I am not sure if Donald Trump is familiar with Albert Camus' work "Caligula," but the American president behaves somewhat like the Roman emperor. Caligula convinced himself that the highest value is death, not life. He executed friends and forgave enemies. The occupant of the White House has asserted that tariffs are beneficial not only for the American economy but also for the global economy. If the Supreme Court strikes them down, the entire world will fall into depression. Seriously, Donald?

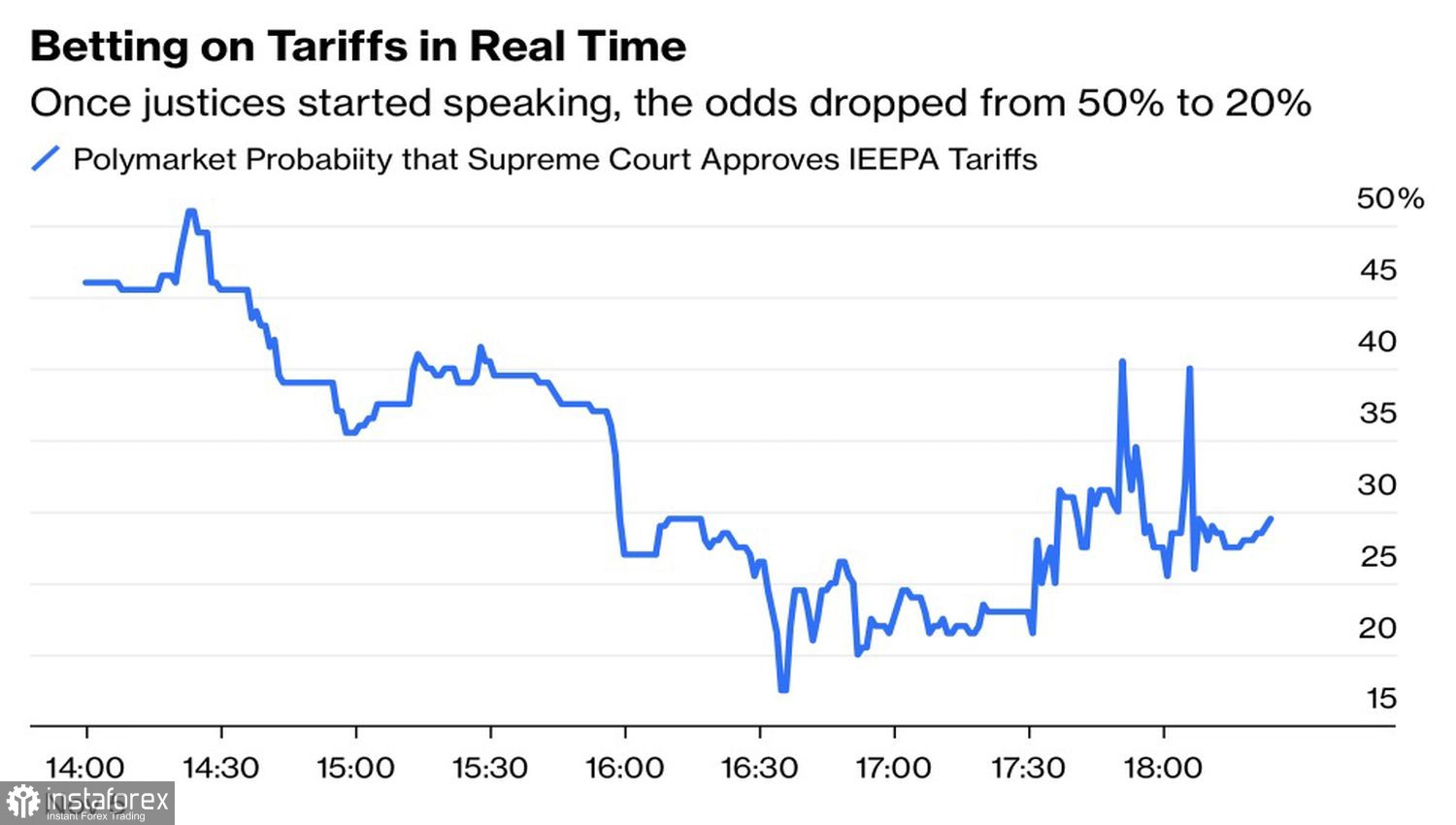

The first day of hearings on the tariffs proved extremely unpleasant for the White House. The judges classified them as taxes, which, in the U.S., is the prerogative of Congress. The chaos in the economy does not bother the judiciary. They believe that serious economic disruption is not a basis to violate the Constitution. After such remarks, the Polymarket betting market decreased Trump's chances of winning from just under 50% to just over 20%.

