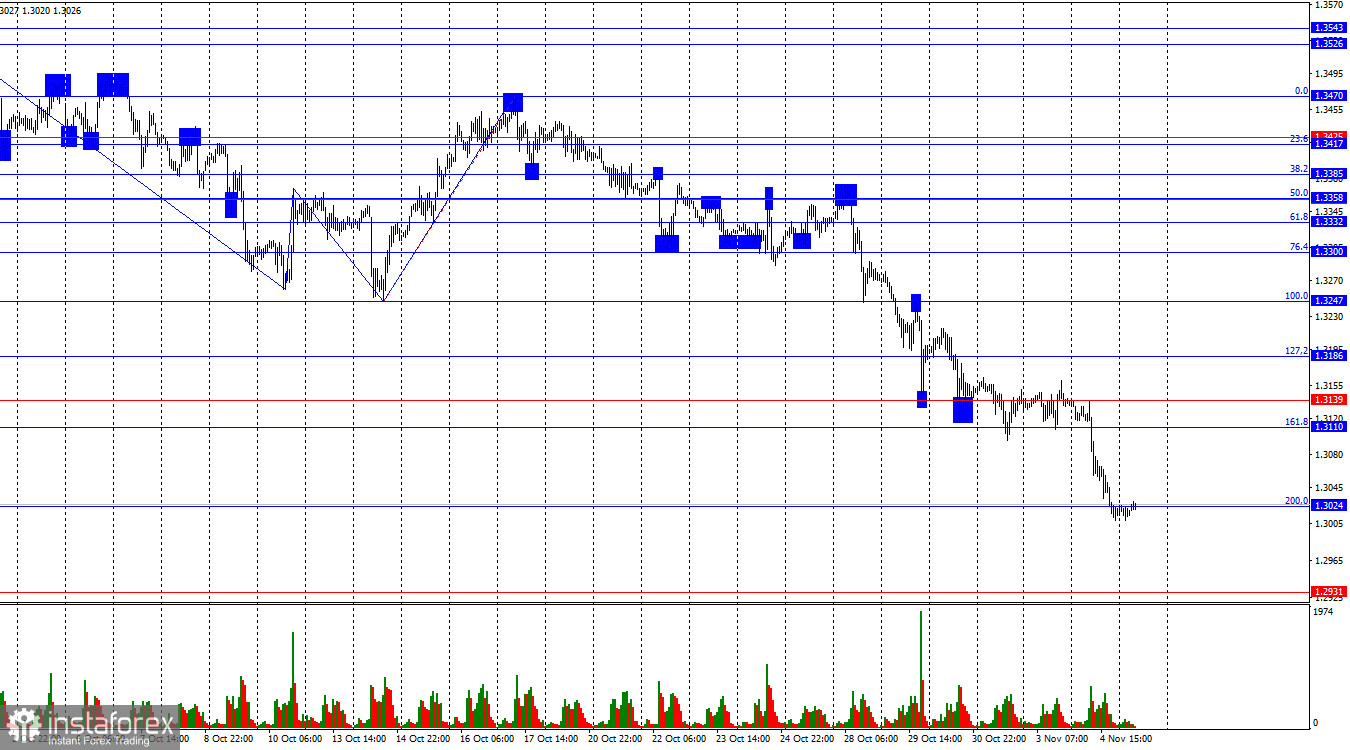

On the hourly chart, the GBP/USD pair on Tuesday consolidated below the support level of 1.3110–1.3139 and continued to decline. By the end of the day, after losing another 100 pips, it reached the 200.0% Fibonacci level at 1.3024. A rebound from this level could lead to a reversal in favor of the pound and some growth toward 1.3110. However, a firm break below this level would increase the likelihood of a continued fall toward the next target of 1.2931.

The wave structure remains bearish. The last completed upward wave broke the previous peak, but the latest downward wave — now forming for three weeks — has long since broken the previous low. The news background in recent weeks has been negative for the U.S. dollar, yet the bulls have failed to take advantage of the opportunities to advance. Last week, they abruptly withdrew from the market despite the Federal Reserve's rate cut, and this week they continue to retreat regardless of the news.

On Tuesday, there was virtually no significant news for either the pound or the dollar, except for another speech by UK Chancellor Rachel Reeves, whose rhetoric once again created problems for the pound. The bears immediately launched another offensive, taking advantage of the bulls' inaction. This Thursday's Bank of England meeting could strongly influence market sentiment. The question is, which side will it favor — bulls or bears? It's worth remembering that the outcome of the Monetary Policy Committee (MPC) vote will be key. Depending on how many policymakers support a rate cut, the pound will either rise or fall. For now, though, the bears seem to need no help — they have been attacking non-stop for three consecutive weeks, while the bulls remain passive under any circumstances.

