The "shutdown" in America is becoming increasingly evident. Ordinary Americans are suffering as they have faced delays and cancellations of many domestic flights in recent weeks. Reports indicate that US airports are experiencing a shortage of air traffic controllers, and many employees have not been paid for over a month. It's likely clear to everyone how someone performs their duties when they are not being paid—sloppily. And an airport is not the kind of place where one can afford to be negligent.

In New York, over the weekend, 80% of air traffic controllers were absent. Last Friday, around 6,200 flights were delayed nationwide, and 500 were canceled. Transportation Secretary Sean Duffy stated that if there is a threat to passenger safety, he will decide to close the airspace, meaning airport operations will be halted.

A similar situation is being observed in many sectors of the American economy. As I mentioned, when a person has their salary delayed or is put on an unpaid leave (yet still a leave), that is one issue. However, if an employee is forced to work for free, that is an entirely different matter. Many American public servants are already prepared to resign and seek other jobs if the "shutdown" does not end soon.

It is important to remember that the American economy is built on credit. Almost every American has either an outstanding credit card balance or a mortgage. How can one pay off debts if salaries are not being paid? Therefore, even without Donald Trump, the US faces a wave of layoffs among public servants.

Treasury Secretary Scott Bessent stated that some areas of the American economy are in recession. He noted that consumer spending is declining. Oddly, a staunch Trump supporter is saying this, even though he should know that consumer spending drops with rising prices. However, it appears that the dollar is no longer the currency of the US. At the very least, one wants to draw such a conclusion when observing its strengthening amid all the events in America.

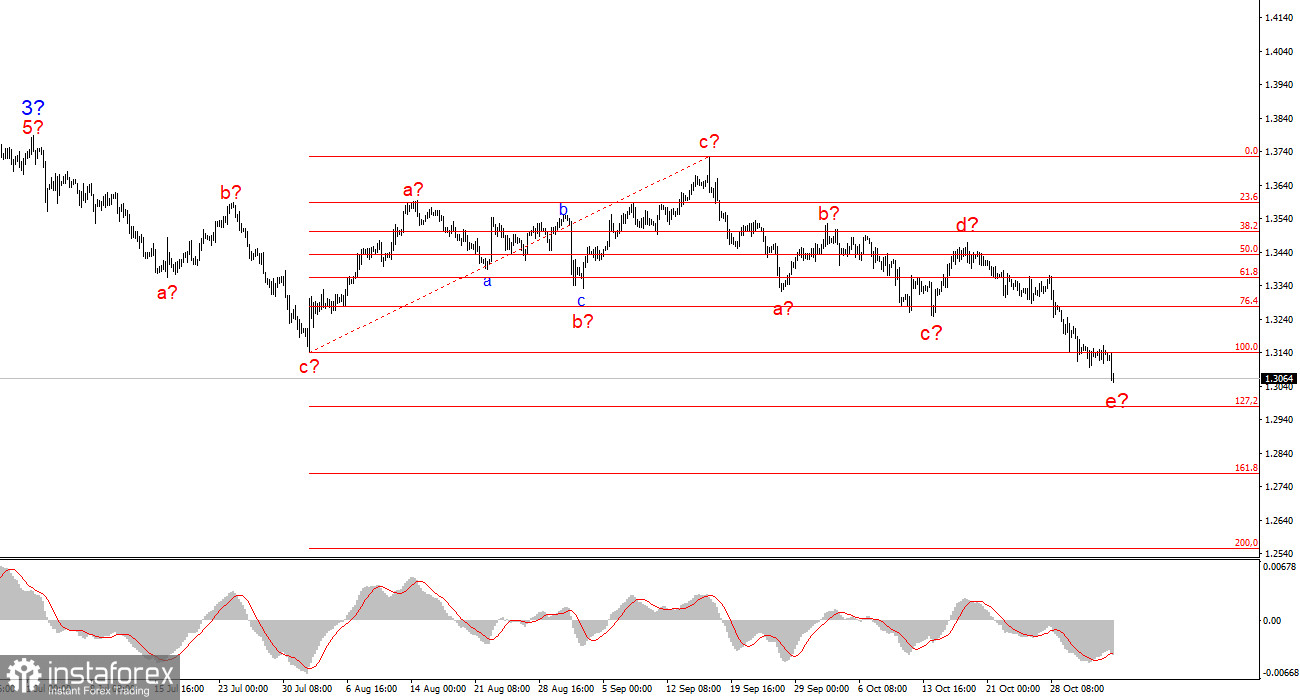

Wave Analysis of EUR/USD

Based on the analysis of EUR/USD, I conclude that the instrument continues to form an upward trend. Currently, the market is in a pause, but Donald Trump's policies and the Fed's remain significant factors in the future decline of the US currency. Targets for the current trend section may extend up to the 25 level. At this time, we can observe the construction of corrective wave 4, which takes on a very complex and elongated form. Therefore, in the near future, I still consider only long positions, as any downward structures appear to be corrective. The latest structure—a-b-c-d-e—may be nearing completion.