Dynamics of the Probability of the Supreme Court Upholding U.S. Tariffs

Supreme Court representatives do not rule out chaos but note that there is a special trade body. This body will handle refund and payment requests. The U.S. has collected about $35 billion a month from import tariffs. If they managed to maintain this for a year, the total would rise to nearly $400 billion.

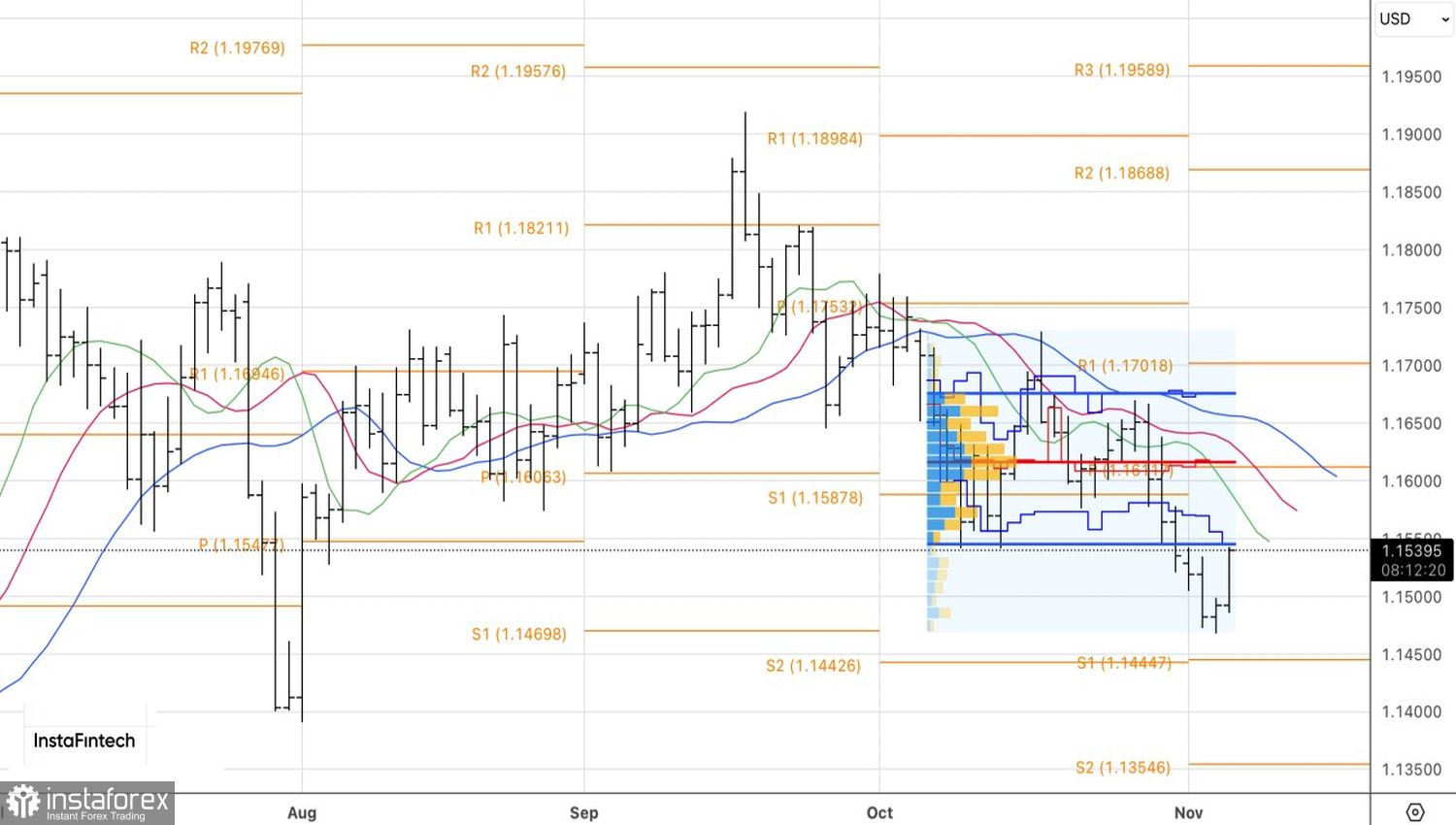

If tariffs are declared illegal, the White House will have to seek alternative sources of funding for the grand tax cut law. This may compel them to increase taxes. Such a move would slow down economic growth and force the Fed to aggressively lower rates. Is it any wonder that news from the Supreme Court allowed EUR/USD to launch a counterattack?

