Trade Review and Trading Advice on the Japanese Yen

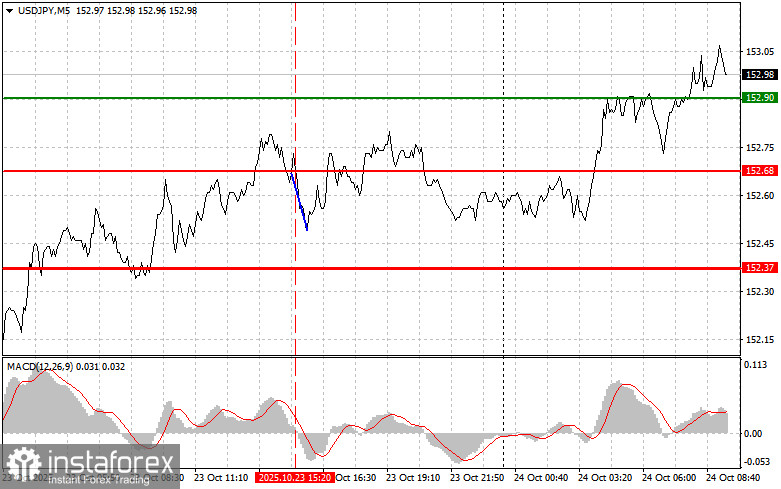

The price test at 152.68 occurred as the MACD indicator began to decline from the zero line, confirming a valid entry point to sell the U.S. dollar. As a result, the pair dropped by 17 pips.

Comments from Federal Reserve officials about the potential for further monetary easing weighed on the U.S. dollar. Nevertheless, in its exchange against the Japanese yen, the dollar held its ground. This paradox is explained by the yen's traditional status as a safe-haven currency, which is currently under pressure due to domestic economic and political factors. The Bank of Japan's difficulty in continuing its tight monetary policy, compounded by a new prime minister, is preventing the yen from strengthening.

Today, Japan released inflation data. The Consumer Price Index (CPI) rose from 2.7% to 2.9%, placing the central bank in an even more difficult position. On the one hand, this confirms that previously adopted economic stimulus measures are affecting inflation. On the other hand, rising prices are occurring amid new political signals from the government that it intends to resume economic stimulus measures. The problem is that further monetary easing could lead to an even weaker yen, which, in turn, would raise import costs and intensify inflationary pressures. A tightening of monetary policy, however, could stifle already weak economic growth.

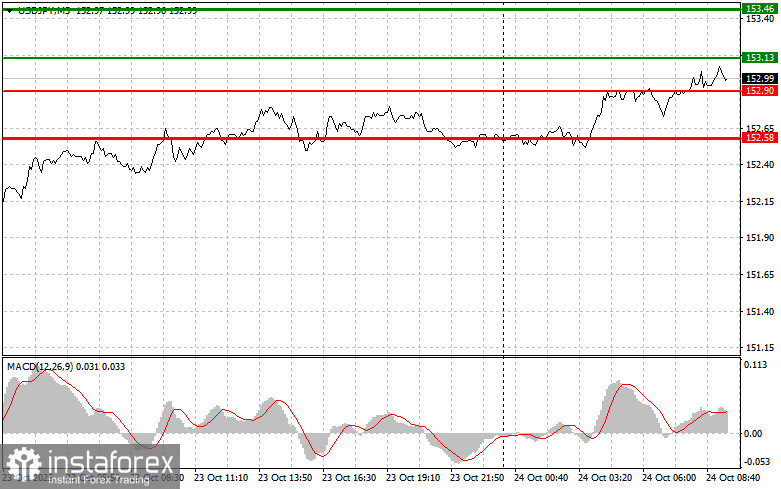

As for the intraday strategy, I will focus on implementing scenarios No. 1 and No. 2.

Buy Scenarios

Scenario No. 1: I plan to buy USD/JPY today at the entry point around 153.13 (thin green line on the chart), with an upside target at 153.46 (thick green line on the chart). At 153.46, I plan to exit long positions and open shorts in the opposite direction, anticipating a 30–35-pip reversal. Buying the pair is best done on corrections and deep pullbacks.

Important: Before buying, ensure that the MACD indicator is above the zero line and just beginning to rise.

Scenario No. 2: I also plan to buy USD/JPY today if the 152.90 level is tested twice while the MACD indicator is in the oversold zone. This will limit the downside potential of the pair and lead to a bullish reversal. A rise toward 153.13 and 153.46 may then be expected.

Sell Scenarios

Scenario No. 1: I plan to sell USD/JPY only after a breakout below 152.90 (red line on the chart), which could lead to a quick decline in the pair. The key target for sellers will be 152.58, where I plan to exit short positions and initiate long positions, aiming for a 20–25 pip corrective move from that level. Selling is better done from higher levels.

Important: Before selling, ensure that the MACD indicator is below the zero line and just beginning to decline.

Scenario No. 2: I also plan to sell USD/JPY today if the 153.13 level is tested twice in a row, while the MACD is in the overbought zone. This will limit the pair's upside potential and lead to a bearish reversal. A decline toward 152.90 and 152.58 may be expected.

What's on the Chart:

Thin green line – entry price for buying the trading instrument

Thick green line – anticipated level for placing Take Profit or manually locking in gains, as further growth above this level is unlikely

Thin red line – entry price for selling the trading instrument

Thick red line – anticipated level for placing Take Profit or manually locking in gains, as further decline below this level is unlikely

MACD Indicator – it's crucial to use overbought and oversold zones when making trading decisions

Important: Beginner Forex traders must make entry decisions carefully. Ahead of major fundamental reports, it's best to stay out of the market to avoid sharp price swings. If you choose to trade during news releases, always place stop-loss orders to minimize losses. Without stop-losses, your entire deposit can be lost very quickly—especially if you don't practice money management and trade with large positions.

And remember, successful trading requires a well-defined trading plan, as demonstrated above. Making spontaneous trading decisions based on the current market situation is an inherently losing strategy for intraday traders.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română