Scott Bessent also reported that China agreed to resume importing soybeans from the U.S. In China, the negotiations were described as productive, and the final statement mentioned achieving a consensus on resolving key issues. Both China and the U.S. agreed to continue discussing all contentious points.

Accordingly, negotiations will continue. In any case, a temporary truce, an extension of the truce, a thaw, and so on signify an improvement in relations between the two countries. This is a significant event that could prompt market reaction. However, market participants have recently begun to take Trump's threats and statements less seriously. About a month ago, Trump announced that he would increase tariffs on Chinese imports by 100% starting on November 1. On October 27, it turns out that China and the U.S. have reached an agreement, so there will be no new measures. What is the point of reacting to the first message if the second one cancels it?

This situation has arisen before, and American media have coined a special term regarding Trump's policy: TACO, which stands for "Trump Always Comes Around." In simpler terms, most of Trump's threats will never be enacted. They are merely part of a larger political game. First, the U.S. President shows he is willing to "cut ties," and then graciously agrees to continue negotiations.

We can expect something similar in the case with Canada. Last week, Trump froze negotiations with Ottawa due to a commercial released by the province of Ontario that featured former U.S. President Ronald Reagan criticizing trade tariffs. Trump saw this as an act of disrespect and believed that Canadians should have asked the White House for permission to use the former president's speech in their video materials.

As a result, Trump halted negotiations, but will likely warm up again in a couple of weeks, announcing that the Canadians have apologized (even if that is not true) and that the negotiation process will resume. At the same time, it should be remembered that Trump is not just interested in a trade agreement but in a trade agreement that is beneficial for the U.S. Whether it is advantageous for the opponent is irrelevant.