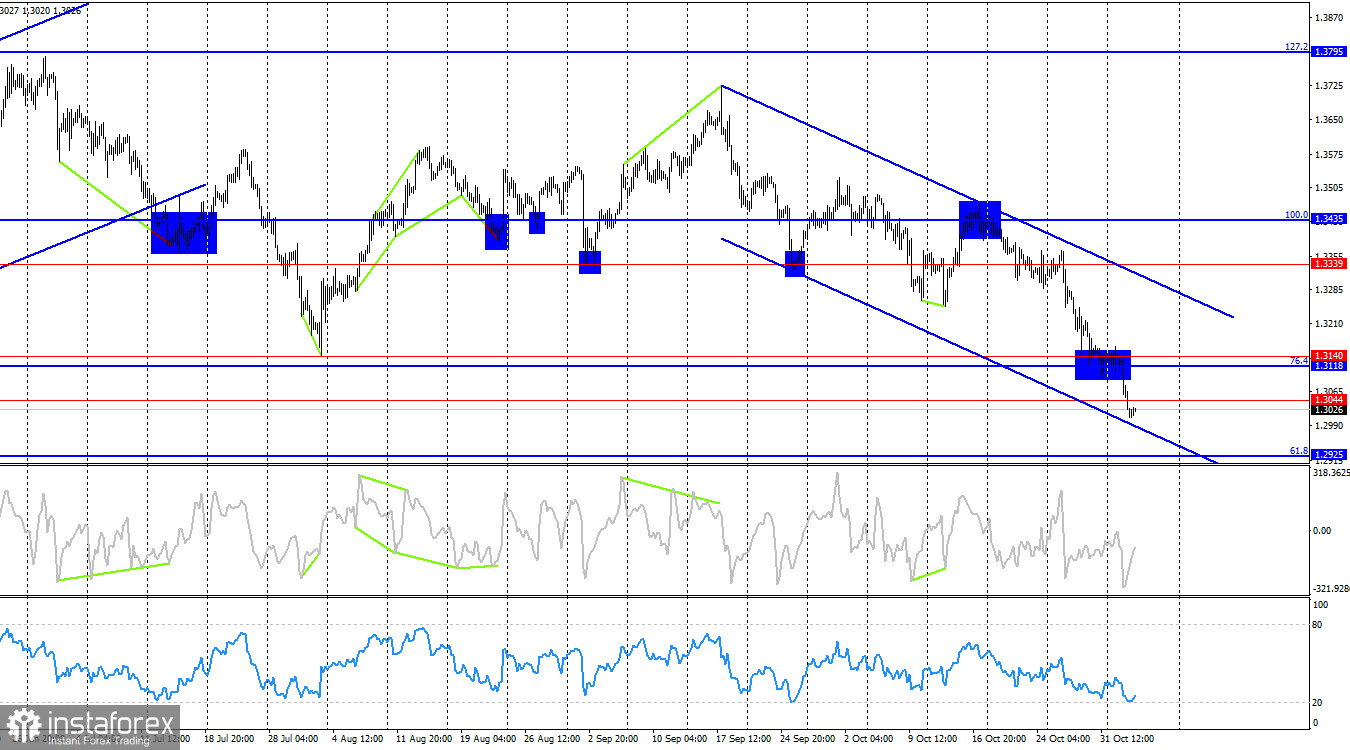

On the 4-hour chart, the pair rebounded from the 100.0% retracement level at 1.3435, which worked in favor of the U.S. currency, and consolidated below 1.3044. Thus, the decline may continue toward the next 61.8% Fibonacci retracement level at 1.2925. No emerging divergences are visible on any indicator. The downward trend channel clearly points to a bearish trend that leaves little room for doubt.

