Analysis of Macroeconomic Reports:

A considerable number of macroeconomic reports are scheduled for Friday. In fact, today is the first day this week when traders will have anything significant to focus on. Therefore, there is no doubt that today's movements will be more volatile. The nature of movement for both currency pairs will depend on the actual reports. Business activity indices (PMIs) in the services and manufacturing sectors will be released in Germany, the Eurozone, the United Kingdom, and the United States. The UK will also publish retail sales data, and in the U.S., the most critical report of the week—CPI (Consumer Price Index) inflation data—will be announced. All of these reports are expected to influence the movement of currency instruments to varying degrees.

Analysis of Fundamental Events:

No fundamental events are scheduled for Friday, but they won't be necessary given the volume of macroeconomic reports due for release today. It's also worth noting that the Federal Reserve has entered its pre-meeting "quiet period," with the next policy meeting scheduled for next week. At the European Central Bank, Christine Lagarde has spoken ten times over the past few weeks, yet none of her remarks have provided the market with anything particularly important. Thus, central bank officials' speeches currently offer little value to traders.

General Conclusions:

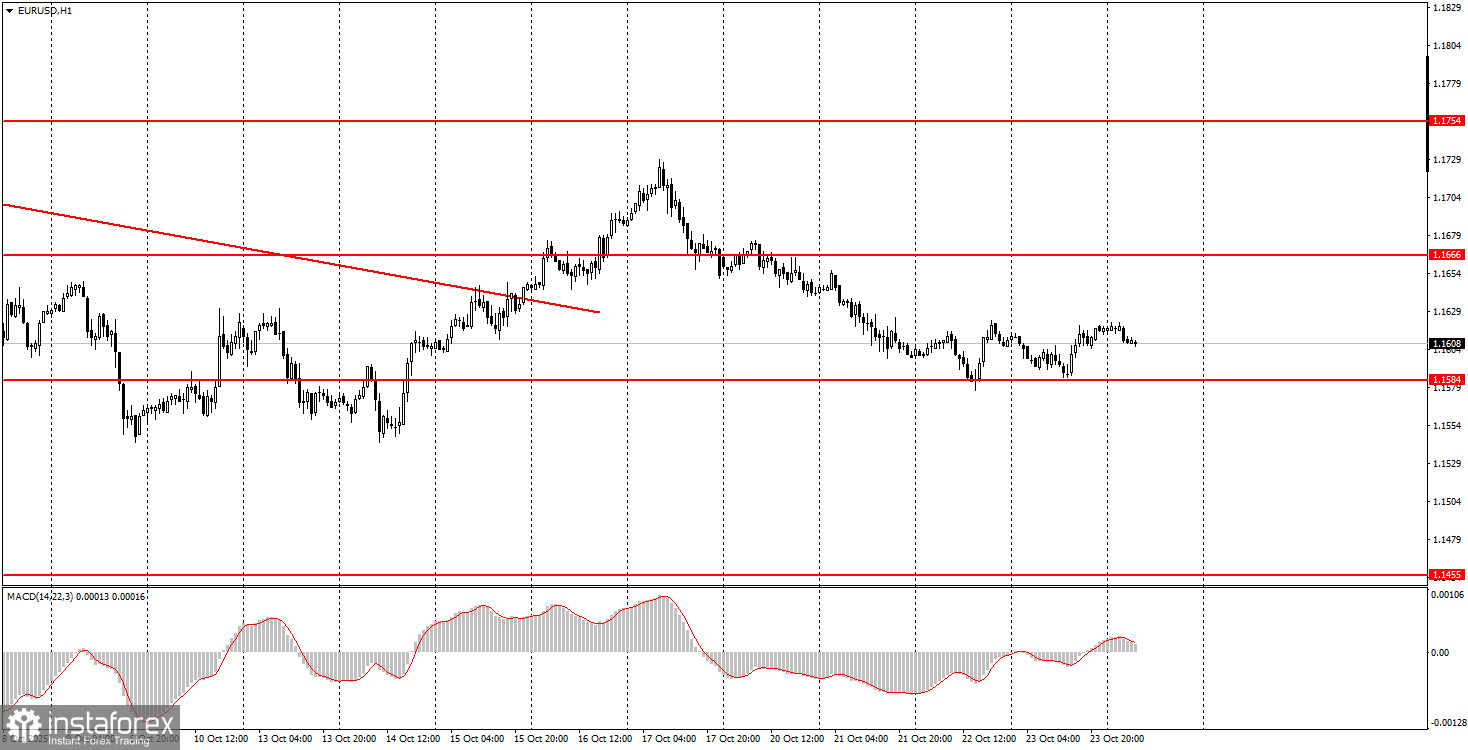

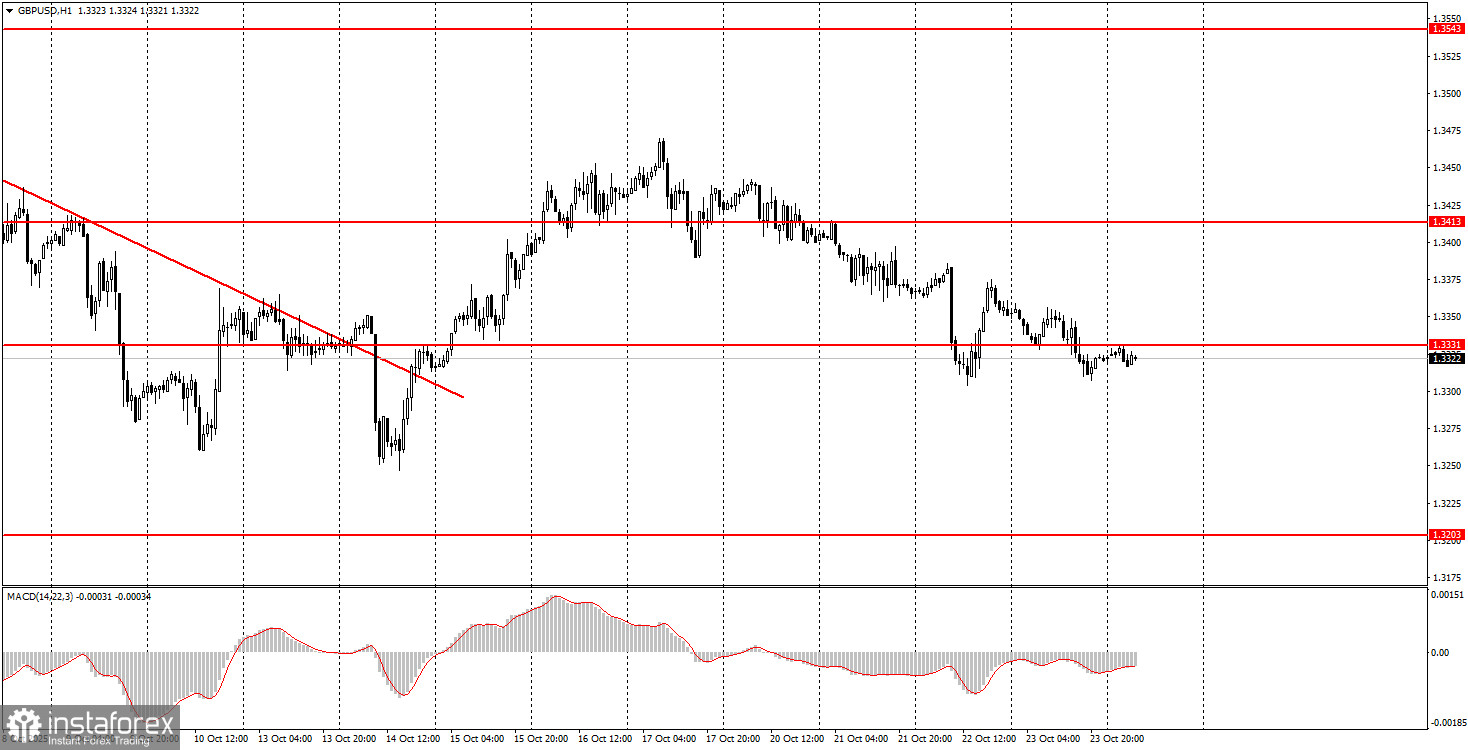

On the final trading day of the week, both currency pairs may experience significantly higher volatility and erratic price movements. The euro has a favorable trading zone at 1.1571–1.1584, from which both long and short positions can be considered. The British pound is near the 1.3329–1.3331 area, which also serves as a valid trading zone.

Basic Rules of the Trading System:

