Trade Review and Tips for Trading the British Pound

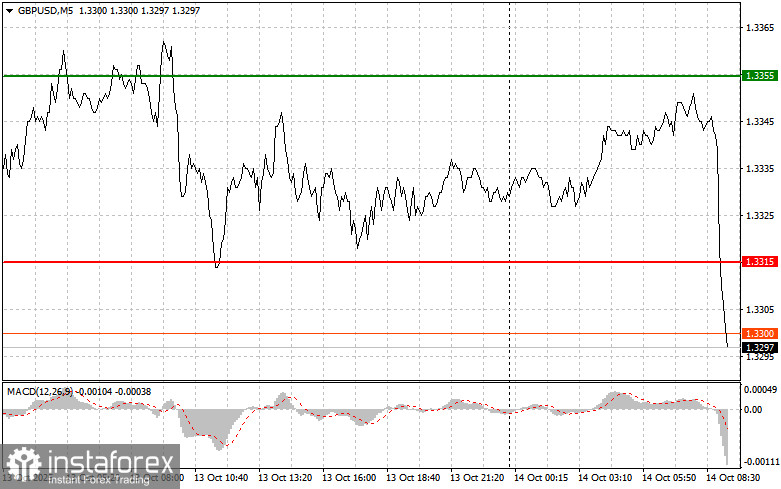

The test of the 1.3315 level occurred when the MACD indicator had already dropped significantly below the zero line, limiting the pair's downside potential.

Attempts by the United States and China to stabilize rapidly deteriorating trade relations have yet to succeed, negatively affecting risk-sensitive assets, including the British pound. The uncertainty surrounding the potential escalation of the trade war continues to raise investor fears about the prospects of global economic growth, putting pressure on currencies closely tied to global market sentiment. The British pound is also affected by internal factors, including political instability. Meanwhile, the strengthening of the U.S. dollar, fueled by the Federal Reserve's cautious monetary policy stance, further contributes to the pound's decline.

Today, traders are paying close attention to labor market data from the United Kingdom, including unemployment figures and average earnings. Also, a key event for the day is a speech by Andrew Bailey, Governor of the Bank of England. Labor market indicators play a central role in assessing the overall health of the UK economy. Positive data — such as declining unemployment and rising wages — are generally seen as a sign of stability and can support the British pound. Bailey's statement is of particular interest to market participants — he is expected to address the current economic outlook, inflation prospects, and further steps in monetary policy.

Only unexpected results in the published data or notable comments from Bailey are likely to trigger significant volatility in the currency market. If labor market data exceed forecasts and Bailey strikes an optimistic tone, the pound may strengthen. Conversely, weak data and cautious comments from the BoE's chief could result in a decline in the pound's value.

As for the intraday strategy, I will rely primarily on Scenarios 1 and 2.

Buy Scenarios

Scenario 1: I plan to buy the pound today at the entry point around 1.3355 (green line on the chart) with a target at 1.3407 (thicker green line on the chart). Around 1.3407, I intend to exit long positions and initiate short positions in the opposite direction, expecting a 30–35 pip pullback from the level. A bullish outlook for the pound today is only appropriate if solid economic data are released.

Important: Before entering long positions, make sure the MACD indicator is above the zero line and has just started to rise from it.

Scenario 2: I also plan to buy the pound today if the price tests the 1.3325 level twice in a row while the MACD indicator is in oversold territory. This would limit the pair's downside potential and may lead to an upward reversal. In this case, a rise toward the opposite levels of 1.3407 and 1.3455 can be expected.

Sell Scenarios

Scenario 1: I plan to sell the pound today after a breakout below 1.3325 (red line on the chart), which may lead to a sharp drop in the pair. Sellers will aim for the 1.3263 level, where I plan to exit the market and consider opening long positions in the opposite direction, expecting a 20–25 pip rebound from the level. Pound sellers will likely build momentum with any weak data.

Important: Before selling, ensure that the MACD indicator is below the zero line and has just begun to decline from it.

Scenario 2: I also plan to sell the pound today if the price tests the 1.3355 level twice in a row while the MACD indicator is in overbought territory. This would limit the pair's upward potential and could lead to a reversal downward. In that case, I expect a decline toward the opposite levels of 1.3325 and 1.3263.

What's on the Chart:

- Thin green line – entry-level for opening buy trades

- Thick green line – projected price for placing Take Profit or closing trades manually, as further growth above this level is unlikely

- Thin red line – entry-level for opening sell trades

- Thick red line – projected price for placing Take Profit or closing trades manually, as further decline below this level is unlikely

- MACD indicator – when entering the market, use overbought or oversold zones as confirmation

Important. Beginner traders in the Forex market should be cautious when deciding to enter the market. Before major fundamental releases, it is best to remain out of the market to avoid sharp price swings. If trading during the news, always use stop-loss orders to minimize losses. Without proper stop-loss levels, you can quickly lose your entire deposit—especially if you don't use money management and trade with large volumes.

And remember: to trade successfully, you must follow a clear trading plan, such as the one presented above. Making spontaneous trades based on short-term price action is a losing strategy for any intraday trader.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română