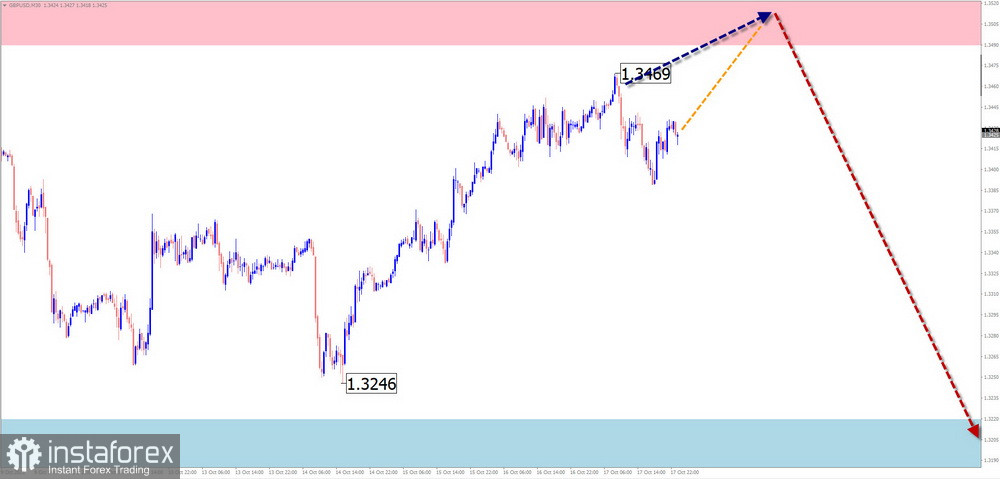

GBP/USD

Brief Analysis:

The current upward wave structure of the British pound's main pair has been developing since the beginning of the year. Within the wave structure, a complex correction in the form of an extended horizontal flat has been forming since late June. The correction structure has entered its final phase, but as of the time of analysis, no signs of completion have appeared.

Weekly Forecast:

During the upcoming week, the pair's price is expected to move within the channel between the nearest opposing zones. At the start of the week, a bullish direction is more probable. Pressure on the calculated resistance zone is possible, including a brief breakout above its upper limit. Toward the end of the week, the likelihood of a directional reversal and the start of a decline increases.

Potential Reversal Zones

- Resistance: 1.3490 / 1.3540

- Support: 1.3220 / 1.3170

Recommendations:

- Sell: Possible after reversal signals appear near the resistance zone, using a fractional volume for intraday trading.

- Buy: Possible within individual sessions using a reduced volume size.

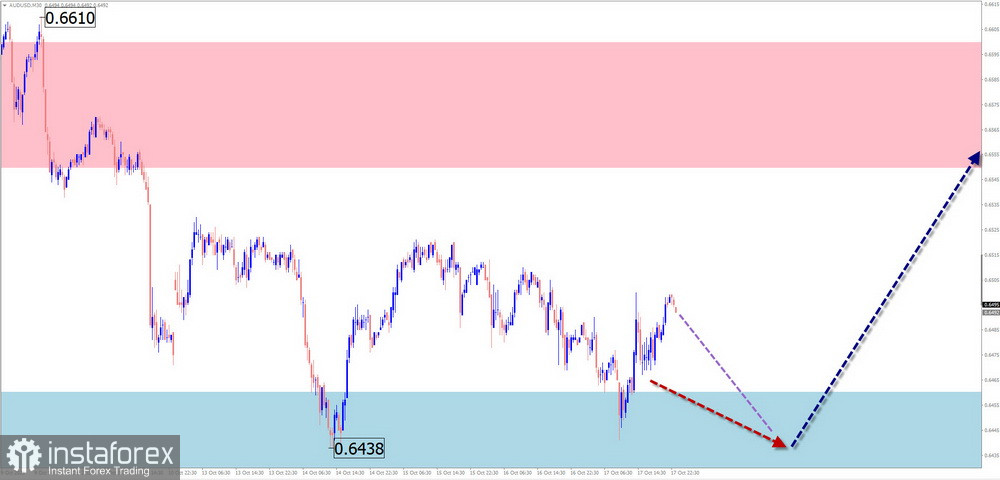

AUD/USD

Brief Analysis:

The Australian dollar's major pair continues moving "north" on the price chart. The current incomplete downward segment has been developing since late September. Within it, over the past ten days, the price has been forming a flat correction that remains unfinished as of the time of analysis. Quotes are near the upper boundary of a strong support zone.

Weekly Forecast:

In the next couple of days, the pair's price is expected to move sideways, forming conditions for a trend reversal. Pressure on the support zone is possible. A reversal can be expected closer to the end of the week. A move above the calculated resistance zone within the coming week is unlikely.

Potential Reversal Zones

- Resistance: 0.6550 / 0.6600

- Support: 0.6460 / 0.6410

Recommendations:

- Buy: Will become relevant after confirmed reversal signals appear near the support zone.

- Sell: High-risk, potentially unprofitable.

