For the third consecutive day, the NZD/USD pair has been trading in negative territory. Following the release of rather uninspiring official Chinese Purchasing Managers' Index (PMI) data, spot prices have been moving slightly, adding to losses against the backdrop of the U.S. dollar's bullish tone. At its two-day meeting on Wednesday, the U.S. Federal Reserve lowered the overnight lending rate to a range of 3.75–4.00% and announced its intention to end balance sheet reduction as early as December, marking the conclusion of its quantitative tightening program. However, the hawkish tone was reinforced by comments from Chair Jerome Powell at the post-meeting press conference, which triggered strong dollar buying and contributed to the NZD/USD pair's decline over the past two days.

Powell dismissed market expectations of a possible rate cut in December, which, combined with increased demand for safe-haven assets, has kept the dollar near its highest level since early August, reached on Thursday. In addition, the dovish outlook from the Reserve Bank of New Zealand (RBNZ) weakened the New Zealand dollar and encouraged the expected continuation of a correction in the NZD/USD pair from the three-week high around 0.5800 reached on Wednesday.

Meanwhile, China's manufacturing PMI for October fell to 49.0 from 49.8 in the previous month, missing expectations of 49.6. This decline offset the unexpected increase in the services PMI, which rose slightly from 50.0 to 50.1. However, these figures, along with the recent optimism driven by de-escalation in U.S.–China trade tensions, provide no real relief for bullish traders. This, in turn, suggests that the path of least resistance for the NZD/USD pair remains downward.

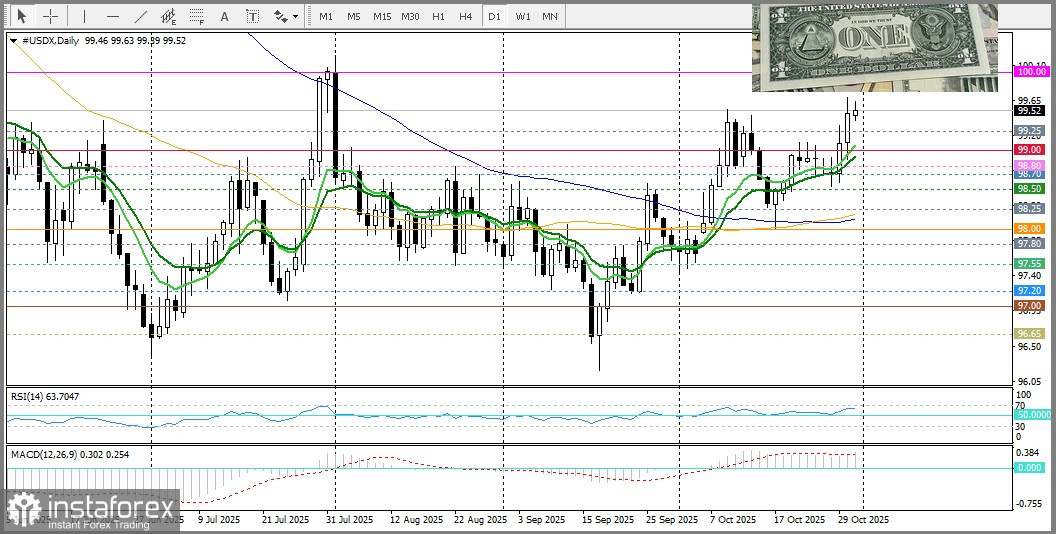

From a technical standpoint, oscillators on the daily chart remain negative, and the pair continues to decline toward the round level of 0.5700. The nearest resistance on any upward move is seen around 0.5750 — the confluence of the 9- and 14-day EMAs.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română