Trade Review and Trading Tips for the Japanese Yen

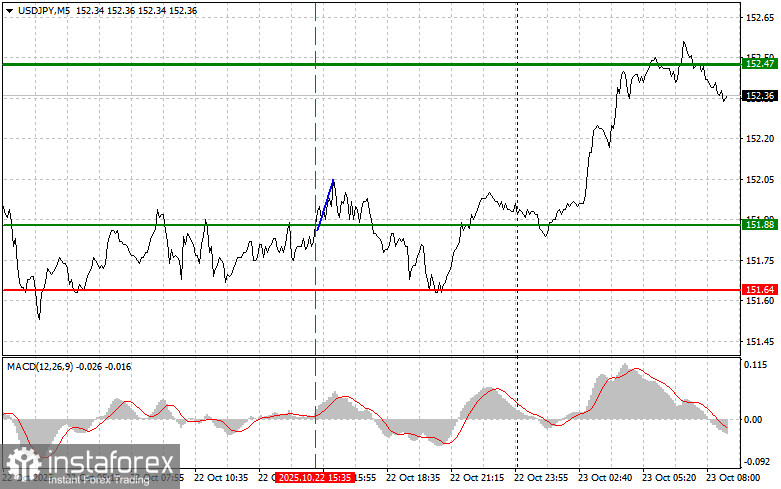

The test of the 151.88 level occurred when the MACD indicator had just started to rise from the zero line, confirming a valid entry point for buying the U.S. dollar against the yen. However, the bullish move ended after a modest 15-pip rally.

Yesterday's comments from Federal Reserve officials in support of a more accommodative monetary policy pressured the dollar, but notably not in its pairing with the Japanese yen. This divergence drew attention and fueled speculation as to why the yen showed resilience despite broader dollar weakness.

Many traders attribute this stability to Japan's new prime minister, who has signaled plans to launch aggressive economic stimulus. This puts the Bank of Japan in a difficult position and casts doubt on its previously announced plans for interest rate increases, which now seem uncertain. The lack of fresh Japanese macroeconomic data also plays a role, as market participants currently place greater trust in the government's fiscal intentions than in the central bank's monetary tightening.

For today's intraday strategy, I will rely primarily on Scenarios #1 and #2.

Buy Scenarios

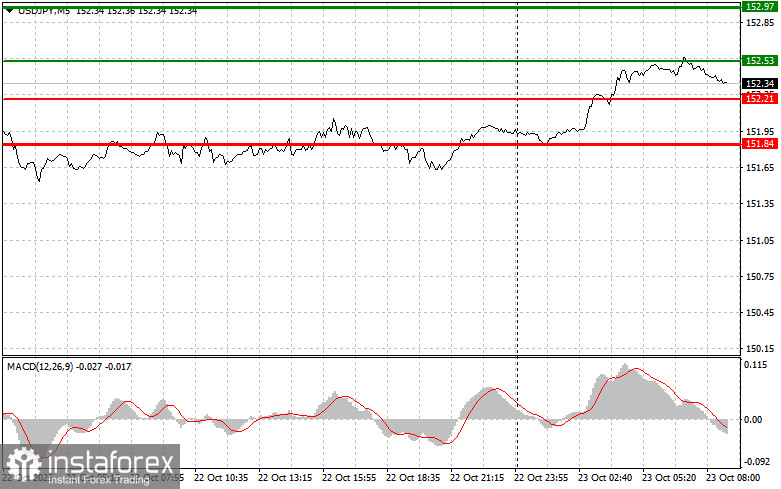

Scenario 1: I plan to buy USD/JPY if the price reaches the entry zone around 152.53 (thin green line), targeting a move toward 152.97 (thick green line). Upon reaching the 152.97 area, I will close long positions and enter short trades in the opposite direction, targeting a 30–35 pip retracement. It is best to re-enter long positions on deep pullbacks or corrections in USD/JPY. Important: Before buying, confirm that MACD is above the zero line and just beginning to rise.

Scenario 2: I also plan to buy USD/JPY if the price tests the 152.21 level twice while the MACD indicator is in the oversold zone. This scenario would likely limit downside momentum and trigger a rebound. Target levels in this case are 152.53 and 152.97.

Sell Scenarios

Scenario 1: I plan to sell USD/JPY if the pair breaks below the 152.21 level (thin red line), which could lead to a quick decline. The first bearish target will be 151.84 (thick red line), where I intend to close short positions and open long ones in the opposite direction, aiming for a 20–25 pip bounce. For optimal short entries, it's best to sell from higher levels. Important: Before selling, confirm that MACD is below the zero line and starting to decline.

Scenario 2: I will also consider selling USD/JPY after two consecutive tests of the 152.53 resistance area while MACD is in the overbought zone. This would suggest limited upside potential and increased chances of a downward reversal. In this case, I expect a decline toward 152.21 and 151.84.

Chart Reference Guide:

Thin green line – price level used for potential buying opportunities

Thick green line – expected Take Profit area or manual exit level where further growth is unlikely

Thin red line – price level used for potential selling

Thick red line – expected Take Profit area or manual exit level where further decline is unlikely

MACD indicator – monitor for overbought/oversold conditions as confirmation for entry signals

Important Note for Beginners:

Forex beginners must exercise caution when entering the market. Ahead of major fundamental releases, it's best to stay flat to avoid sudden price swings. If trading during high-impact events, always place stop-loss orders to minimize risk. Without stop-loss protection, especially when trading large positions without proper money management, your entire account can quickly be wiped out.

Remember: success in trading requires a clear plan—like the example provided above. Spontaneous decisions based on short-term price action alone are typically a losing strategy for intraday traders.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română