Yesterday, stock indices ended mixed. The S&P 500 rose by 0.17%, while the Nasdaq 100 gained 0.46%. The Dow Jones Industrial Average fell by 0.48%.

However, today, pressure on the market has returned, as uncertainty regarding the Federal Reserve's policy outlook has made investors more cautious. S&P 500 futures contracts declined by 0.8% after the base index showed a slight increase on Monday. Nasdaq 100 futures dropped by 1.1%. European indices are also preparing for a weak opening.

The factor of uncertainty has intensified following the publication of US macroeconomic data, which also failed to clarify the situation. Production data indicated further contraction in the sector, which should push the Fed toward more accommodative actions. According to data released on Monday, the Institute for Supply Management's manufacturing index fell by 0.4 points to 48.7. Values below the 50 mark indicate contraction, and for most of this year, the index has remained in a narrow range. On the other hand, inflation indicators, although showing a downward trend, still remain significantly above the target level, creating a dilemma for the central bank. As a result, investors prefer to take a wait-and-see approach by reducing their risk assets.

Asian stocks fell by 0.8%, while in South Korea, the regulator issued an unusual investment warning regarding SK Hynix Inc. following a 240% rise in the stock.

The US dollar index continued its rise for the fifth consecutive day after strengthening against most currencies, trading at levels last seen in August of this year. The increase occurred amid mixed signals from Fed officials after Chairman Jerome Powell's warning last week that a rate cut in December is not a predetermined decision.

Several members of the US central bank have expressed conflicting views on the prospects for further rate cuts. Federal Reserve Bank of Chicago President Austan Goolsbee stated that he is more concerned about inflation than about the labor market. Earlier, Fed Governor Lisa Cook noted that she believes the risk of further weakening in the labor market outweighs the probability of accelerating inflation. She refrained from endorsing another rate cut next month. "Looking ahead, policy is not on a predetermined path," said Cook. "We are at a moment when risks to both sides of the dual mandate are elevated. Every meeting, including December's, is a live meeting."

In other market segments, gold declined for the third consecutive session. Treasury bonds stabilized, while oil prices fell in response to the market's reaction to OPEC+'s decision to halt production increases. The yen strengthened after Japan's finance minister issued another verbal warning about currency fluctuations.

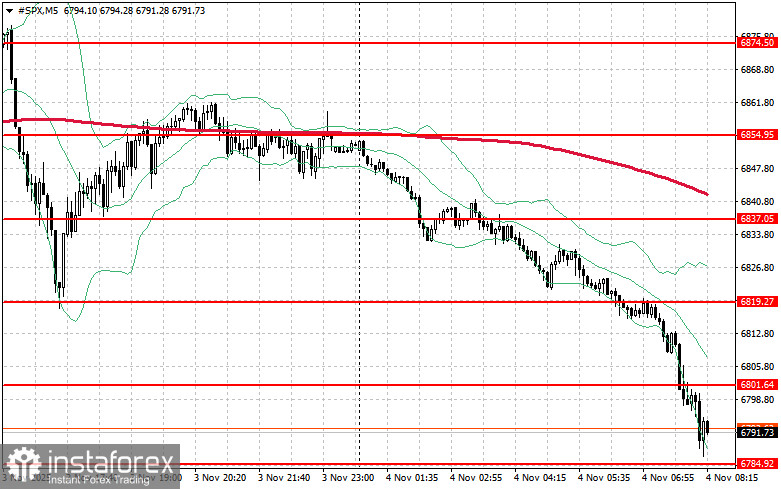

Regarding the technical picture of the S&P 500, the main task for buyers today will be to overcome the nearest resistance level of $6,801. This will help the index gain ground and also pave the way for a breakout to the new level of $6,819. An equally important task for bulls will be maintaining control above $6,837, which would strengthen buyers' positions. In the event of a downward move driven by reduced risk appetite, buyers must assert themselves around the $6,784 area. A break below this level would quickly push the trading instrument back to $6,769 and open the path toward $6,756.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română