On Monday, news emerged that the U.S. and China had reached a trade agreement. U.S. Treasury Secretary Scott Bessent announced this in an interview. Just a few hours later, several media outlets reported that the trade agreement would not be signed in November, as it only concerns extending the trade truce and avoiding a new escalation of the trade war. Beijing understands that a 100% tariff increase would signal the end of trade between the U.S. and China, where China sells significantly more than it buys. Washington realizes that China's refusal to sell rare earth metals would spell disaster for many American high-tech industries that rely on these metals, of which China is essentially a monopoly producer. Therefore, both sides have reluctantly attempted to reach an agreement. What has resulted from this?

There should soon be a personal meeting between the leaders of China and the U.S. Typically, only the most "sensitive" issues that cannot be entrusted to negotiation delegations are discussed in personal meetings. Thus, there will not be substantial negotiations between Donald Trump and Xi Jinping in South Korea. At this personal meeting, either the relevant document will be signed, or it will be announced that negotiations have failed. Scott Bessent stated that China agreed to postpone its decision on restricting the export of rare earth metals, but the point is that they decided to "postpone," not to "cancel."

Bessent also mentioned that the 100% tariff increase threatened by Donald Trump is unlikely to be implemented. However, in 2025, Trump raised tariffs on China multiple times. What does this mean? There may not be a 100% tariff increase, but a 50% or 30% increase could come later. The essence is not simply the 100% increase in November. Trump can always find a new reason to exert pressure on China. Therefore, any cancellation of tariffs is merely a postponement until the conflict reignites with renewed force.

From all of the above, we are likely looking at a maximum warming of relations, not a ceasefire; an extension of the thaw rather than an end to the conflict.