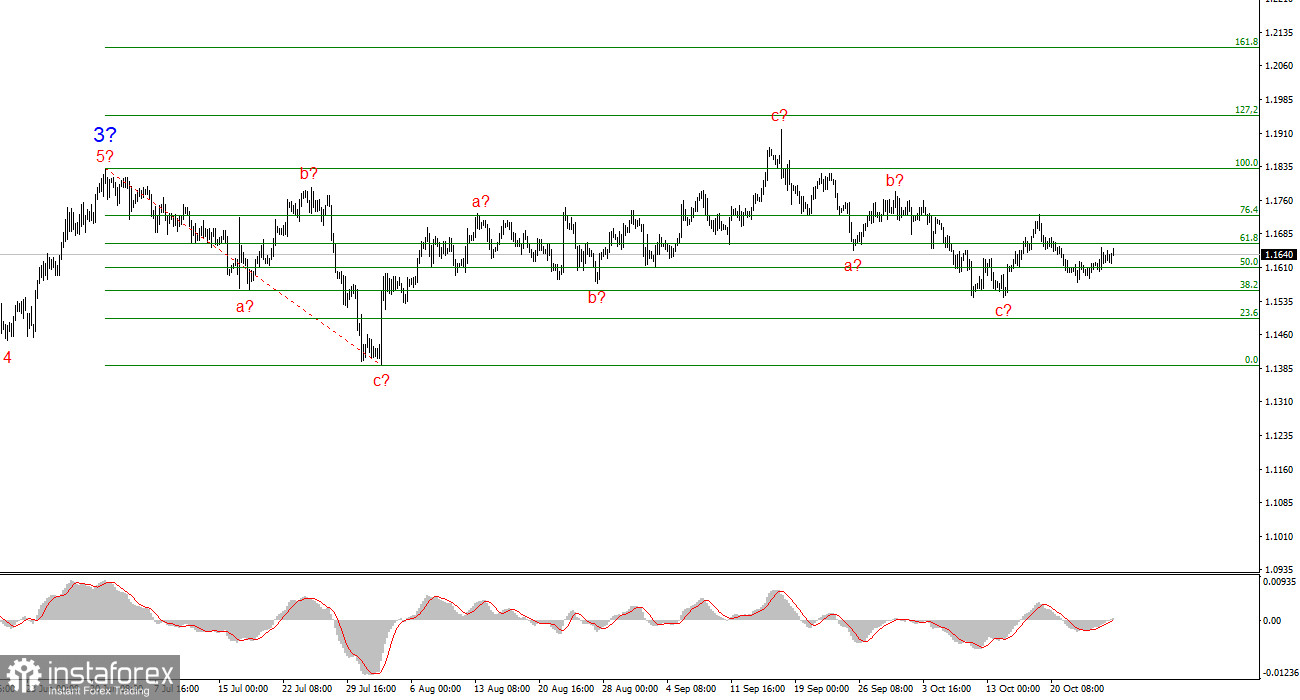

Wave Analysis of EUR/USD

Based on the analysis of EUR/USD, I conclude that the instrument continues to build an upward trend. There is currently a pause in the market, but Trump's policies and the Federal Reserve's stance remain significant factors in the U.S. dollar's decline. The targets of the current trend segment may reach into the 25-figure range. At this time, we can observe the formation of a corrective wave 4, which is taking on a complicated and elongated shape. Therefore, in the near term, I still consider only buying. By the end of the year, I expect the euro currency to rise to 1.2245, which corresponds to 200.0% on the Fibonacci scale.

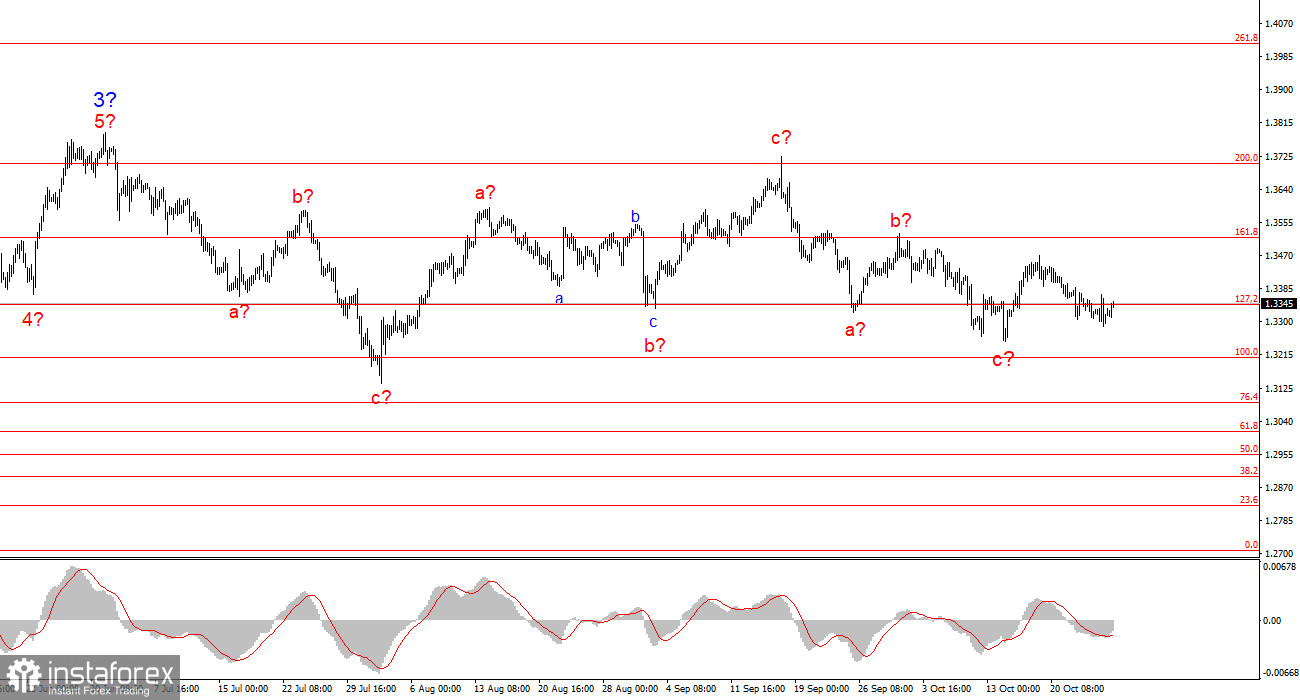

Wave Analysis of GBP/USD

The wave picture of the GBP/USD instrument has changed. We continue to deal with an upward, impulsive segment of the trend, but its internal wave structure is becoming more complex. Wave 4 appears to be in a three-wave form, and its structure is significantly more extended than that of wave 2. Another downward three-wave structure is presumably completed, but it could complicate further. If this is the case, the instrument could resume its upward movement within the broader wave structure, aiming initially for the 38 and 40 figure levels, but a correction is currently underway.

Key Principles of My Analysis:

- Wave structures should be simple and understandable. Complex structures are difficult to interpret and often lead to changes.

- If there is no confidence in market conditions, it is better not to enter the market.

- There can never be 100% certainty about the direction of movement. Remember to use stop-loss orders.

- Wave analysis can be combined with other types of analysis and trading strategies.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română