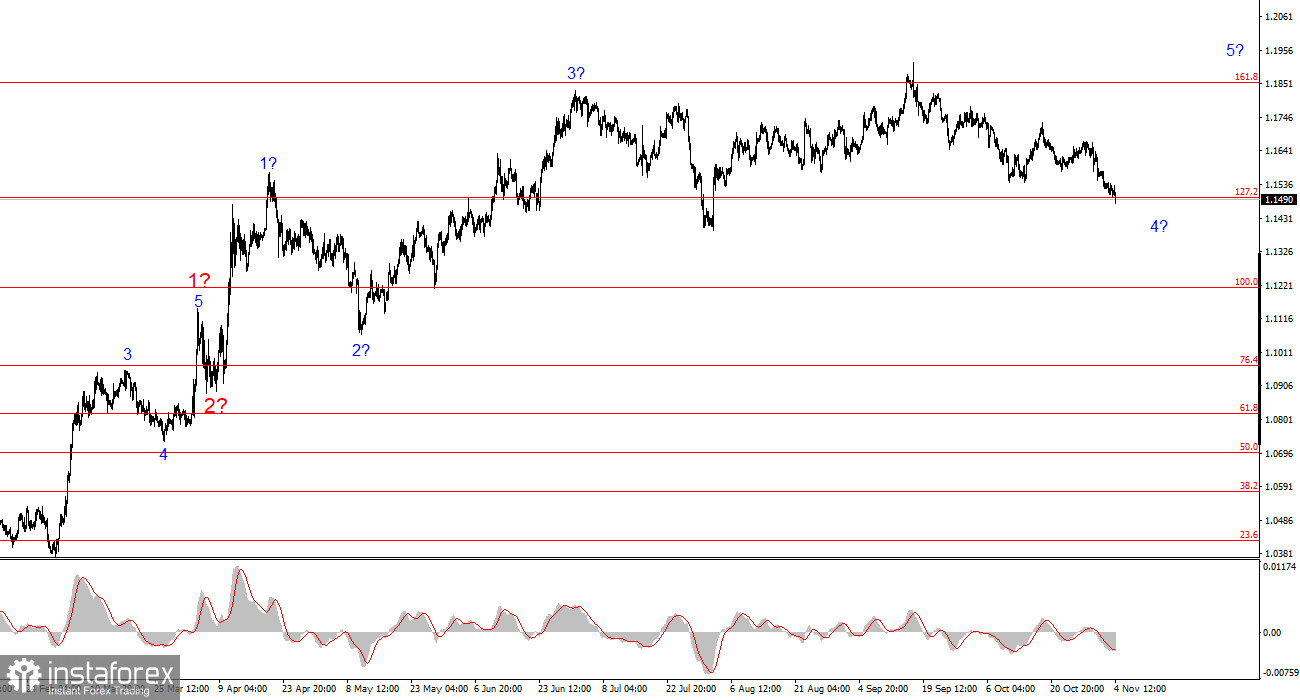

The 4-hour chart wave structure for EUR/USD has changed — unfortunately, not for the better. It's still too early to conclude that the upward section of the trend has been canceled, but the latest decline in the euro has made it necessary to refine the wave pattern.

