The political crisis in the United States continues to grip financial markets, exerting significant influence, with the dollar being the main beneficiary. How long will its positive momentum on Forex continue? Let's try to analyze this question.

The political crisis in the US, known as the shutdown, has already exhausted everyone and is causing substantial losses to the American economy. There seems to be no end in sight, as the political standoff in Washington remains intense. The absence of fresh economic data also unnerves and disorients investors. This Friday, the release of the Department of Labor employment report was expected, but it did not happen due to the government shutdown, leaving the markets in limbo and creating uncertainty about the Fed's future interest rate cuts.

While the shutdown continues to hang over the markets, the dollar will likely continue to receive support as a safe-haven asset. However, once the government resumes operations, the local political crisis is resolved, and the Department of Labor releases the September jobs report, the US currency could come under serious pressure and, according to the ICE index, could again fall just below 97.00.

What can be expected in the markets today given the current situation?

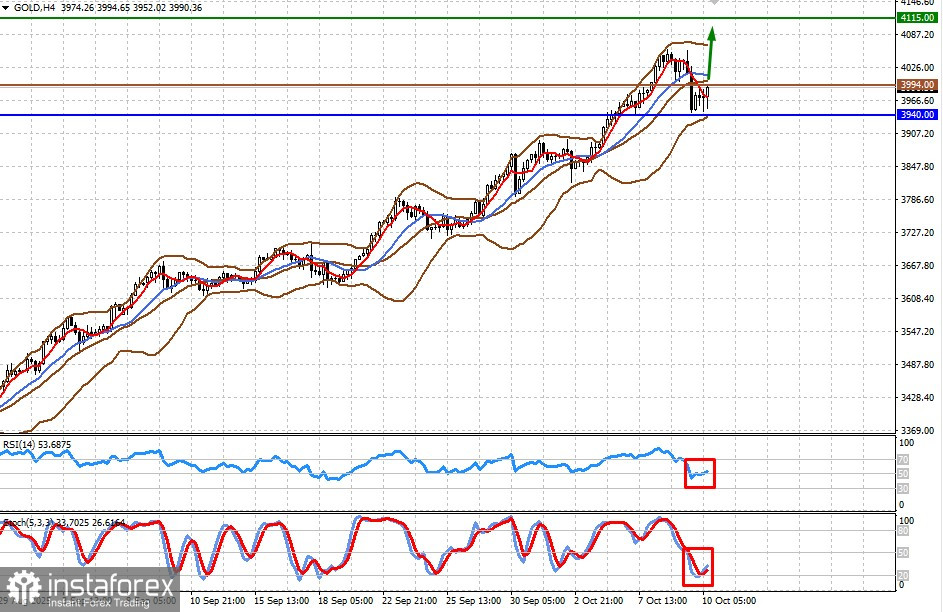

I believe that the upward trend in company stocks, especially in the US, will continue. Gold prices, after a minor correction, will recover and rise above $4,000 per troy ounce. As for the US dollar, I think it may correct slightly downward, but not by much, since the shutdown continues to hang over the markets. Its further rise, however, will likely be capped around 100.00 on the index.

Daily Forecast:

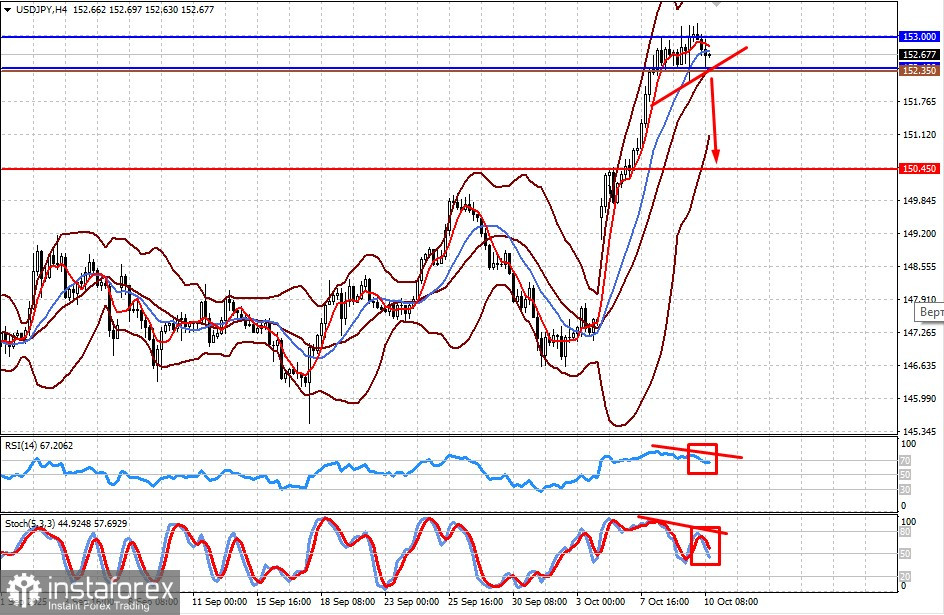

USD/JPY The pair found resistance at 153.00. Its failure to break through this level could lead to a corrective drop toward 150.45. A potential selling level could be 152.35 if the price falls below the 152.40 support.

Gold Gold prices are rising after a minor downward correction. The persistence of several negative geopolitical factors will continue to support gold prices. A potential buying level could be 3,994.00.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română