Monday Trade Review:

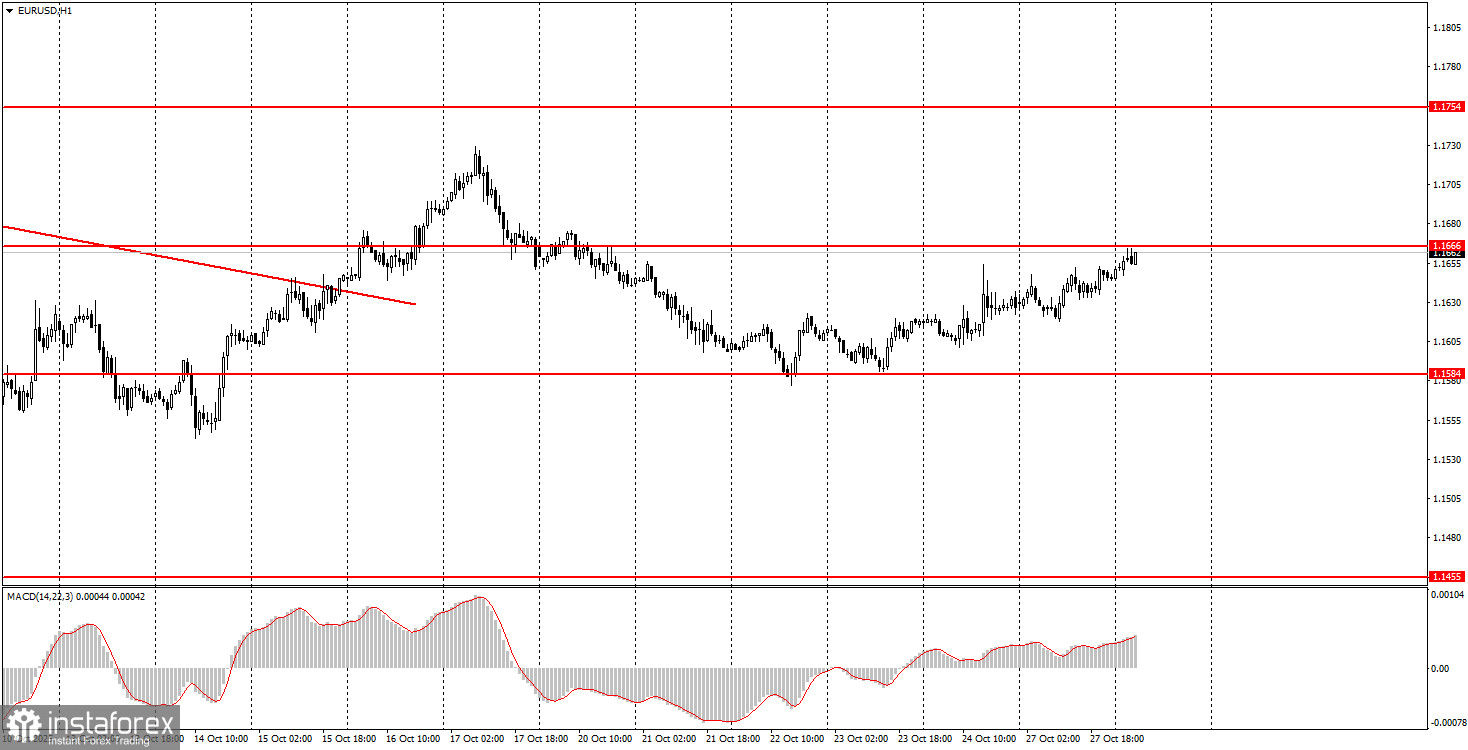

1H Chart of the EUR/USD Pair

The EUR/USD currency pair traded with minimal volatility and a slight upward slope on Monday. The upward slope is not surprising, as the trend on the hourly timeframe shifted upward a few weeks ago, and given the global fundamental backdrop, the rise of the euro is entirely logical under any local circumstances. However, the very low volatility is explained by the absence of significant fundamental or macroeconomic events on Monday. Only the business climate index was published in Germany, which went largely unnoticed. Recall that many important macroeconomic reports were released on Friday, but volatility remained very weak. Thus, this is the current general state of the market. Nevertheless, the local upward trend persists, and the global upward trend continues as well. Therefore, we expect only the euro to grow.

