Bitcoin continues to face selling pressure on every moderate upswing, which paradoxically supports its medium-term bullish outlook. Ethereum is also attempting to regain ground above the $4,000 mark, but so far with little success.

Yesterday, reports surfaced that U.S. federal agencies have outlined major steps for cryptocurrency regulation to be completed by the end of 2025. Acting Chairman of the Commodity Futures Trading Commission (CFTC), Christy Goldsmith Romero, stated that the agency will prioritize crypto and tokenized asset markets.

Later on Wednesday, SEC Chairman Paul Atkins also confirmed plans to advance crypto regulatory initiatives by year-end. In an interview, he explained that the ongoing government shutdown continues to impact agency operations. Since September 30, Congress has failed to approve funding, which has significantly limited the functioning of federal entities like the CFTC and SEC.

He added that once operations resume, the agencies' top focus will be implementing the priorities set out in this summer's report. Meanwhile, Washington lawmakers will continue pushing forward regulatory efforts for the entire crypto sector. This initiative has also been backed by the White House, which aims to see legislation adopted by year-end.

Regarding my intraday strategy, I will continue trading based on major pullbacks in Bitcoin and Ethereum, while anticipating the continuation of the medium-term bull market, which remains intact.

Short-term trading setups are outlined below.

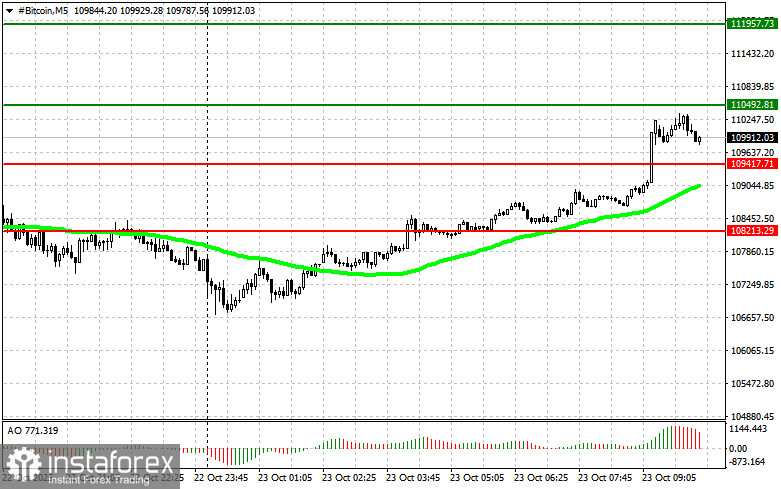

Bitcoin

Buy Scenario

Scenario 1: Buy Bitcoin today at the entry point near $110,500 with a target at $111,900. At $111,900, exit long positions and sell the asset on a pullback.

Before trading the breakout, confirm that the 50-day moving average is below the current price and that the Awesome Oscillator is above zero.

Scenario 2: Buy Bitcoin from the lower boundary at $109,400, assuming there is no market response to a downside breakout, with targets at $110,500 and $111,900.

Sell Scenario

Scenario 1: Sell Bitcoin today if the price reaches $109,400, targeting a decline toward $108,200. At $108,200, exit shorts and buy on the rebound.

Before trading the breakout, confirm that the 50-day moving average is above the current price and that the Awesome Oscillator is below zero.

Scenario 2: Sell from the upper boundary at $110,500, provided there is no upward breakout confirmation, targeting $109,400 and $108,200.

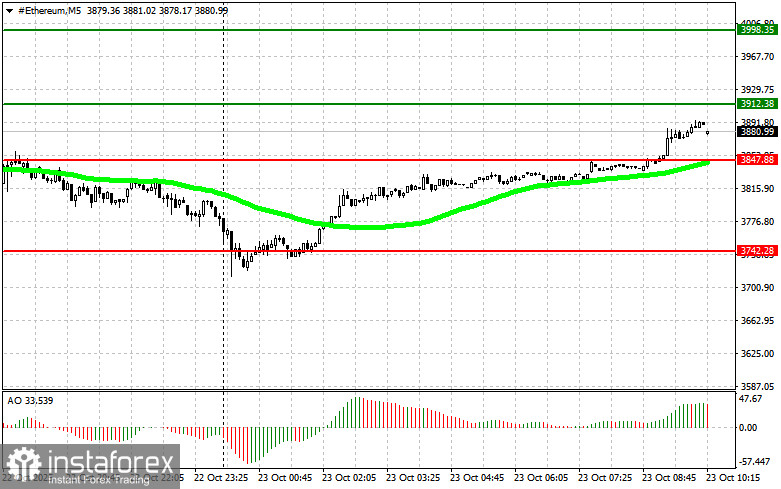

Ethereum

Buy Scenario

Scenario 1: Buy Ethereum today at the entry point near $3,912 with a target at $3,998. At $3,998, exit long positions and sell on the rebound.

Before trading the breakout, ensure that the 50-day moving average is below the current price and that the Awesome Oscillator is above zero.

Scenario 2: Buy from the lower boundary at $3,847 if there is no active breakout response downward, targeting $3,912 and $3,998.

Sell Scenario

Scenario 1: Sell Ethereum today at the entry point near $3,847 with a target at $3,742. At $3,742, exit shorts and buy on the bounce.

Before trading the breakout, confirm that the 50-day moving average is above the current price and that the Awesome Oscillator is below zero.

Scenario 2: Sell from $3,912 if there is no sustained breakout above that level, targeting $3,847 and $3,742.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română