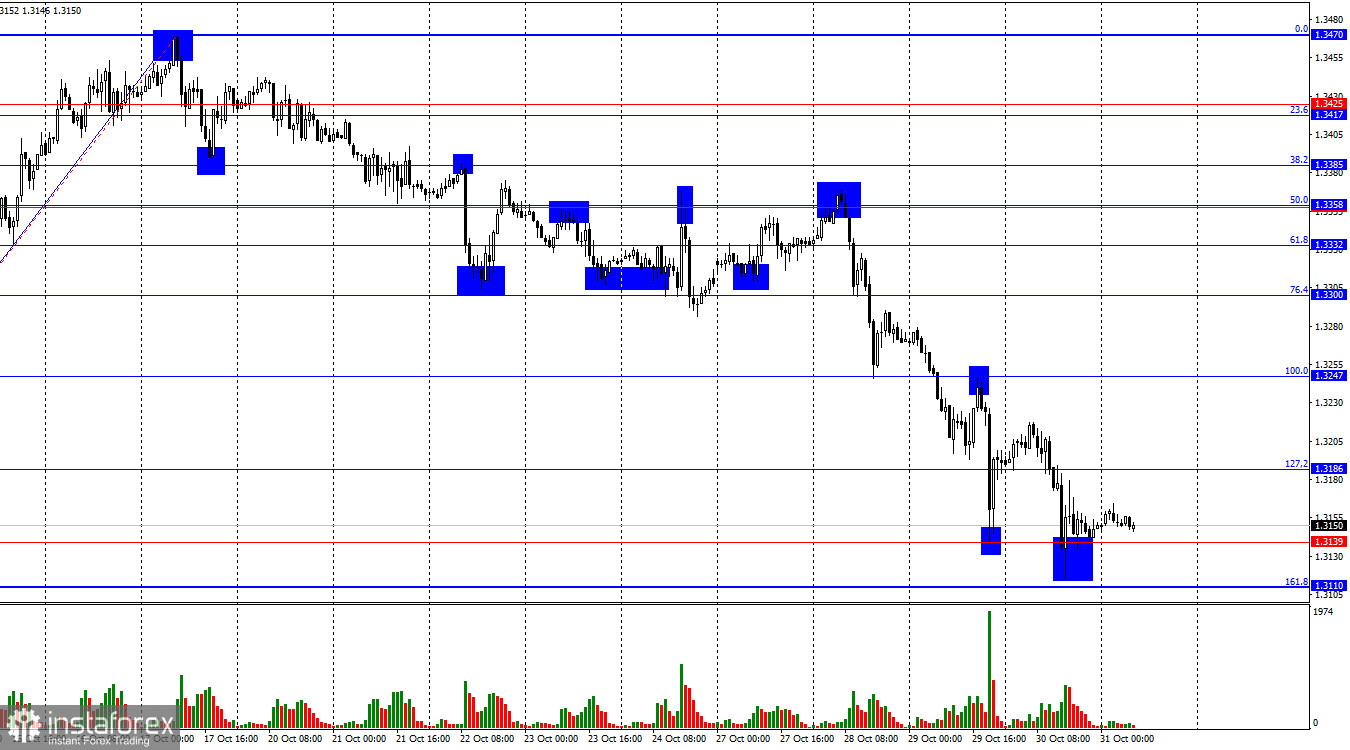

On the hourly chart, the GBP/USD pair on Thursday made a new reversal in favor of the U.S. dollar, falling into the support level of 1.3110–1.3139. A rebound of quotes from this zone would allow for a potential reversal in favor of the pound and some growth toward the 1.3186 and 1.3247 levels. A consolidation of the pair's rate below the 161.8% Fibonacci corrective level at 1.3110 would increase the likelihood of continued decline toward the next 200.0% Fibonacci level at 1.3024.

The wave structure remains bearish. The last completed upward wave broke the previous high, and the most recent downward wave broke the previous low. In recent weeks, the news background has been negative for the U.S. dollar, yet bullish traders have not taken advantage of the opportunities to advance. This week, they have sharply retreated from the market despite the Fed's interest rate cut.

On Thursday, there was no news background for either the pound or the dollar, but that did not stop the bears from pressing their attack. Traders had hoped for a more dovish tone from the Federal Reserve ahead of its final meeting of the year — but, in my view, that expectation was misplaced. Jerome Powell saw no need to make any promises about future rate cuts, which was quite expected given the lack of unemployment and labor market data for September and October. Nevertheless, traders were clearly disappointed.