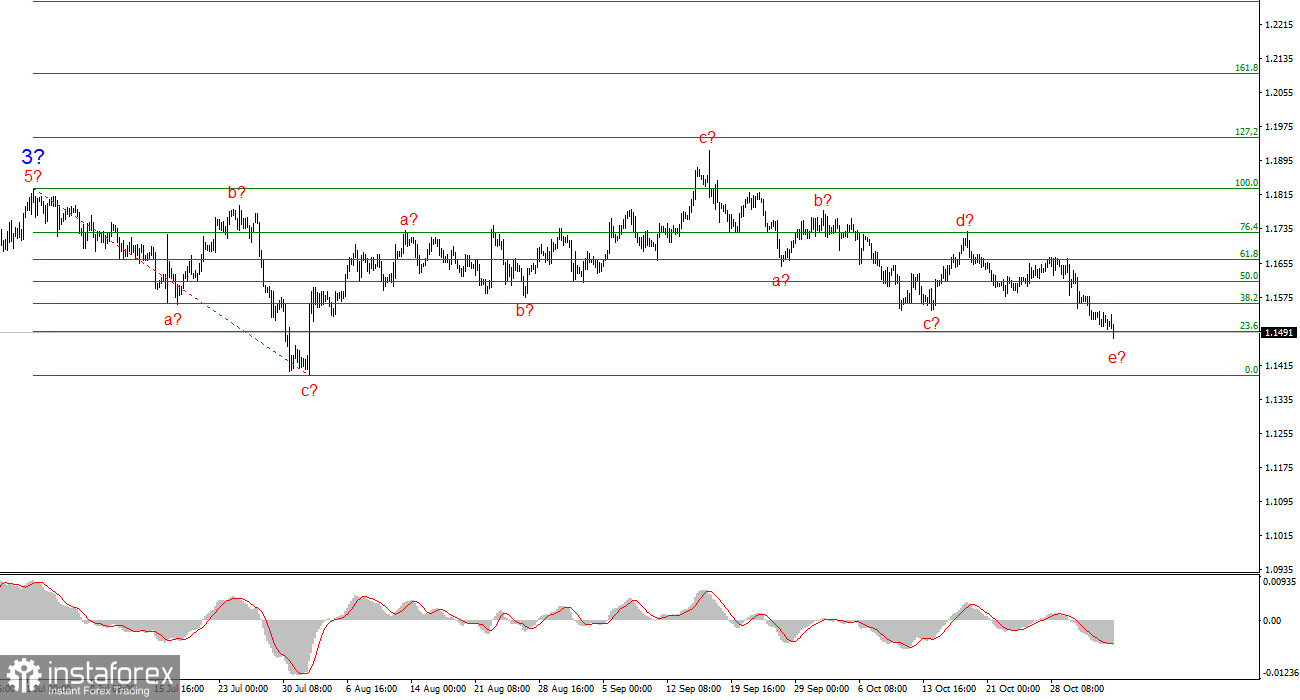

Now we see a series of corrective structures, which may be part of the global wave 4 within the upward trend section. In this case, wave 4 has taken on an unnaturally extended form, but overall, the wave pattern remains internally consistent.

The upward trend section continues to develop, and the news background still largely supports everything but the dollar. The trade war started by Donald Trump continues. The confrontation between the president and the Federal Reserve also continues. The market's "dovish" expectations for the Fed's rate policy remain high, especially for 2026. In the U.S., the government shutdown is ongoing. The labor market is "cooling down."

I believe the recent strengthening of the dollar is, to some extent, a paradox. But paradoxes do happen in financial markets.

In my view, the upward trend section is not yet complete, and its targets extend up to the 1.25 level. Based on this, the euro may continue to decline for some time — even without strong reasons (as has been the case over the past month) — but the wave pattern still implies a continuation of the upward trend.

The EUR/USD pair fell by only 10 basis points on Monday and lost another 30 points on Tuesday. Once again, I draw readers' attention to the fact that market volatility is very weak, and the euro's decline is even weaker. In other words, sellers do not currently have extraordinary strength, but their efforts are still enough to push the pair lower almost every day — often in the complete absence of news, and sometimes even contrary to the news background.

Monday was quite an interesting day. Traders completely ignored the final October manufacturing PMI figures in the morning. However, they did notice the U.S. ISM Manufacturing Index... for about five minutes.

The index for October fell from 49.1 to 48.7 points, while the market had expected 49.5 points. Thus, the indicator worsened and came in below expectations. Is that good or bad for the U.S. economy and the dollar? To me, the answer is obvious — but apparently not for most market participants, who reduced their demand for the U.S. currency for just 5–10 minutes, and then continued to push the pair downward.

On Tuesday, there was no news background at all, yet sellers continued to pressure the euro. Another corrective wave sequence is still forming.

General Conclusions

Based on the analysis of EUR/USD, I conclude that the pair is still building an upward trend section. The market is currently in a pause, but Donald Trump's policies and the Federal Reserve's stance remain significant factors that could lead to a future decline in the U.S. dollar.

The targets of the current trend section may extend up to the 1.25 level. At present, we are likely observing the formation of corrective wave 4, which is taking on a complex and extended form.

Therefore, in the near term, I still consider only buy trades, as all downward structures appear to be corrective. The latest a–b–c–d–e pattern may be approaching completion.

On a smaller scale, the entire upward trend structure is visible. The wave pattern is not entirely standard, as the corrective waves differ in size. For example, the larger wave 2 is smaller than the internal wave 2 within wave 3 — but such cases do occur.

I'd like to remind readers that it's best to identify clear and understandable structures on charts rather than trying to label every single wave. The current upward pattern is generally not in doubt.

Key Principles of My Analysis

- Wave structures should be simple and clear. Complex structures are hard to interpret and often lead to changes.

- If you are not confident about what's happening in the market, it's better to stay out.

- There is never 100% certainty about the market's direction. Always remember to use Stop Loss protective orders.

- Wave analysis can be combined with other analytical methods and trading strategies.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română