History repeats itself. Sometimes it seems almost like a copy. The EUR/USD pair has fallen for five consecutive trading days. This marks the longest losing streak since July. In both mid-summer and late autumn, we see very similar processes taking place. A strong U.S. economy has prompted the futures market to lower the odds of a Federal Reserve rate hike, while the political crisis in France has pressured the euro. Additionally, the escalation of the trade conflict between Washington and Brussels has raised doubts about the Eurozone's bright future.

There are, of course, differences. The government of Elisabeth Borne is still holding together, unlike that of Francois Bayrou, who was ousted. Concessions to socialists on pension reform must be made, along with listening to their views on raising taxes on the wealthy. The U.S. tariffs have proven to be less destructive for the currency bloc's economy than previously thought. The end of the shutdown increases the likelihood of a prompt hike in the federal funds rate in December. At first glance, the situation looks better for the euro than it did at the end of July. However, there is no savior in the wings like there was back then.

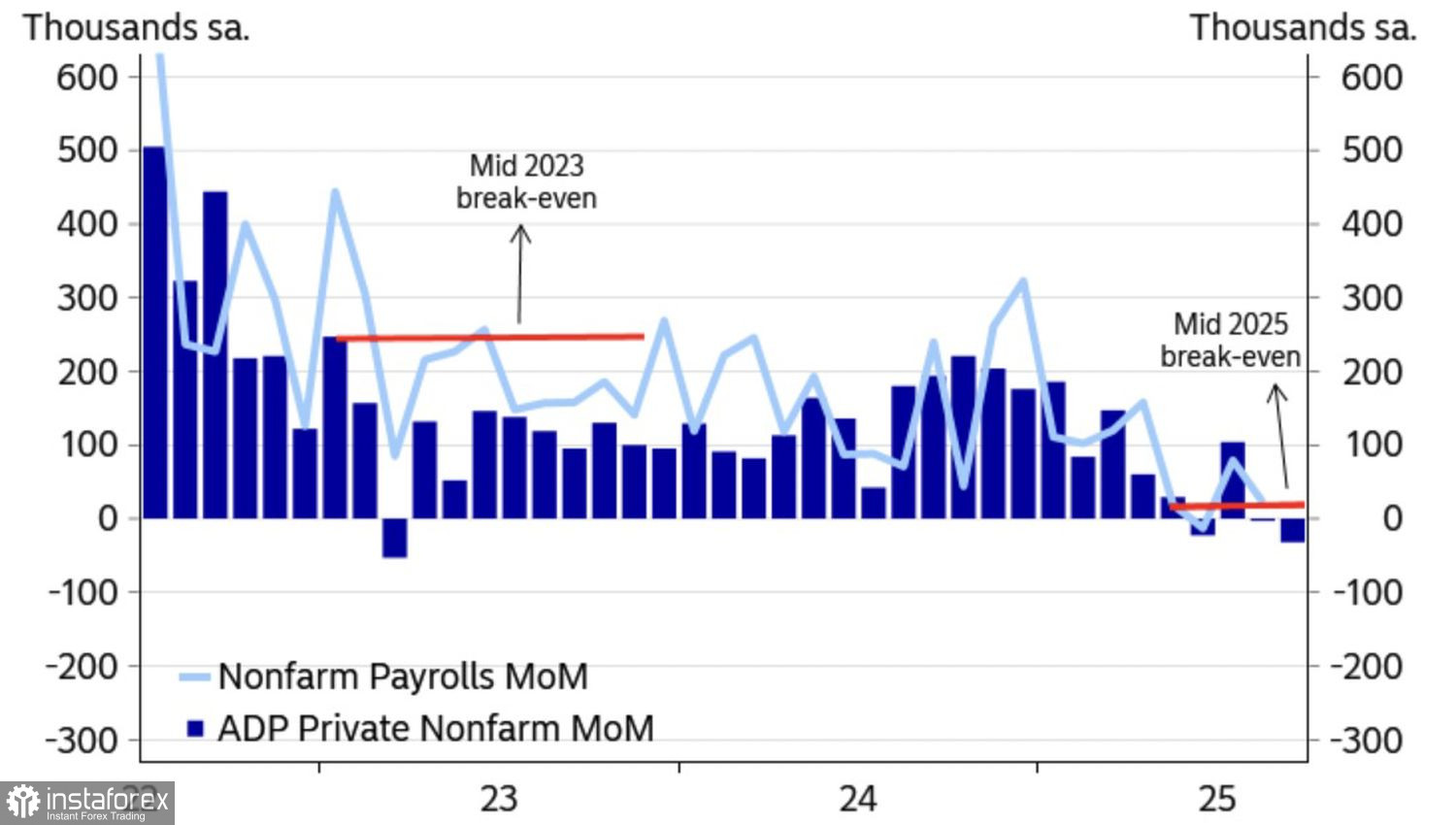

Dynamics of U.S. Employment

In early August, EUR/USD soared due to a disappointing U.S. employment report. This led to a shift in the Fed's rhetoric. In Jackson Hole, Jerome Powell changed his cautious mantra to state that cooling labor markets would reduce domestic demand and slow inflation. Investors expected a September rate cut and began selling the U.S. dollar.

