Analysis of Deals and Trading Tips for the Japanese Yen

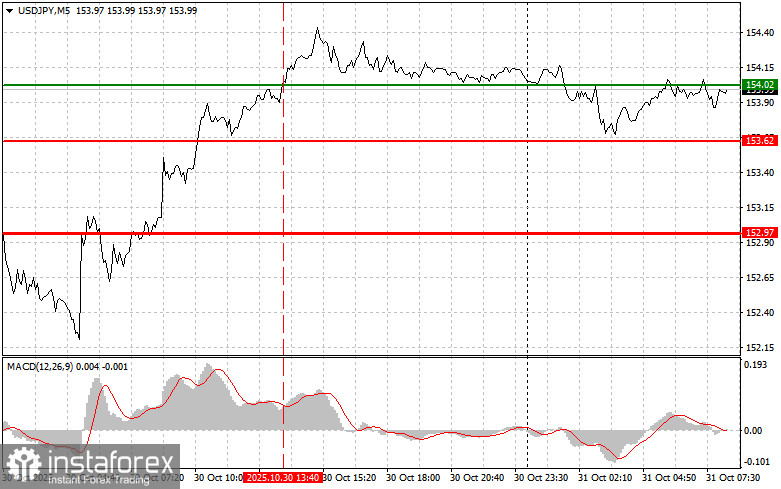

The price test at 154.02 came at a time when the MACD indicator had moved significantly above the zero mark, limiting the pair's upside potential. For this reason, I did not buy the dollar and missed another upward movement of the pair.

The Japanese yen reached an 8-month low after the Bank of Japan's decision yesterday to keep interest rates unchanged, which is already causing concern among several politicians. Finance Minister Satsuki Katayama stated today that the Japanese government is closely monitoring the yen's exchange rate, marking its first clear warning regarding currency fluctuations since she took office.

It is evident that further yen weakness could lead to rising inflation, particularly on imported goods, significantly impacting consumer spending and overall economic stability. The government is likely concerned that this will intensify social tensions, especially among the most vulnerable populations. The implications of the Bank's decisions and future actions by the government and central bank will demonstrate Japan's readiness to maintain financial stability amid global uncertainty and conduct currency interventions, which could lead to spikes in market volatility. However, the effectiveness of such interventions, as practice shows, may be limited in the context of a strong trend. The question remains: does the BoJ have the resources and political will for large-scale intervention capable of changing the situation?

As for the intraday strategy, I will rely more on the implementation of scenarios #1 and #2.

Buying Scenarios

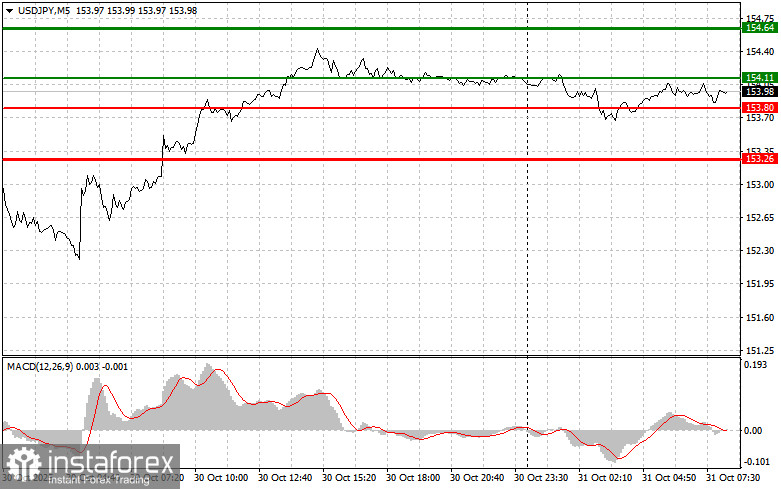

Scenario #1: I plan to buy USD/JPY today when the entry point reaches around 154.11 (green line on the chart), to rise to 154.64 (thicker green line on the chart). Near 154.64, I intend to exit the long positions and open shorts in the opposite direction (aiming for a movement of 30-35 pips in the opposite direction from the level). It is best to resume buying the pair on corrections and significant pullbacks in USD/JPY. Important! Before buying, ensure the MACD indicator is above the zero mark and just beginning an upward move from it.

Scenario #2: I also plan to buy USD/JPY today in case the price tests 153.80 twice while the MACD is in the oversold area. This will limit the downside potential of the pair and lead to a market reversal upwards. An increase to the opposite levels of 154.11 and 154.64 can be expected.

Selling Scenarios

Scenario #1: I plan to sell USD/JPY today only after a break of the level at 153.80 (red line on the chart), which will lead to a rapid decline of the pair. The key target for sellers will be the 153.26 level, where I intend to exit the shorts and immediately buy back (aiming for a move of 20-25 pips in the opposite direction from that level). It is better to sell as high as possible. Important! Before selling, ensure the MACD indicator is below the zero mark and just beginning its downward movement.

Scenario #2: I also plan to sell USD/JPY today if the price tests 154.11 twice while the MACD is in the overbought area. This will limit the upside potential of the pair and lead to a market reversal downwards. A decline to the opposite levels of 153.80 and 153.26 can be expected.

What is on the Chart:

Thin green line – entry price for buying the trading instrument;

Thick green line – estimated price where Take Profit can be placed or profits can be secured, as further growth above this level is unlikely.

Thin red line – entry price for selling the trading instrument;

Thick red line – estimated price where Take Profit can be placed or profits can be secured, as further decline below this level is unlikely;

MACD indicator. When entering the market, it is essential to rely on the overbought and oversold zones.

Important. Beginner traders in the Forex market need to be very cautious when making entry decisions. Before the release of important fundamental reports, it is best to stay out of the market to avoid sudden exchange rate fluctuations. If you decide to trade during news releases, always set stop orders to minimize losses. Without setting stop orders, you can quickly lose your entire deposit, especially if you do not use money management and trade large volumes.

And remember, for successful trading, you need a clear trading plan, similar to the one I presented above. Spontaneous trading decisions based on the current market situation are fundamentally a losing strategy for intraday traders.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română