Trade analysis and recommendations for trading the British pound

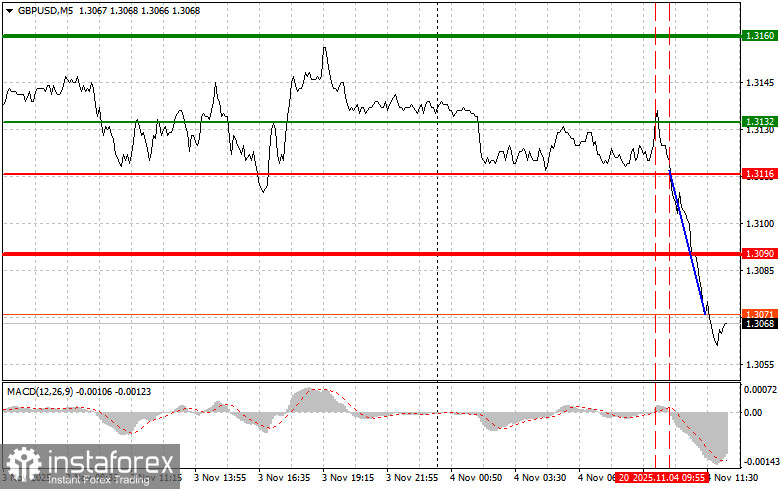

The 1.3116 price test occurred when the MACD indicator had just started moving downward from the zero line, confirming a proper entry point for selling the pound and resulting in a 50-point decline in the pair.

The British pound came under heavy selling pressure earlier today after UK Prime Minister Keir Starmer made it clear that he supports raising taxes to help balance the budget for the next fiscal year. Investors reacted nervously, fearing that increased tax burdens could slow down the recovery of the UK economy, which is already facing multiple challenges.

The short-term outlook for the British pound looks gloomy. Investors are advised to act cautiously and monitor ongoing political and economic developments in the UK. Until the government clears up the uncertainty and presents a convincing economic growth plan, the pound will remain under selling pressure.

During the U.S. trading session, pressure on the GBP/USD pair may intensify further. It will be enough for FOMC member Michelle Bowman to make statements regarding interest rates. In addition to her speech, the U.S. RCM/TIPP Economic Optimism Index will also be released. Data are expected to show the resilience of economic activity, which could further justify the Federal Reserve's wait-and-see stance. If Bowman confirms the Fed's readiness to maintain this stance, the U.S. dollar could strengthen further.

As for intraday strategy, I will mainly focus on implementing Scenarios #1 and #2.

Buy Signal

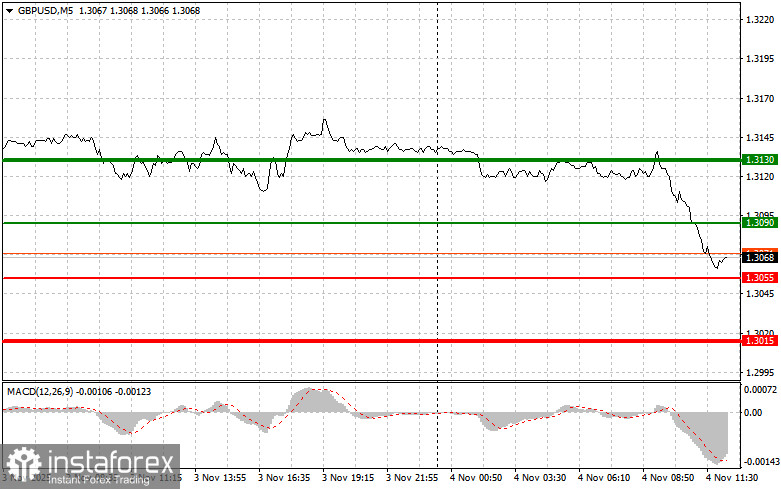

Scenario #1: I plan to buy the pound today at the entry point around 1.3090 (green line on the chart), targeting growth to 1.3130 (thicker green line on the chart). Around 1.3130, I will exit the buy trades and open short positions in the opposite direction, expecting a 30–35-point pullback from the level. A rise in the pound today can only be expected if the Federal Reserve adopts a very soft stance.Important: Before buying, make sure the MACD indicator is above the zero line and is just beginning to rise from it.

Scenario #2: I also plan to buy the pound if the price tests 1.3055 twice while the MACD is in the oversold area. This will limit the pair's downward potential and lead to a market reversal upward. A rise toward 1.3090 and 1.3130 can then be expected.

Sell Signal

Scenario #1: I plan to sell the pound today after the 1.3055 level is broken (red line on the chart), which should lead to a quick decline in the pair. The key target for sellers will be 1.3015, where I plan to exit sell positions and open new buy trades in the opposite direction, expecting a 20–25-point pullback from that level. The pound could fall sharply if the Fed takes a hawkish stance.Important: Before selling, make sure the MACD indicator is below the zero line and is just beginning to decline from it.

Scenario #2: I also plan to sell the pound if the price tests 1.3090 twice while the MACD is in the overbought area. This will limit the pair's upward potential and trigger a market reversal downward. A decline toward 1.3055 and 1.3015 can then be expected.

Chart Explanation:

- Thin green line – entry price for buying the trading instrument;

- Thick green line – suggested level for setting Take Profit or manually fixing profit, since further growth above this level is unlikely;

- Thin red line – entry price for selling the trading instrument;

- Thick red line – suggested level for setting Take Profit or manually fixing profit, since further decline below this level is unlikely;

- MACD indicator – when entering the market, it is important to consider overbought and oversold zones.

Important Notes

Beginner Forex traders should be extremely cautious when making decisions to enter the market. Before the release of major fundamental reports, it's best to stay out of the market to avoid sharp price swings. If you decide to trade during news releases, always place stop-loss orders to minimize potential losses. Without stop-losses, you can very quickly lose your entire deposit, especially if you don't use money management and trade with large volumes.

And remember: successful trading requires a clear trading plan, like the one outlined above. Spontaneous trading decisions based solely on the current market situation are an inherently losing strategy for an intraday trader.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română