Unfortunately, the ongoing government shutdown prevents this history from repeating itself. Data is not coming in, and employment must be inferred from ADP statistics. This data is collected from the private sector, meaning it does not account for government finances. But if there's nothing else, any information will do. It is expected that the figure for October will rise by 22,000. This is not an impressive number, but after a 32,000 reduction in September, it is already a positive sign. Likely, this has already been priced into the EUR/USD quotes, so numbers close to the forecast are most likely to result in a rebound of the main currency pair upwards.

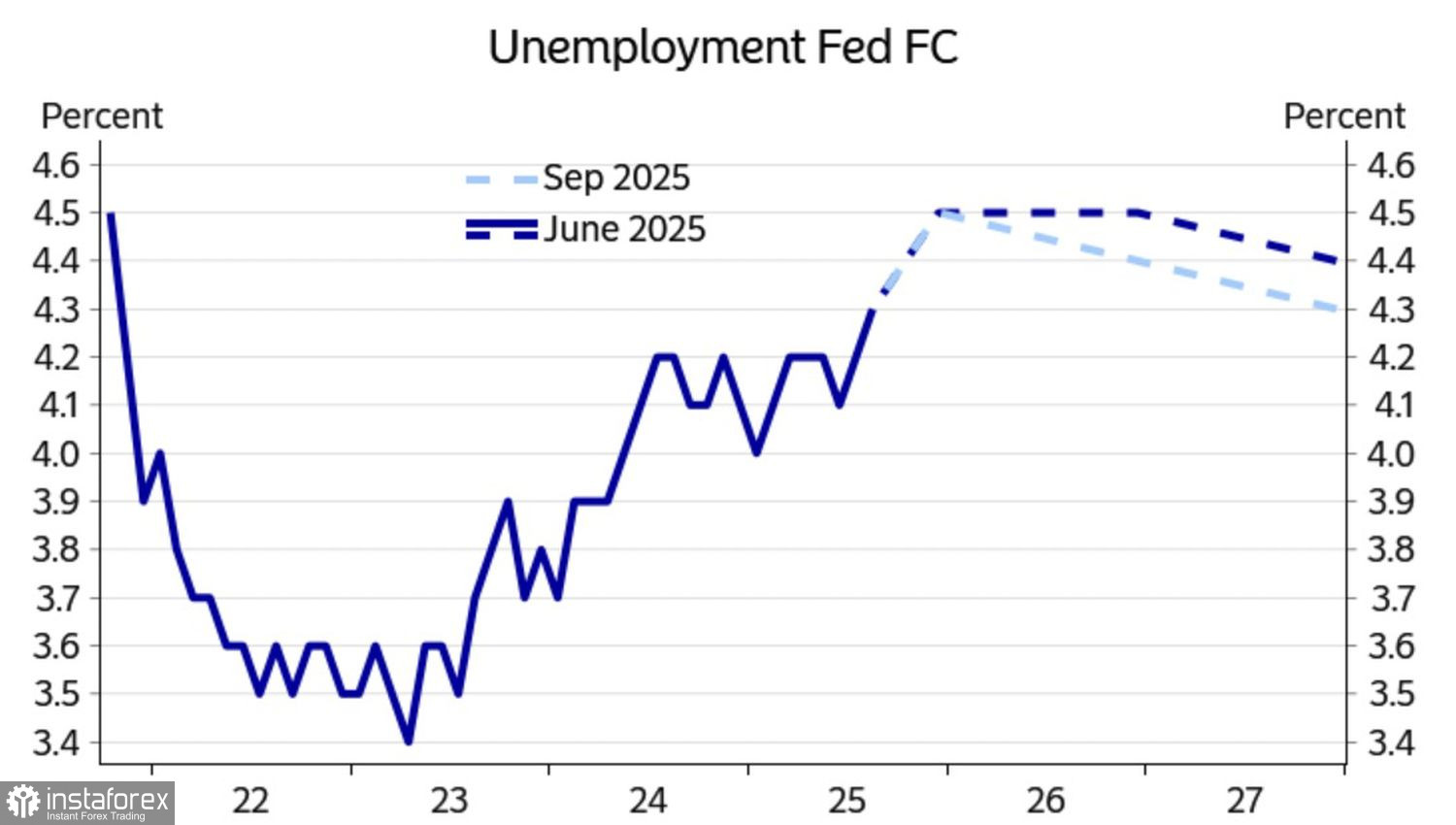

Unemployment Dynamics and Fed Forecasts

Interestingly, recent FOMC forecasts indicated a modest rise in unemployment. This suggests that the Fed intends to throw a lifebuoy to the labor market to prevent it from freezing. It seems that Jerome Powell's comments that not everything is determined regarding a rate cut in December are just empty words. The central bank will ease monetary policy. If that is the case, the U.S. dollar's strengthening has gone too far.

