Trade Analysis and Recommendations for Trading the Japanese Yen

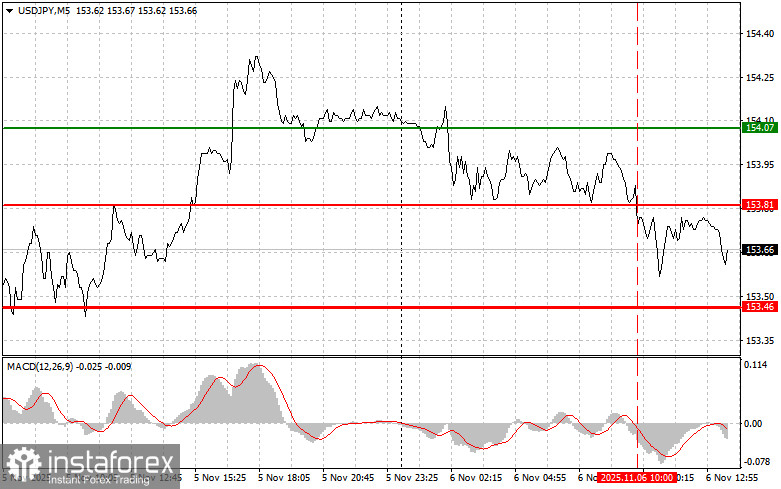

A price test at 153.81 occurred when the MACD indicator had already moved far below the zero mark, which limited the pair's downward potential. For that reason, I chose not to sell the dollar.

Today, all investors will be closely watching statements from three members of the Federal Open Market Committee (FOMC). Remarks by Michael S. Barr, John Williams, and Christopher Waller are expected to help determine the direction of USD/JPY.

Michael Barr is of particular interest to analysts, as his views on inflation dynamics and economic growth prospects are still evolving. John Williams, head of the Federal Reserve Bank of New York, is known as a pragmatic economist, and his assessment of the U.S. economy always draws strong market attention. Christopher Waller, who takes a more hawkish stance, will no doubt address the need to maintain rates at current levels in order to reach the Fed's inflation targets.

Traders will carefully monitor every word from these officials, seeking hints about potential adjustments to the FOMC's monetary policy course. Any differences of opinion among committee members could trigger significant volatility in the currency market.

As for the intraday strategy, I will focus mainly on Scenarios #1 and #2 below.

Buy Signal

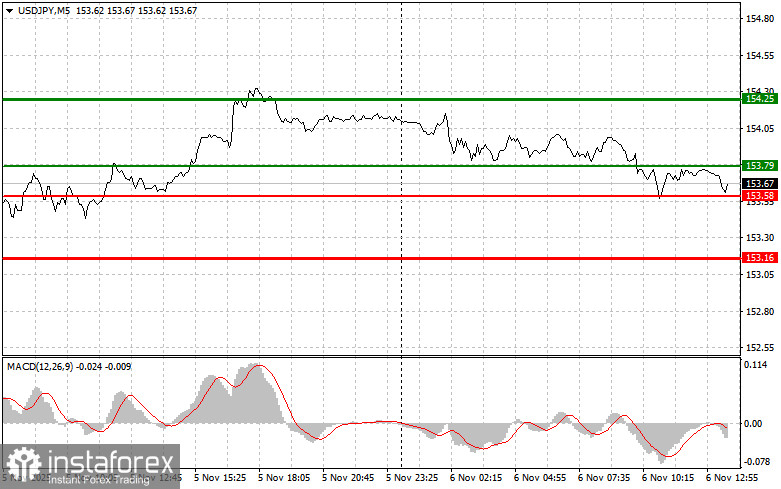

Scenario #1: I plan to buy USD/JPY today when the price reaches around 153.79 (green line on the chart), targeting 154.25 (thicker green line on the chart). Near 154.25, I plan to exit buy positions and open sell trades in the opposite direction, expecting a 30–35-point pullback from that level. A rise in the pair can be expected only after strong U.S. data.

Important! Before buying, make sure that the MACD indicator is above the zero line and just beginning to rise from it.

Scenario #2: I also plan to buy USD/JPY if there are two consecutive tests of the 153.58 level while the MACD is in the oversold area. This should limit the pair's downward potential and trigger a reversal upward. A rise toward 153.79 and 154.25 can then be expected.

Sell Signal

Scenario #1: I plan to sell USD/JPY today after a break below 153.58 (red line on the chart), which should lead to a quick decline in the pair. The key target for sellers will be 153.16, where I plan to exit sell trades and open buy positions in the opposite direction, expecting a 20–25-point rebound from that level. Pressure on the pair could return if Fed representatives deliver dovish comments.

Important! Before selling, make sure that the MACD indicator is below the zero line and just beginning to decline from it.

Scenario #2: I also plan to sell USD/JPY if there are two consecutive tests of the 153.79 level while the MACD is in the overbought area. This would limit the pair's upward potential and trigger a reversal downward. A decline toward 153.58 and 153.16 can then be expected.

Chart Explanation

- Thin green line – entry price for opening a buy trade;

- Thick green line – suggested level for placing a Take Profit order or manually securing profits, since further growth above this level is unlikely;

- Thin red line – entry price for opening a sell trade;

- Thick red line – suggested level for placing a Take Profit order or manually securing profits, since further decline below this level is unlikely;

- MACD indicator – when entering the market, focus on overbought and oversold zones.

Important Notes for Beginner Forex Traders

Beginner traders should be extremely cautious when deciding to enter the market. Before the release of major fundamental reports, it's best to stay out of the market to avoid sudden price swings. If you choose to trade during news events, always set stop-loss orders to minimize potential losses. Trading without stop-loss protection can result in a rapid loss of your entire deposit, especially if you ignore money management rules and trade large volumes.

And remember: To trade successfully, you must have a clear trading plan, like the one presented above. Spontaneous trading decisions, based solely on the current market situation, are from the start a losing strategy for any intraday trader.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română