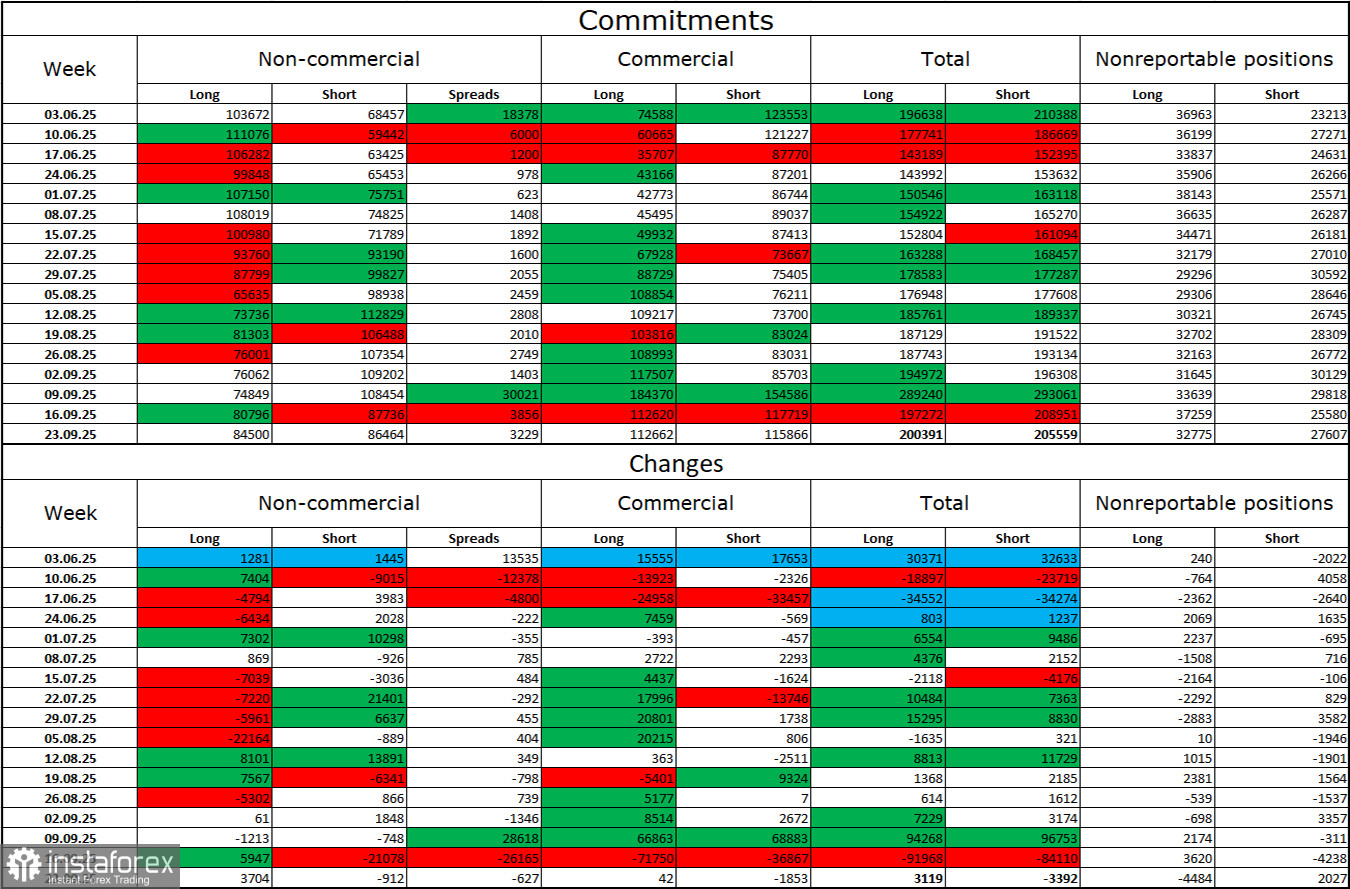

Commitments of Traders (COT) Report:

The sentiment among the Non-commercial trader category became slightly more bullish in the most recent reporting week — though that data is now a month old. The number of long positions held by speculators increased by 3,704, while the number of short positions decreased by 912. The gap between long and short contracts currently stands at roughly 85,000 vs. 86,000. Bulls are again trying to tip the balance in their favor.

In my view, the pound still has room to fall, although the U.S. dollar appears weaker with each passing month. Previously, traders worried about Donald Trump's protectionist policies without fully understanding their consequences. Now, they may be concerned about the aftermath of those policies — potential recession, the constant introduction of new tariffs, and Trump's confrontation with the Federal Reserve, which could lead to the central bank becoming politically biased. Thus, at this stage, the pound seems far less risky than the U.S. currency.

Economic Calendar for the U.S. and the U.K.:

- U.K. – Services PMI (09:30 UTC)

- U.S. – ADP Employment Change (13:15 UTC)

- U.S. – ISM Services PMI (15:00 UTC)

On November 5, the economic calendar contains three entries, two of which are significant. The impact of these events on market sentiment may be felt in the second half of the day.

GBP/USD Forecast and Trader Recommendations: Selling the pair was possible after a close below the 1.3354–1.3357 zone on the hourly chart, with targets at 1.3313, 1.3247, and 1.3186 — all of which have been reached comfortably. I am not considering new sell positions at the moment, as the pound has already fallen considerably. Long positions may be considered if the pair rebounds from the 1.3024 level on the hourly chart, with targets at 1.3110 and 1.3186.

Fibonacci levels are drawn between 1.3247–1.3470 on the hourly chart and 1.3431–1.2104 on the 4-hour chart.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română