Trade Analysis and Recommendations for Trading the British Pound

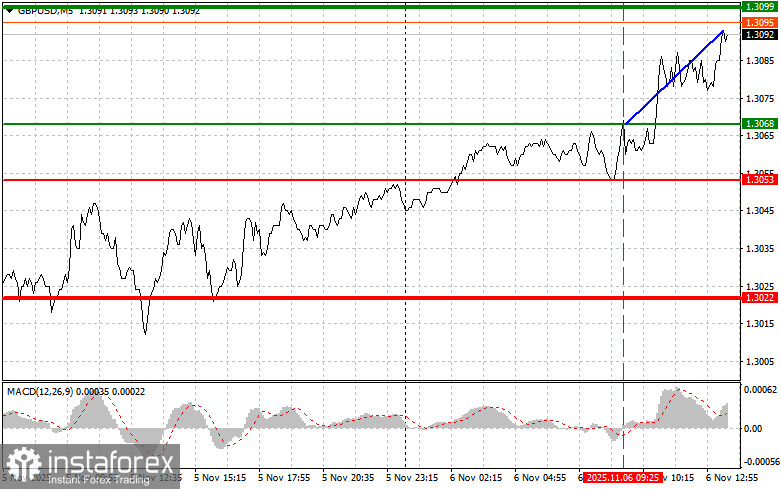

A price test at 1.3068 occurred when the MACD indicator had just started to move upward from the zero mark, confirming the correct entry point for buying the pound. As a result, the pair rose by more than 30 points.

The pound showed no reaction to the news of a decline in the U.K. Construction PMI index. Despite the fact that the indicator fell further below the 50-point threshold, signaling a contraction in construction activity, investors seemed to ignore this data. Most likely, the market's attention is focused on broader factors such as the Bank of England's interest rate outlook and the overall state of the British economy.

The drop in the PMI is certainly a worrying sign for the construction sector, which plays an important role in the nation's economic growth. Falling demand for new housing and commercial properties may negatively affect employment and investment. However, since the construction sector represents only part of the economy, the effect of the decline could be offset by positive trends in other industries.

Next, investor attention will shift to statements from three key members of the Federal Open Market Committee (FOMC): Michael S. Barr, John Williams, and Christopher Waller. Their comments are expected to shed light on the Fed's ongoing dilemma—how to balance the need to curb inflationary pressures with the risk of excessively tight monetary policy that could further slow labor market growth.

As for the intraday strategy, I'll rely primarily on Scenarios #1 and #2 below.

Buy Signal

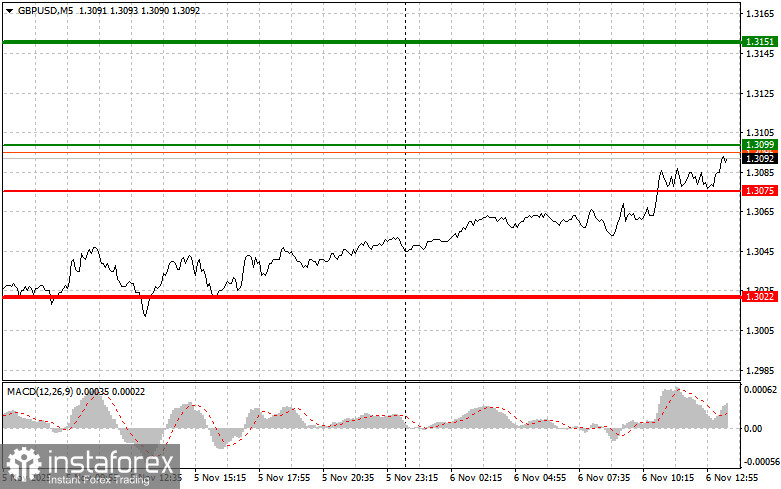

Scenario #1: I plan to buy the pound today when the price reaches around 1.3099 (green line on the chart), targeting 1.3151 (thick green line on the chart). Near 1.3151, I plan to exit buy positions and open sell trades in the opposite direction, expecting a 30–35-point move back from that level. A rise in the pound today is possible only if the Bank of England maintains a very hawkish stance.

Important! Before buying, make sure that the MACD indicator is above the zero line and just beginning to rise from it.

Scenario #2: I also plan to buy the pound if there are two consecutive tests of the 1.3075 level while the MACD is in the oversold area. This would limit the pair's downward potential and trigger a reversal upward. A rise toward the 1.3099 and 1.3151 levels can then be expected.

Sell Signal

Scenario #1: I plan to sell the pound today after a break below 1.3075 (red line on the chart), which should lead to a quick decline in the pair. The key target for sellers will be 1.3022, where I intend to exit sell positions and open buy trades in the opposite direction, expecting a 20–25-point rebound from that level. The pound may fall further if Fed officials adopt a hawkish tone.

Important! Before selling, make sure that the MACD indicator is below the zero line and just beginning to decline from it.

Scenario #2: I also plan to sell the pound if there are two consecutive tests of the 1.3099 level while the MACD is in the overbought area. This would limit the pair's upward potential and trigger a reversal downward. A decline toward 1.3075 and 1.3022 can then be expected.

Chart Explanation

- Thin green line – entry price at which a buy trade can be opened;

- Thick green line – suggested level for placing Take Profit orders or manually securing profits, since further growth above this level is unlikely;

- Thin red line – entry price at which a sell trade can be opened;

- Thick red line – suggested level for placing Take Profit orders or manually securing profits, since further decline below this level is unlikely;

- MACD indicator – when entering trades, focus on overbought and oversold zones.

Important Notes for Beginner Forex Traders

Beginner traders should be very cautious when deciding to enter the market. Before the release of major fundamental reports, it's best to stay out of the market to avoid sharp price swings. If you choose to trade during news events, always set stop-loss orders to minimize losses. Trading without stop-loss protection can lead to a rapid loss of your entire deposit, especially if you ignore money management principles and trade large positions.

And remember: To trade successfully, you must have a clear trading plan, such as the one presented above. Spontaneous trading decisions based solely on current market movements are, from the start, a losing strategy for any intraday trader.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română