Macroeconomic Report Review:

There are a few macroeconomic reports scheduled for Thursday. The most noteworthy will come from the United Kingdom, although even these are not expected to have a major impact. In roughly an hour, the UK will release data on industrial production and gross domestic product. However, the GDP figure will be monthly rather than quarterly. Markets tend to place more weight on quarterly and annual data. As for industrial production, it is not seen as a top-tier indicator among traders. Nevertheless, both reports could trigger a market reaction simply because no other significant data is scheduled for the day. In the Eurozone and the United States, no important macroeconomic reports are expected.

Fundamental Event Review:

A large number of fundamental events are scheduled for Thursday, but few of them are likely to attract meaningful attention from market participants. In Europe, speeches are expected from ECB President Christine Lagarde and Chief Economist Philip Lane. In the U.S., several FOMC members will speak, including Thomas Barkin, Michael Barr, Steven Mirran, Christopher Waller, and Michelle Bowman, among others.

As noted in earlier reviews, both Lagarde and Powell have spoken frequently in recent weeks. As a result, the market has a relatively clear understanding of what to expect from both central banks in the near term. The ECB has no plans to lower rates, as there is presently no reason to do so, while the Fed is expected to continue easing monetary policy due to persistent weakness in the U.S. labor market.

General Conclusions:

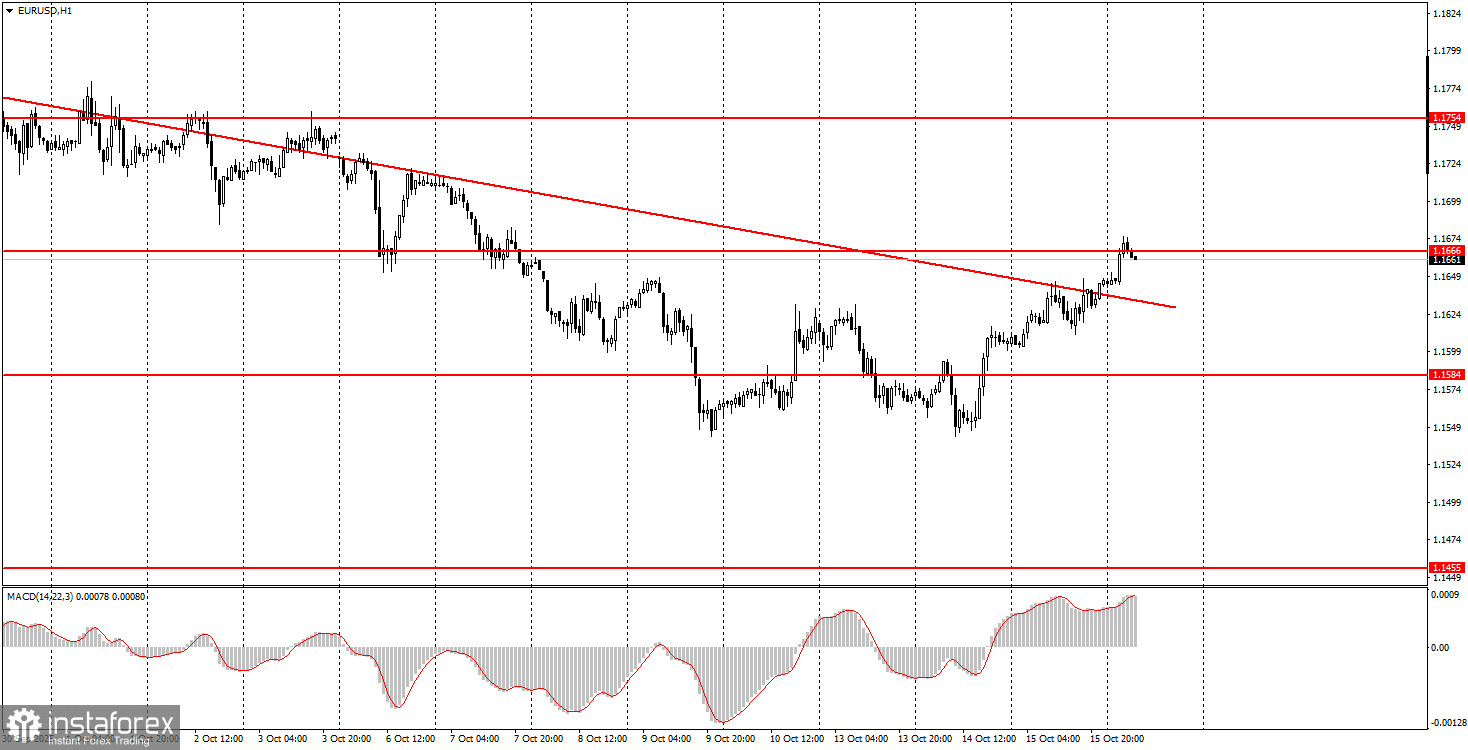

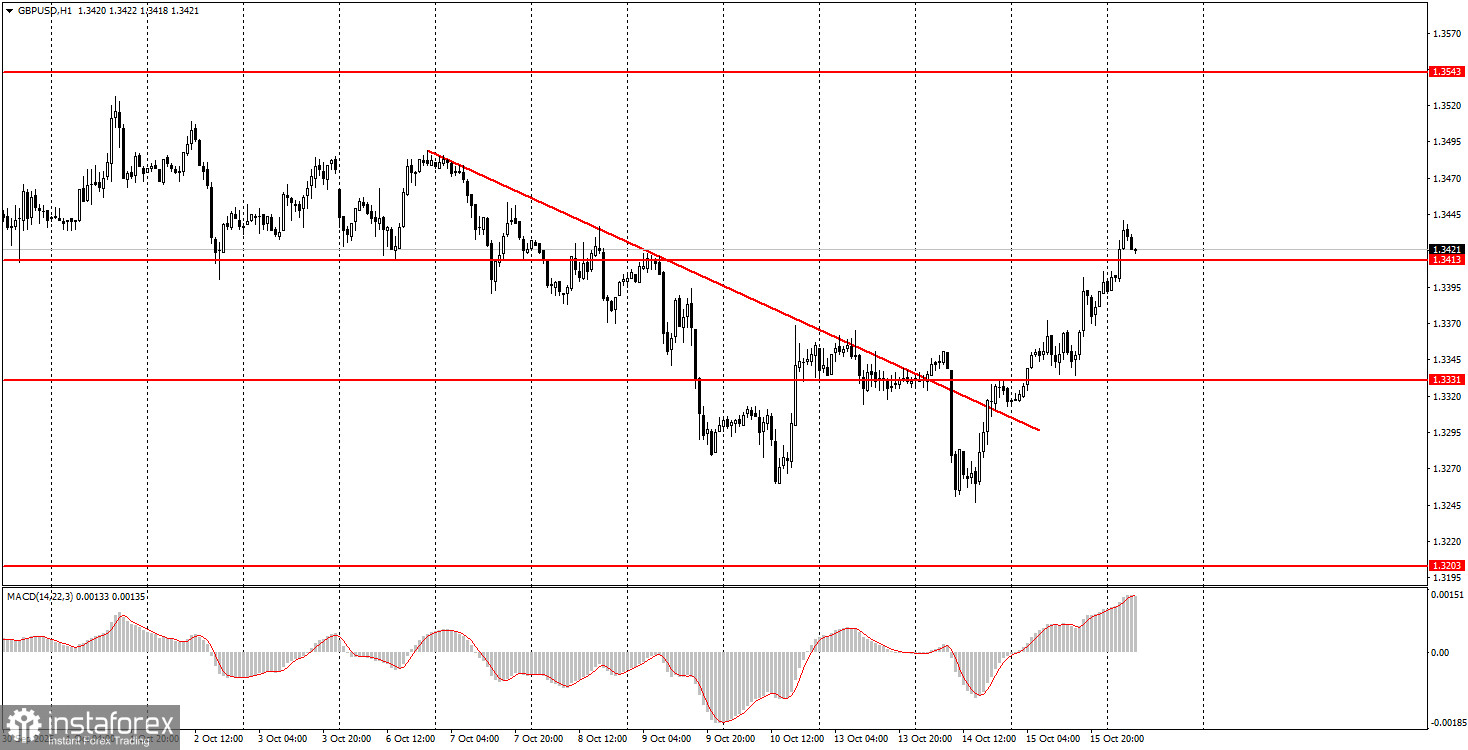

During the second-to-last trading day of the week, both currency pairs may continue their upward movements, having broken above trendlines on their respective charts. The euro has established a favorable trading zone at 1.1655–1.1666, while the British pound has a similar range at 1.3413–1.3421. From these areas, both long and short positions can be considered depending on how the price behaves near these levels.

Core Rules of the Trading System:

- Signal strength is judged by the time required for signal formation (bounce or breakout). The quicker the formation, the stronger the signal.

- If two or more false trades were opened at a level, any subsequent signals from that level should be ignored.

- In flat markets, currency pairs may produce numerous false signals or none at all. It's best to stop trading at the first signs of a flat.

- Trades should be opened during the European session through the midpoint of the U.S. session. All trades should be manually closed afterward.

- On the hourly chart, MACD signals should only be used when good volatility and a clear trend are confirmed with a trendline or channel.

- If two levels are too close to each other (within 5 to 20 pips), they should be considered a support/resistance zone.

- After 15-20 pips of movement in the correct direction, set the Stop Loss at breakeven.

Chart Annotations:

- Support/resistance levels: key targets for opening buy/sell trades. Take Profit levels can also be set near them.

- Red lines: trendlines or channels indicating the current trend and preferred trade direction.

- MACD (14,22,3): histogram and signal line, used as an auxiliary signal generator.

Important Note:

Key speeches and economic reports (always available in the news calendar) can significantly affect currency pair movements. During such events, trade with extreme caution or exit the market to avoid sudden reversals against the prior trend.

Reminder for Beginners:

No trade is guaranteed to be profitable. The key to long-term success in forex trading is to develop a clear strategy and apply sound money management principles.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română