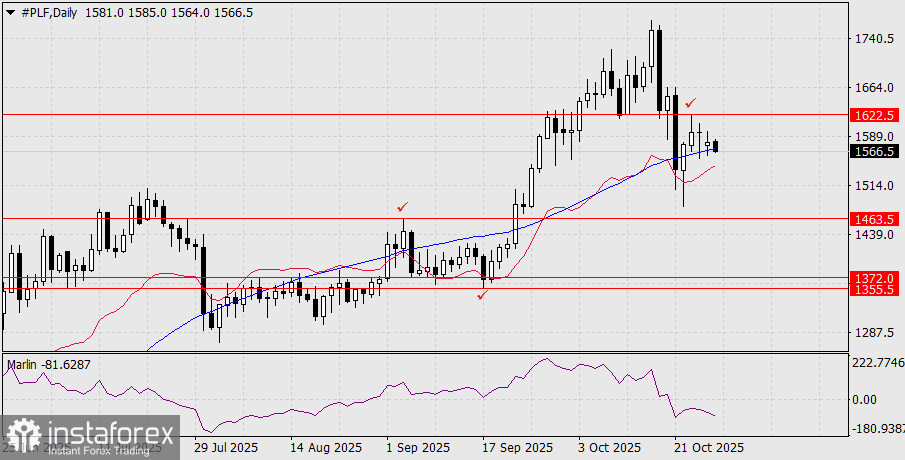

After testing the 1622.5 level on October 23, the price reached the MACD support line this morning and forcefully breached it. The daily candle will likely close below this line, opening the target support at 1463.5—the September 3 peak. Overcoming this level would open the target range of 1355.5-1372.0 (the low from September 17).

The Marlin oscillator has been in negative territory since October 21, when a strong price drop occurred. Since then, the oscillator's position has not changed, as it continues to help the price explore new lows.

On the H4 chart, the price has been trading below the balance indicator line for a long time – a sign that all attempts at price growth have been corrective.

Both indicator lines – the balance and MACD – are declining, indicating the prevailing direction of the medium-term trend. The Marlin oscillator is consolidating around the zero line and is ready to enter a downward move.

An alternative scenario may unfold if the price firmly establishes itself above 1622.5. The MACD line has reinforced this level, so a breakout above this strong resistance could lead to a retest of the October 16 peak at 1768.0.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română