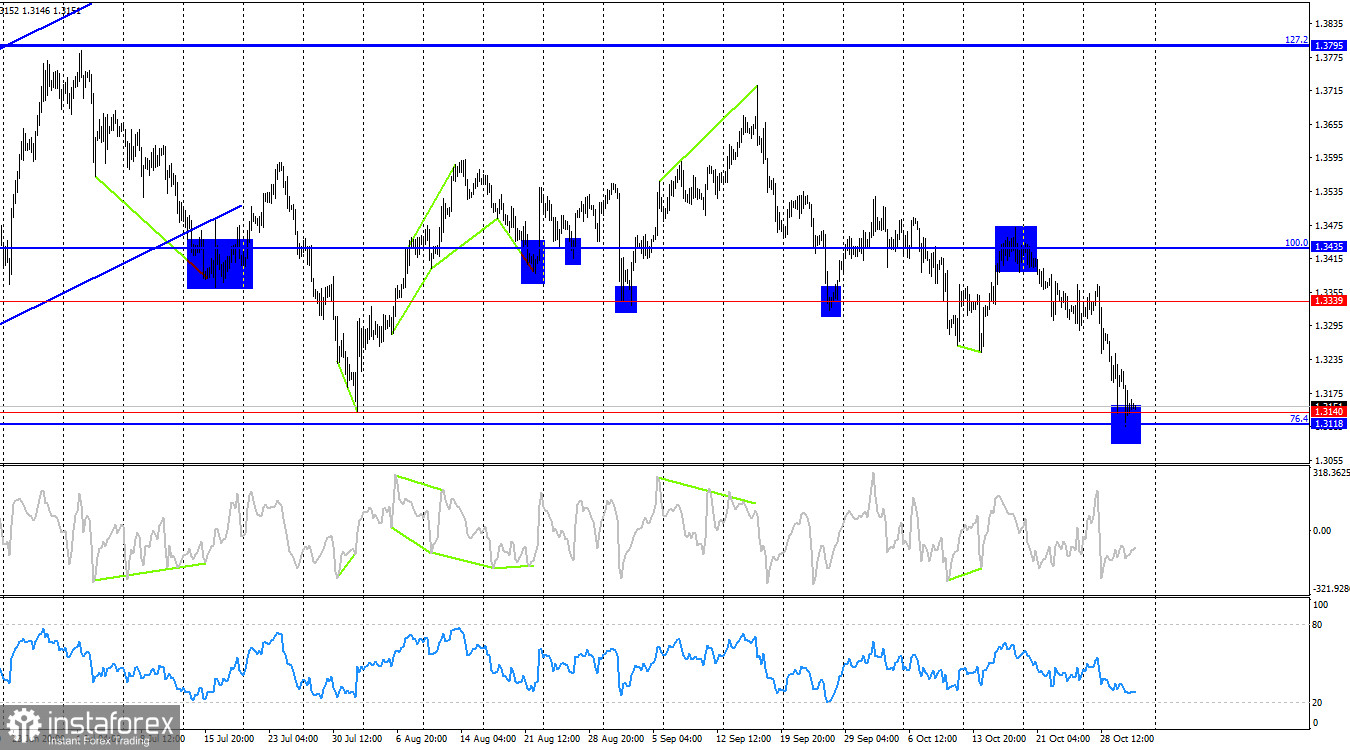

At the moment, I believe the news background does not correspond to the pair's current movement. A very important factor, in my opinion, is the reaction around the 1.3118–1.3140 support level on the 4-hour chart, which almost coincides with the same zone on the hourly chart. If the bears fail to break through this zone, a bullish trend could resume. If they do manage to overcome it, then regardless of the news background, the bears may continue their assault. For me, such a development would be quite strange — but one must follow the trend, not trade against it.

On the 4-hour chart, the pair bounced off the 100.0% corrective level at 1.3435, which worked in favor of the U.S. currency, and then fell into the 1.3118–1.3140 support level, which has already stopped the pound's decline twice before. A rebound from this zone would favor the pound and growth toward 1.3339. A consolidation below it would open the way for a decline toward 1.3040. No emerging divergences are observed on any of the indicators.