- The strength of a signal is determined by how quickly it forms (i.e., a bounce or breakout of a level). The shorter the time, the stronger the signal.

- If two or more false signals appear near a certain level, all subsequent signals from that level should be ignored.

- In a flat market, any currency pair may generate many false signals or none at all. In any case, it's better to stop trading at the first signs of a flat trend.

- Trade entries should occur between the start of the European session and the middle of the U.S. session. All trades should be closed manually afterward.

- On the 1-hour chart, MACD signals should be acted on only when there is significant volatility and a trend confirmed by a trendline or trend channel.

- If two levels are located too closely together (5–20 pips apart), consider them as a support or resistance zone.

- Once the price moves 15-20 pips in the correct direction, a Stop Loss should be moved to breakeven.

What's on the Charts:

Support and resistance price levels – levels that serve as targets when opening buy or sell trades. Take Profit levels can be placed near them.

Red lines – channels or trendlines that show the current trend and indicate the preferred trading direction.

MACD (14,22,3) indicator – histogram and signal line – a supporting indicator that can also be used as a signal source.

Important speeches and reports (always listed in the economic calendar) can significantly affect the movement of currency pairs. Therefore, during their release times, trading should be highly cautious, or it's better to exit the market to avoid sharp reversals against the preceding movement.

Beginner traders on the Forex market should remember that not every trade will be profitable. Developing a clear strategy and sound money management are the keys to long-term success in trading.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română