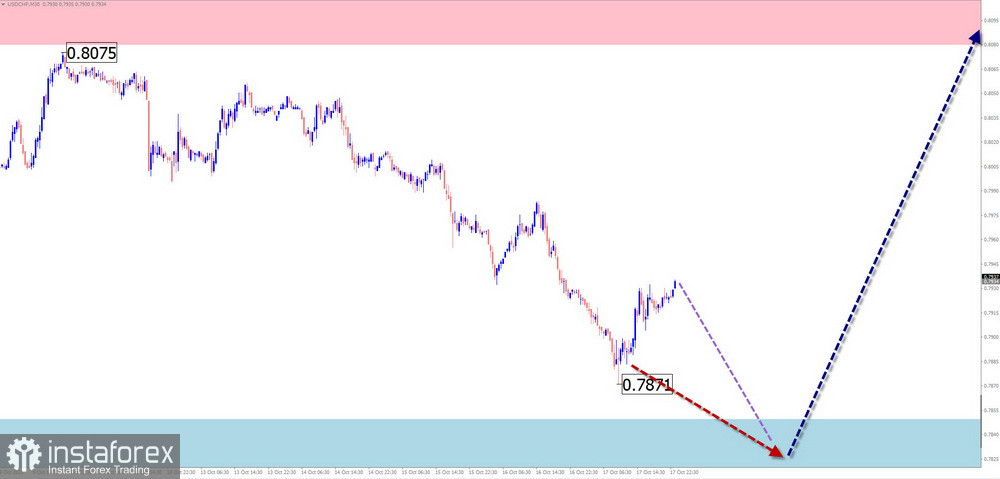

USD/CHF

Brief Analysis:

The current wave structure of the Swiss franc's major pair is directed upward. It began on April 11 and has been developing mostly within a sideways plane. On the larger daily chart, this segment represents a reversal of the previous trend. Quotes are moving within a horizontal price channel.

Weekly Forecast:

At the beginning of the upcoming week, the sideways movement is likely to continue. A decline toward the support zone is possible. Closer to the weekend, the probability of a reversal and a resumption of price growth increases. The resistance zone aligns with the lower boundary of the potential reversal zone on the 4-hour time frame.

Potential Reversal Zones

- Resistance: 0.8080 / 0.8130

- Support: 0.7850 / 0.7800

Recommendations:

- Sell: Can be used for short-term trading with a reduced volume size.

- Buy: Will become possible after reversal signals appear near the support zone on your trading systems.

EUR/JPY

Brief Analysis:

Since late February of this year, the direction of the euro/yen pair has been defined by an upward wave. Within its structure, during the final part (C), an intermediate correction has been forming for the past two weeks. Throughout this period, the price has been moving sideways within the boundaries of a large-scale potential reversal zone.

Weekly Forecast:

At the start of the upcoming week, the pair's price is expected to continue its sideways movement along the calculated support boundary. Afterwards, a reversal and the beginning of price growth can be expected. The resistance zone marks the most probable upper boundary of the pair's weekly range.

Potential Reversal Zones

- Resistance: 179.50 / 180.00

- Support: 175.00 / 174.50

Recommendations:

- Sell: No potential.

- Buy: Will become relevant after confirmed reversal signals appear near the support zone.

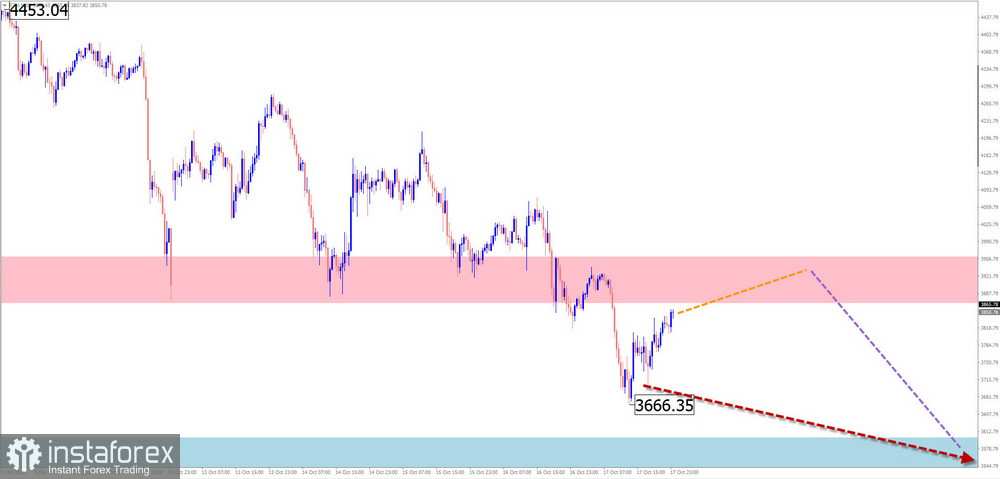

#Ethereum

Brief Analysis:

As a result of a multi-month uptrend, Ethereum's price has reached the boundaries of a wide large-scale potential reversal zone. Since late summer, quotes have been declining from an intermediate resistance level. Within this movement, the final part (C) has been developing in a sideways pattern over recent weeks.

Weekly Forecast:

Throughout the coming week, Ethereum's price is expected to move within the channel between opposing zones. Early in the week, a sideways trend is likely, with a possible upward vector. A reversal and resumption of the decline may occur closer to the weekend. A breakout of the calculated zones within the week is unlikely.

Potential Reversal Zones

- Resistance: 3870.00 / 3970.00

- Support: 3600.00 / 3500.00

Recommendations:

- Sell: Will become relevant after confirmed reversal signals appear near the resistance zone.

- Buy: Risky, with low potential.

Notes: In simplified wave analysis (SWA), all waves consist of three parts (A–B–C). In each time frame, the analysis focuses on the last, incomplete wave. Expected movements are shown with dashed lines.

Attention: The wave algorithm does not take into account the duration of price movements over time!

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română