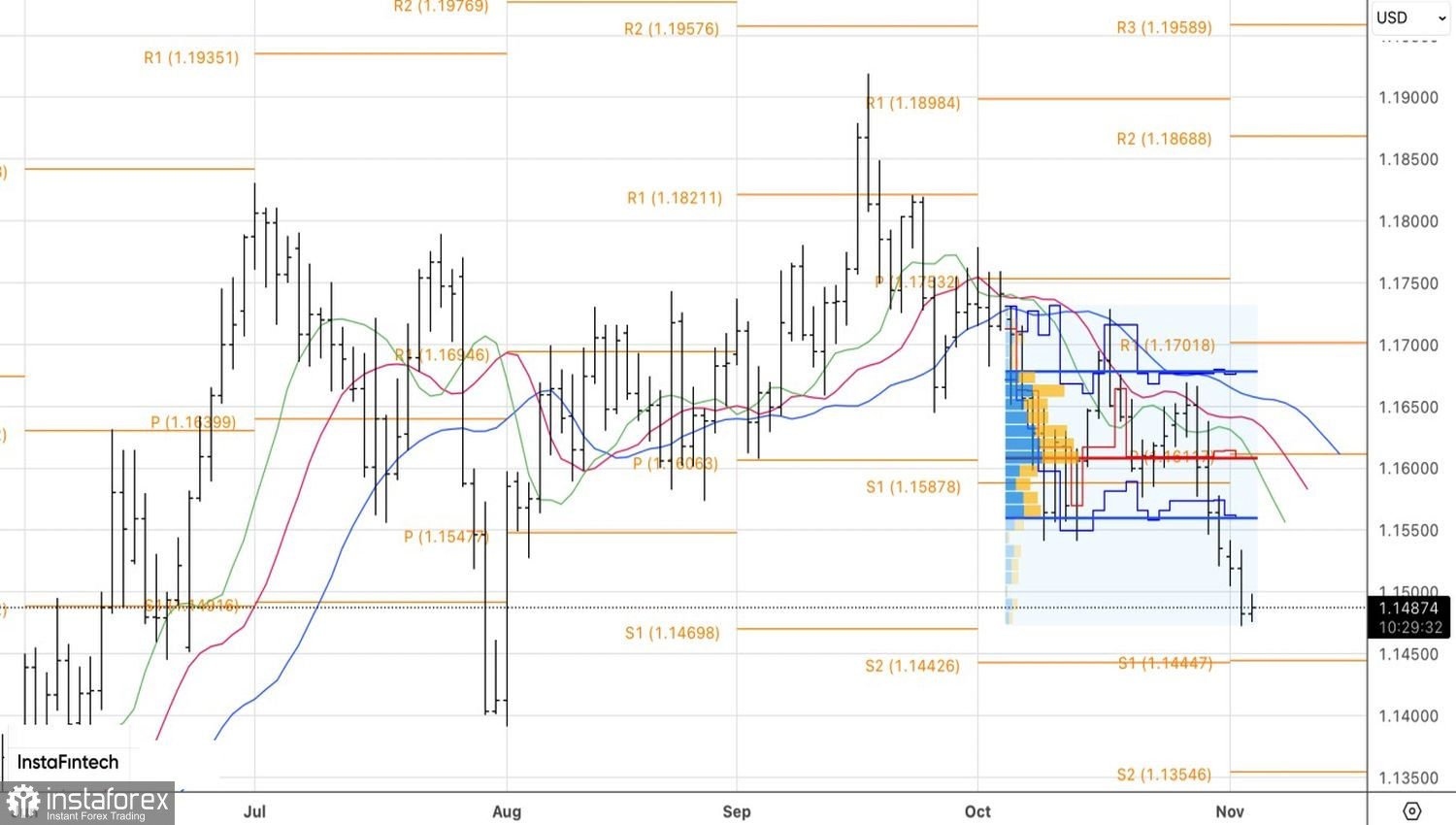

Technically, on the daily chart, the EUR/USD decline appears relentless. However, the main currency pair has entered a strong convergence zone at 1.147–1.149. An inability to break below this will signal weakness among sellers. A return above 1.150 would be a reason to buy. A bullish scenario can also be considered with a dip to 1.145, followed by a return above 1.147.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română