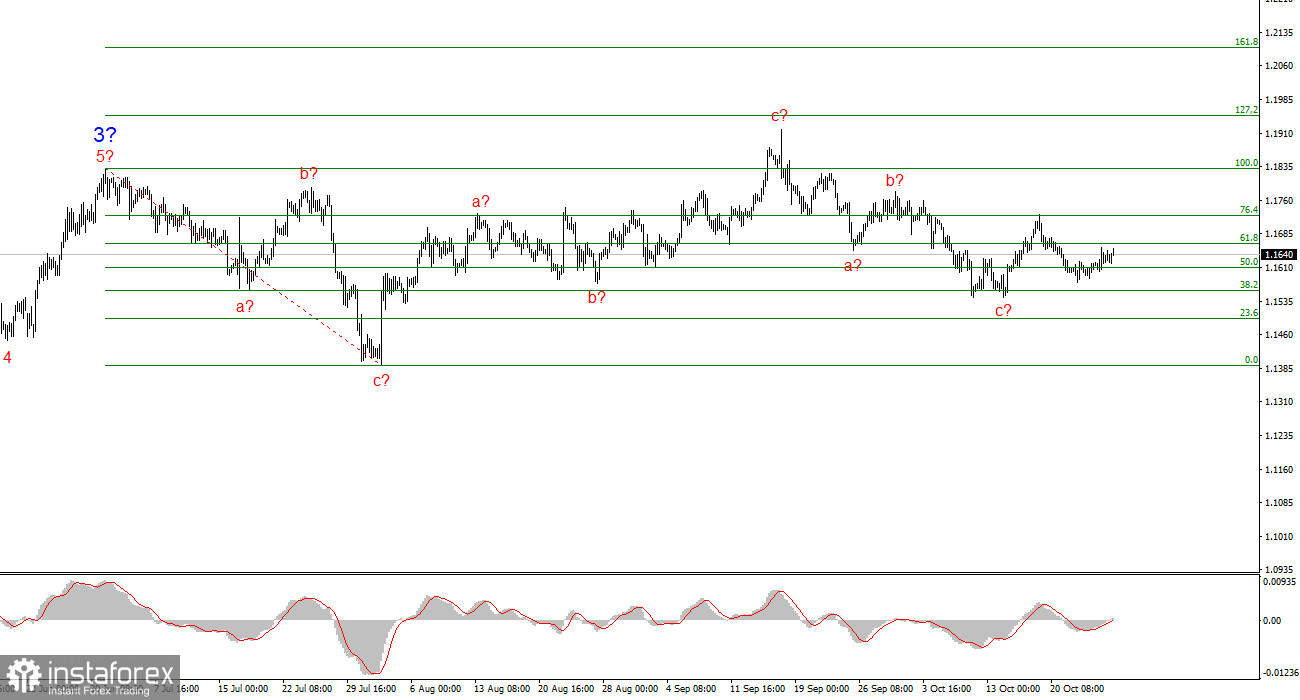

Wave Analysis of EUR/USD

Based on the analysis of EUR/USD, I conclude that the instrument continues to build an upward trend. There is currently a pause in the market, but Trump's policies and the Federal Reserve's stance remain significant factors in the U.S. dollar's decline. The targets of the current trend segment may reach into the 25-figure range. At this time, we can observe the formation of a corrective wave 4, which is taking on a complicated and elongated shape. Therefore, in the near term, I still consider only buying. By the end of the year, I expect the euro currency to rise to 1.2245, which corresponds to 200.0% on the Fibonacci scale.

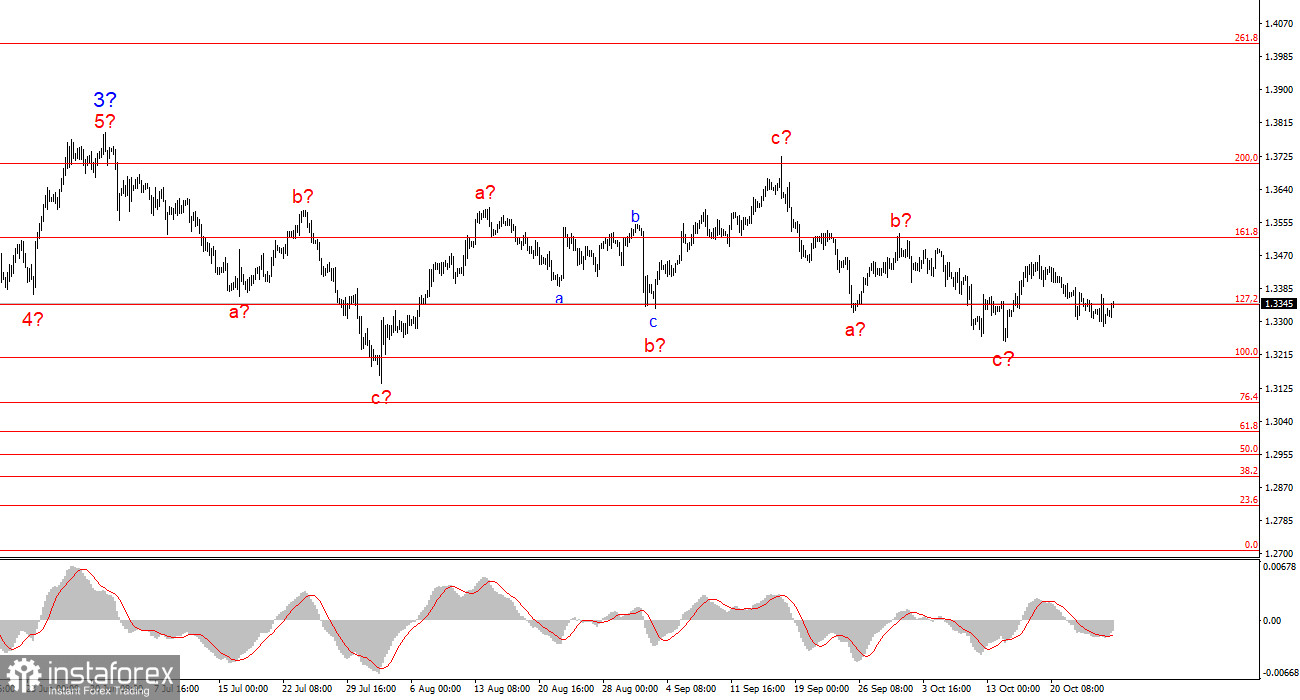

Wave Analysis of GBP/USD

The wave picture of the GBP/USD instrument has changed. We continue to deal with an upward, impulsive segment of the trend, but its internal wave structure is becoming more complex. Wave 4 appears to be in a three-wave form, and its structure is significantly more extended than that of wave 2. Another downward three-wave structure is presumably completed, but it could complicate further. If this is the case, the instrument could resume its upward movement within the broader wave structure, aiming initially for the 38 and 40 figure levels, but a correction is currently underway.

Key Principles of My Analysis:

- Wave structures should be simple and understandable. Complex structures are difficult to interpret and often lead to changes.

- If there is no confidence in market conditions, it is better not to enter the market.

- There can never be 100% certainty about the direction of movement. Remember to use stop-loss orders.

- Wave analysis can be combined with other types of analysis and trading strategies.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română