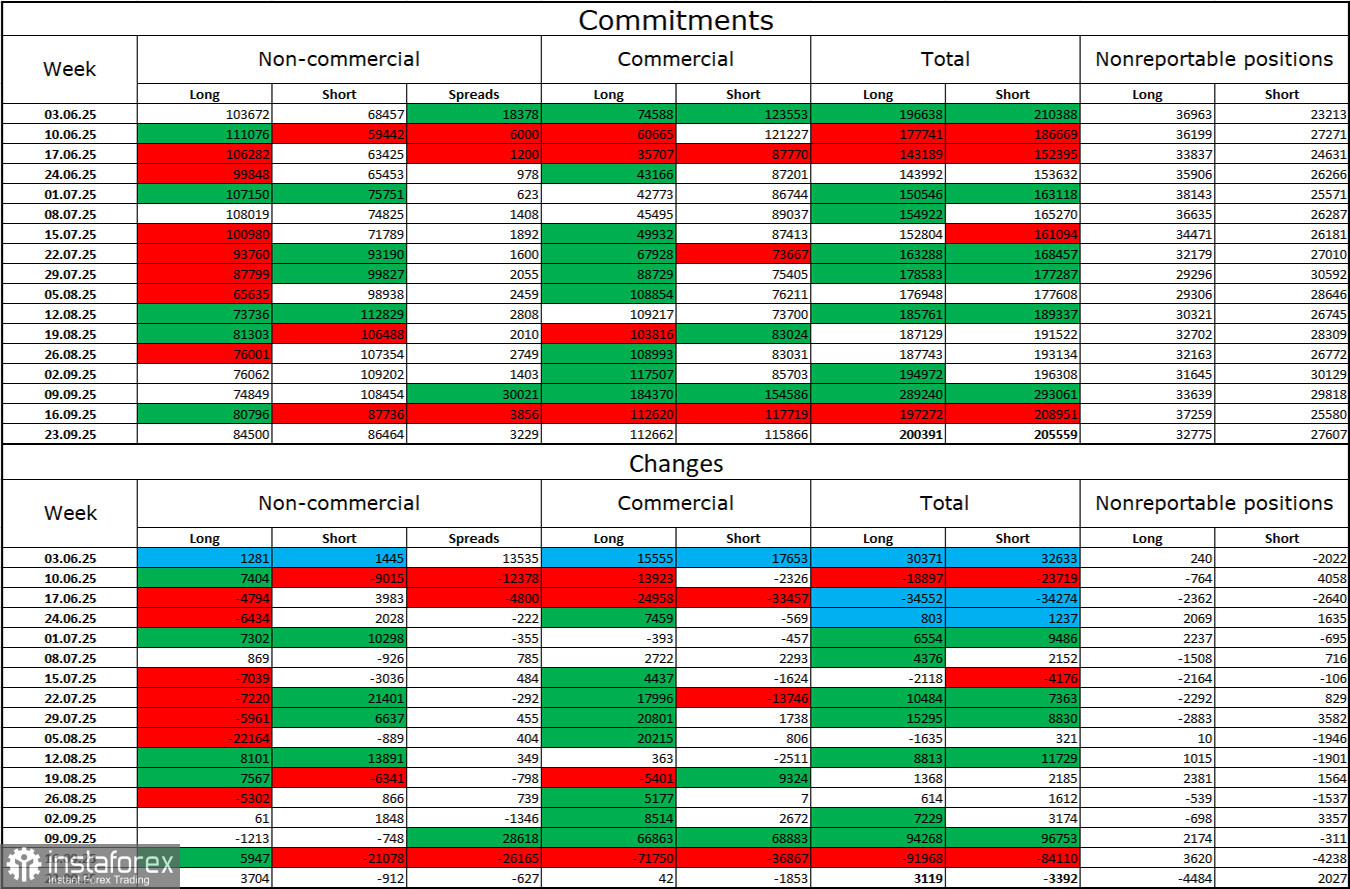

Commitments of Traders (COT) Report

The sentiment of the Non-commercial category became more bullish in the last reporting week — though that report dates back a month. The number of long positions held by speculators increased by 3,704, while the number of short positions decreased by 912. The gap between long and short positions currently stands at approximately 85,000 versus 86,000. Bullish traders are once again tipping the balance in their favor.

In my view, the pound still faces downward potential, but with each passing month the U.S. dollar appears weaker and weaker. Previously, traders worried about Donald Trump's protectionist policies, not realizing what consequences they might bring. Now, they may worry about the aftereffects of those policies: a potential recession, the constant introduction of new tariffs, and Trump's ongoing conflict with the Fed, which could make the regulator politically biased. Thus, the pound now looks far less risky than the U.S. currency.

News Calendar for the U.S. and the U.K.

On October 31, the economic calendar contains no notable events. Therefore, the news background will have no influence on market sentiment on Friday.

GBP/USD Forecast and Trader Recommendations

Sales of the pair were possible after the breakdown below the 1.3354–1.3357 level on the hourly chart, with targets at 1.3313, 1.3247, and 1.3186 — all of which have already been achieved with margin. Today, I do not recommend new sales, as I believe the pound has already fallen sufficiently in recent days. Buying can be considered if there is a rebound from the 1.3110–1.3139 level on the hourly chart, with targets at 1.3186 and 1.3247.

Fibonacci grids are built between 1.3247–1.3470 on the hourly chart and 1.3431–1.2104 on the 4-hour chart.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română