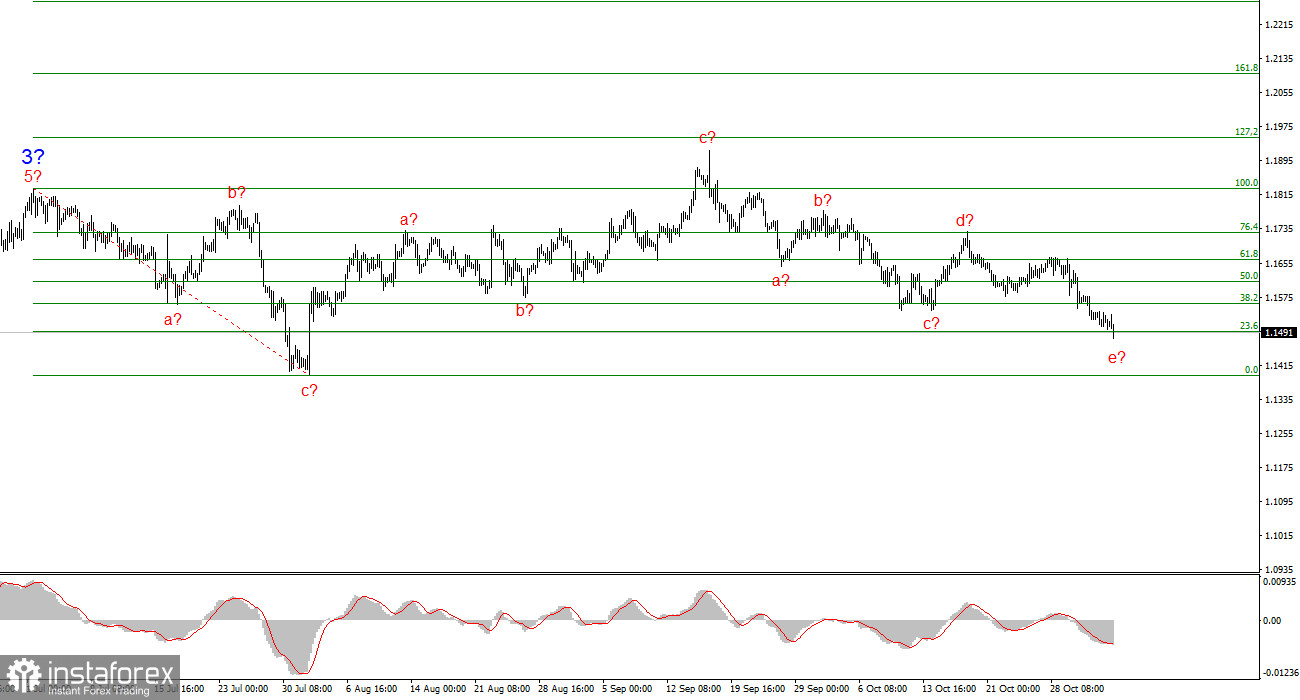

Wave Analysis of GBP/USD

The wave pattern for the GBP/USD instrument has changed. We continue to deal with an upward, impulsive trend section, but its internal wave structure is becoming more complex. Wave 4 takes on a three-wave form, and its structure is significantly more elongated than wave 2. Another downward corrective structure is nearing completion. I continue to expect that the main wave structure will resume its development with initial targets around 38 and 40 levels, and I believe this could happen as early as the beginning of November.

Key Principles of My Analysis

- Wave structures should be simple and understandable. Complex structures are difficult to trade and often undergo changes.

- If there is no confidence in market movements, it is better not to enter the market.

- There is no such thing as 100% certainty in directional movements, and there never can be. Always remember to use protective stop loss orders.

- Wave analysis can be combined with other types of analysis and trading strategies.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română