks much less dangerous than the US currency.

News calendar for the US and UK:

- US – University of Michigan Consumer Sentiment Index (14:00 UTC).

On October 10, the economic calendar contains only one secondary event. The impact of the news background on market sentiment on Friday will be weak.

GBP/USD Forecast and Trading Advice:

Selling the pair was possible earlier on a rebound from the 1.3482 level with targets at 1.3425 and 1.3357 on the hourly chart. New selling opportunities appeared after closing below 1.3332 with a target at 1.3225. Today these trades can be kept open. Buying can be considered on a rebound from the 1.3225 level or on a close above the 1.3332–1.3357 level.

Fibonacci grids are built from 1.3332–1.3725 on the hourly chart and from 1.3431–1.2104 on the 4-hour chart.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română