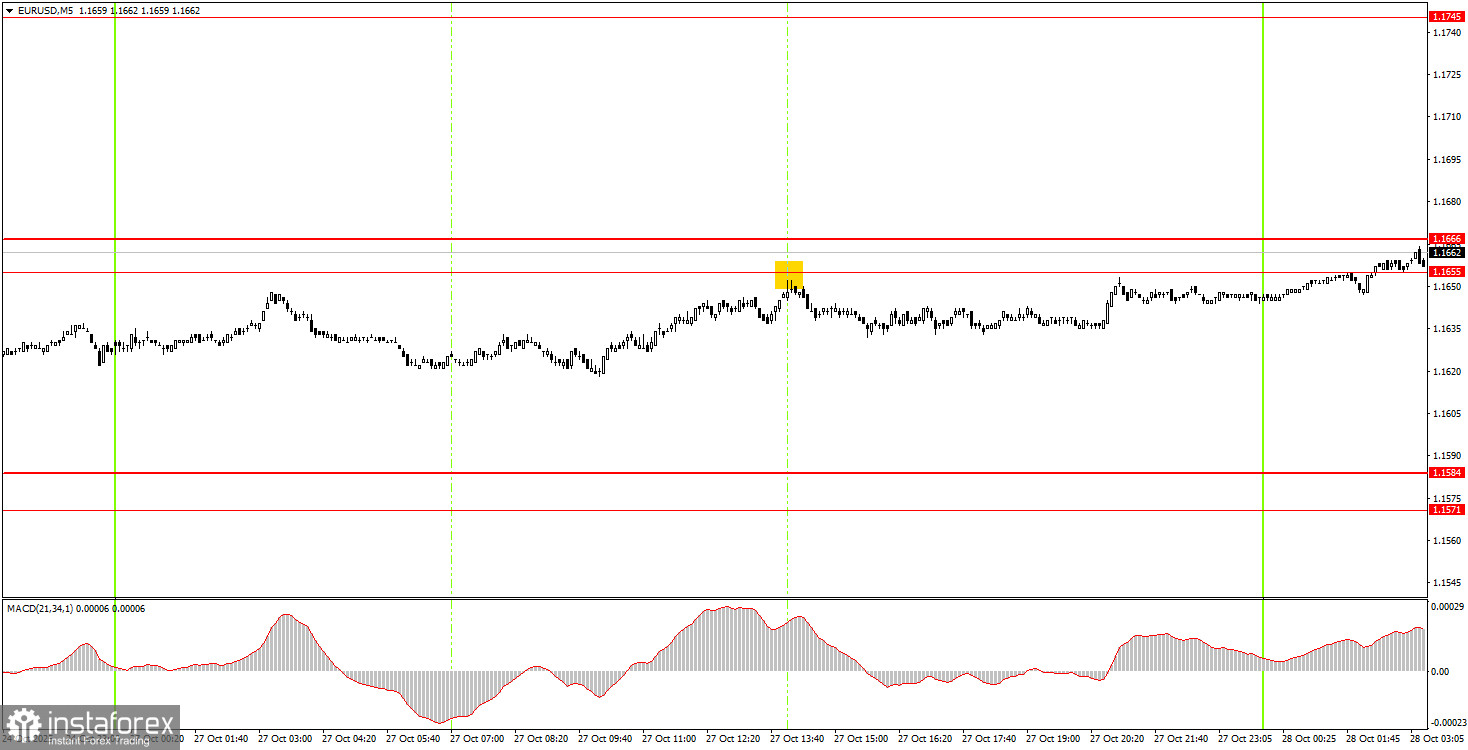

5M Chart of the EUR/USD Pair

Over the 5-minute timeframe, only one trading signal was generated on Monday. At the very beginning of the American trading session, the price bounced off the level of 1.1655, but in the following hours, it became clear that no further movements would take place, despite the new "truce" between China and the U.S. Thus, this sell trade could have been closed at breakeven at almost any time.

How to Trade on Tuesday:

On the hourly timeframe, the EUR/USD pair shows some signs of starting an upward trend. The descending trend line has been overcome, and the overall fundamental and macroeconomic backdrop remains weak for the U.S. dollar. Therefore, we continue to expect the resumption of the upward trend of 2025. However, a flat continues on the daily timeframe, which is currently expressed as low volatility and illogical movements on the minor timeframes.

On Tuesday, the EUR/USD pair may move in any direction, likely again with minimal volatility. New trading signals are expected in the 1.1655-1.1666 area, but volatility should be kept in mind.

On the 5-minute timeframe, levels to consider are 1.1354-1.1363, 1.1413, 1.1455-1.1474, 1.1527, 1.1571-1.1584, 1.1655-1.1666, 1.1745-1.1754, 1.1808, 1.1851, 1.1908, 1.1970-1.1988. On Tuesday, there are no significant or interesting events scheduled in either the U.S. or the Eurozone. The only notable event might be the German consumer confidence index, which is unlikely to provoke a market reaction. Thus, we are likely facing another "boring Monday," which has become too frequent lately.

Basic Rules of the Trading System:

- The strength of a signal is assessed based on the time it took to form the signal (bounce or breakout of a level). The less time it took, the stronger the signal.

- If two or more trades based on false signals were opened around a specific level, all subsequent signals from that level should be ignored.

- In a flat market, any pair can generate a plethora of false signals or none at all. In any case, at the first signs of a flat, it is better to stop trading.

- Trades are opened during the time period between the start of the European session and the middle of the American session, after which all trades should be closed manually.

- On the hourly timeframe, trading signals from the MACD indicator are preferably used only when there is good volatility and a trend confirmed by a trend line or trend channel.

- If two levels are located too close to each other (5 to 20 pips), they should be treated as an area of support or resistance.

- After moving 15 pips in the correct direction, a Stop Loss should be set to breakeven.

What's on the Charts:

- Price support and resistance levels are targets for opening buy or sell positions. Take Profit levels can be placed around them.

- Red lines indicate channels or trend lines, showing the current trend and the preferred trading direction.

- The MACD indicator (14,22,3) – histogram and signal line – is a supplementary indicator that can also be used as a source of signals.

Important speeches and reports (always found in the news calendar) can significantly affect the movement of the currency pair. Therefore, trading during their release should be done with utmost caution, or one should exit the market to avoid sudden price reversals against the preceding movement.

Beginners trading in the Forex market should remember that not every trade can be profitable. Developing a clear strategy and money management are the keys to success in trading over the long term.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română