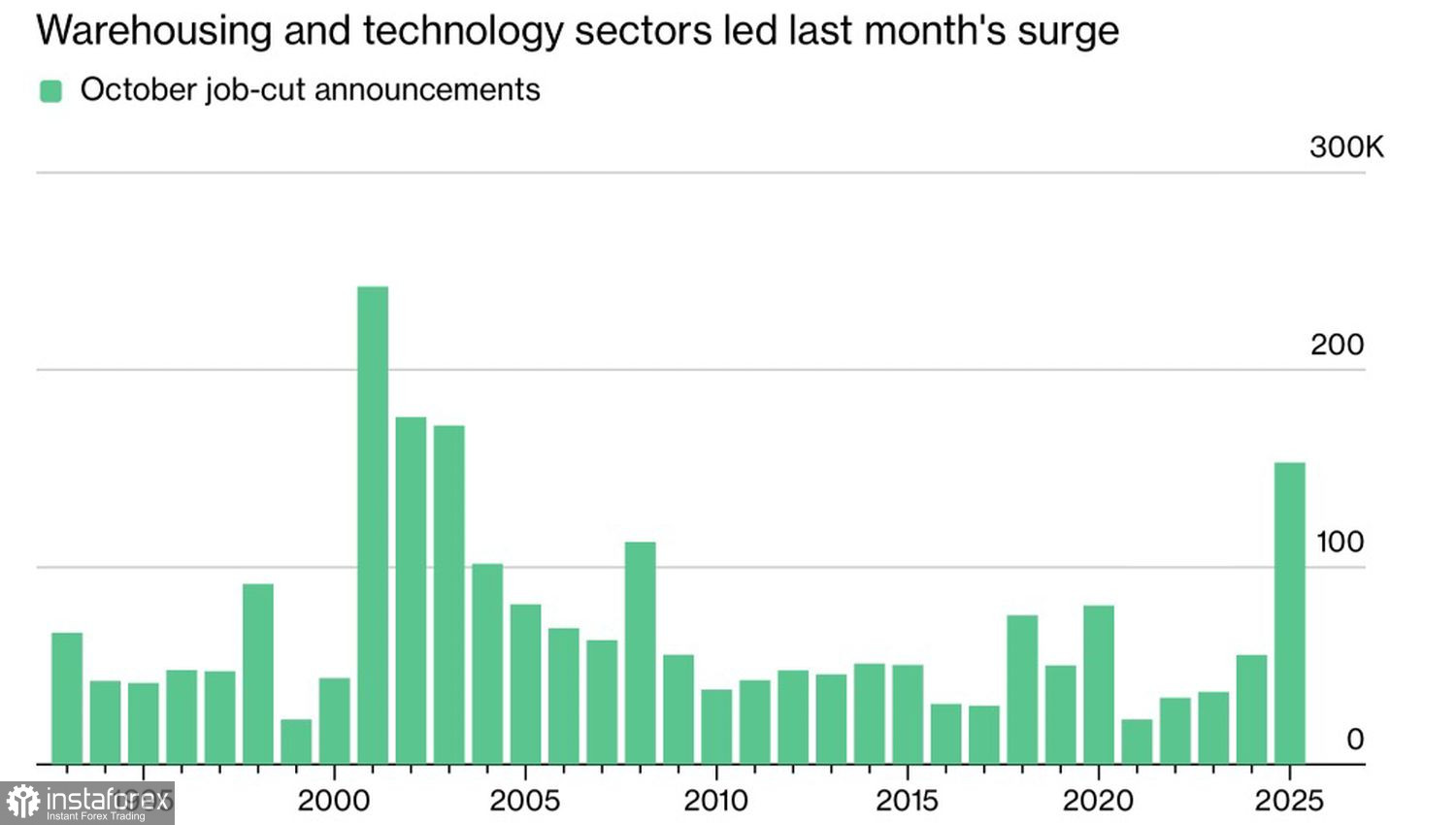

The bad news for the dollar does not end there. According to Challenger, Gray & Christmas, American companies cut jobs at the fastest pace in 22 years in October. In 2003, the need for workers fell due to the widespread adoption of mobile phones; in 2025, it will fall due to the widespread adoption of artificial intelligence technologies. AI is displacing workers and taking jobs away.

Trends in Job Losses Among U.S. Companies

In the absence of official data due to the shutdown, investors have to rely on alternative sources. In this respect, the modest growth in private sector employment from the ADP and the data from Challenger, Gray & Christmas increase the chances of a continuation of the Fed's monetary expansion cycle. The probability of a federal funds rate cut in December rose from 62% to 67%. This is unwelcome news for the U.S. dollar.

Technically, a bullish bar with a wide body was formed on the daily chart for EUR/USD. Buyers are attempting to re-enter the boundaries of the fair value range of 1.1545-1.1675. If they succeed, long positions in euros against the dollar opened from the convergence area of 1.1470-1.1490 can be increased.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română