In recent years, every time the FOMC meeting comes up, I tend to repeat the same thing – the market consistently becomes a hostage to its own inflated expectations. If we extrapolate this phrase to the Federal Reserve's monetary policy, it is more about deflated expectations. Remember 2024, when market participants were convinced there would be 6-7 rounds of policy easing. Recall the beginning of 2025, when everyone was certain there would be four rounds of easing, while the dot-plot charts indicated a maximum of 2. Now, at the end of 2025, the same situation is occurring.

The market decided that the Fed would cut rates twice more by the end of the year. When Jerome Powell hinted at the lack of a decision regarding the December meeting in October, market participants felt disappointed and upset with the Fed Chair. Can you recall an instance in which Powell commented on the next meeting's decisions right after a meeting, especially about a decision the FOMC would make 1.5 months later? However, the market clearly expected Powell to hint at another round of easing before the year ends. But based on what grounds can Powell make such statements and give such promises when the labor market and unemployment data up to September are still unclear?

The central bank is in a state of complete uncertainty and can only guess at the labor market's actual state. It is evident that the market is "cooling," but that is insufficient for three consecutive rate cuts. Confidence in the correctness of the current course is needed. Reasons and justifications are necessary. And where will these come from if the US has been experiencing a "shutdown" for a whole month, during which, only at the personal request of Donald Trump, did the US Bureau of Statistics get back to work and provide the inflation report for September?

Therefore, personally, I did not expect any promises from Powell regarding further rate cuts. Moreover, the Fed Chair has consistently stated that decisions will be based solely on economic data, which are currently somewhat constrained and inaccurate. The "shutdown" is a temporary phenomenon, but it will affect many economic indicators without long-term consequences. Economic data for October may be distorted due to the mandatory leave of government agencies. Under these circumstances, expecting promises from the Fed is like waiting for snow in the summer.

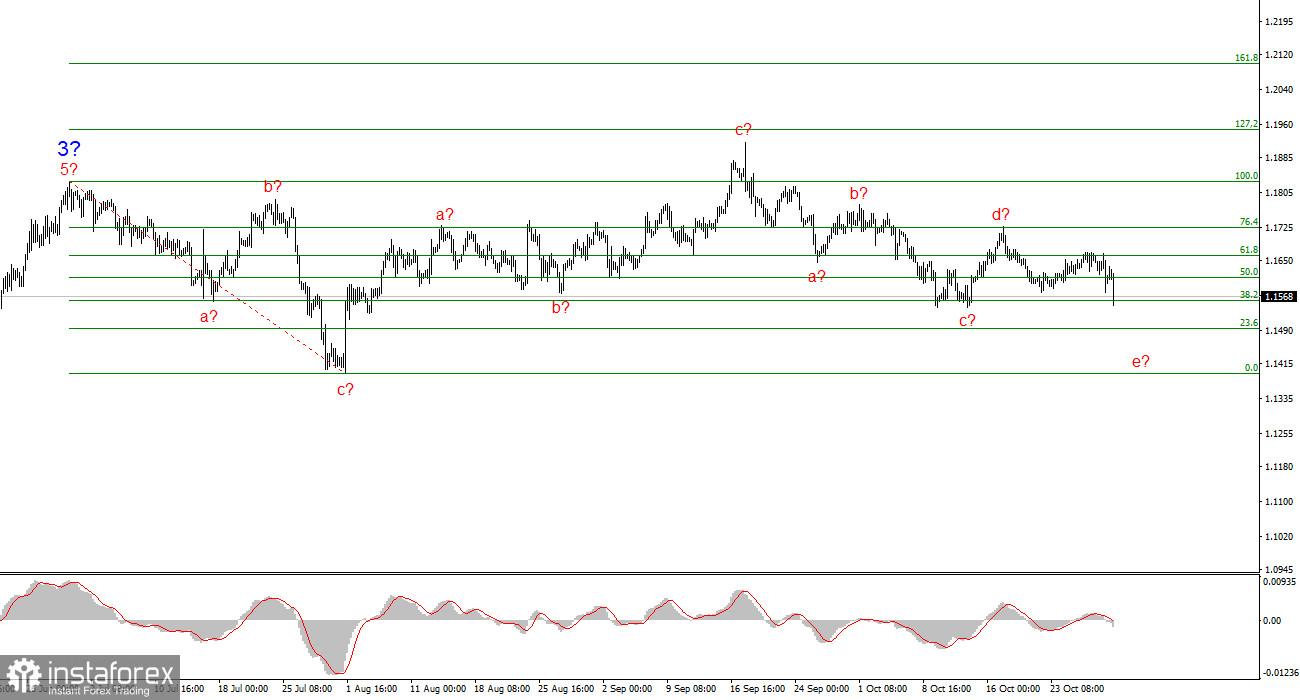

Wave Picture for EUR/USD:

Based on the conducted analysis of EUR/USD, I conclude that the instrument continues to build an upward segment of the trend. Currently, the market is in a pause, but Donald Trump's policies and the Fed's remain significant factors in the decline of the US currency. The targets for the current segment of the trend could reach up to the 25 figure. At the moment, we can observe the formation of correction wave 4, which is taking on a very complex and elongated shape. Therefore, I continue to consider only buying in the near term. By the end of the year, I expect the euro currency to rise to 1.2245, which corresponds to 200.0% on the Fibonacci scale.

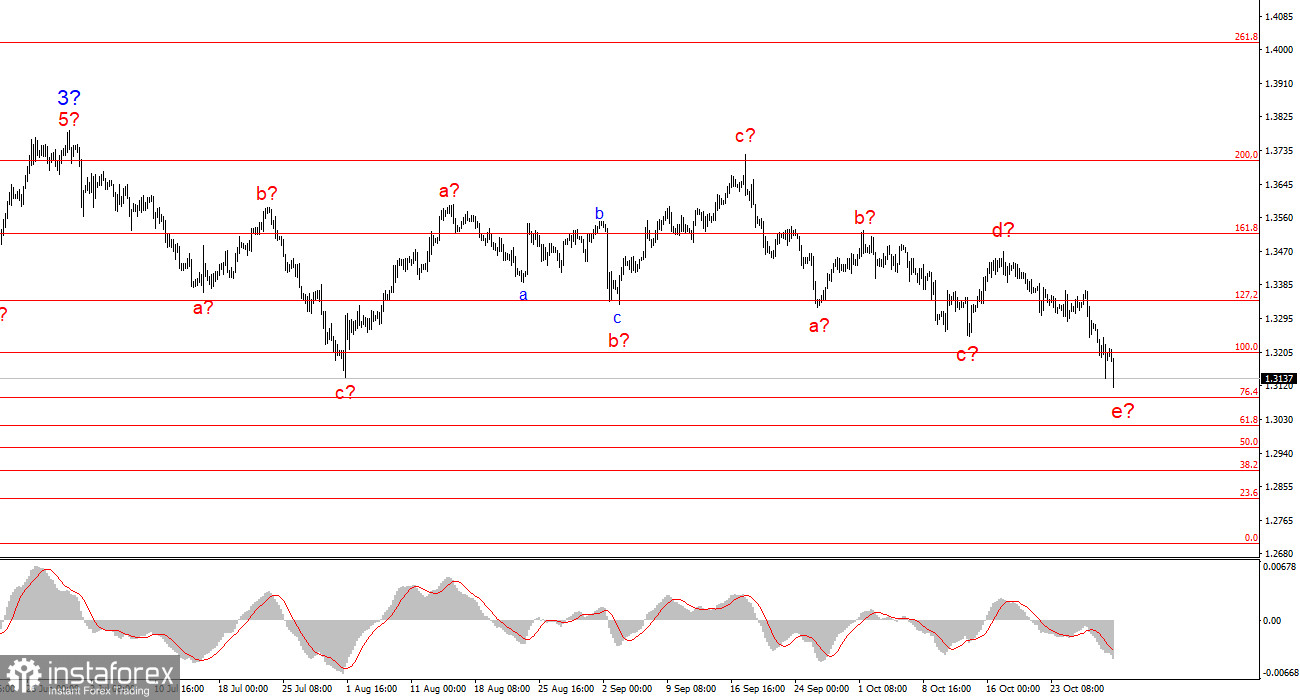

Wave Picture for GBP/USD:

The wave picture for the GBP/USD instrument has changed. We continue to deal with an upward, impulsive segment of the trend, but its internal wave structure is becoming more complex. Wave 4 is taking on a three-wave form, and its structure is significantly more elongated than wave 2's. Another downward corrective structure is nearing completion, but it could complicate a few more times. If this indeed happens, the rise of the instrument within the global wave structure may resume with initial targets around the 38 and 40 figures. However, the correction is still ongoing at this time.

Core Principles of My Analysis:

- Wave structures should be simple and understandable. Complex structures are difficult to play; they often involve changes.

- If there is no confidence in what is happening in the market, it is better not to enter.

- There can never be 100% certainty about the direction of movement. Always remember to use protective stop-loss orders.

- Wave analysis can be combined with other types of analysis and trading strategies.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română