Trade analysis and advice on trading the Japanese yen

No tests of the key levels I outlined occurred during the first half of the day, and the pair's volatility left much to be desired.

In the second half of the session, demand for the U.S. dollar against the yen is expected to return only if the University of Michigan Consumer Sentiment Index and inflation expectations data turn out strong. There will also be a speech by FOMC member Philip N. Jefferson.

The market closely monitors consumer sentiment data because it reflects the current state of the economy and households' willingness to spend. Strong figures may indicate an improvement in economic conditions and, as a result, strengthen the dollar. Conversely, weak numbers may reduce demand for the U.S. currency, as they could signal a slowdown in economic growth.

Inflation expectations tracked by the University of Michigan are another important factor. If consumers expect prices to rise, this may push the Federal Reserve toward a more cautious stance — typically supportive for the dollar. Conversely, if inflation expectations remain low, the Fed might adopt a more dovish tone, which could weaken the dollar.

The speech by Philip N. Jefferson, a member of the FOMC, could also influence market sentiment. Investors will pay close attention to his remarks on the economy, inflation, and monetary policy outlook. Any hints of the Fed's readiness to cut rates further could put pressure on the dollar.

As for the intraday strategy, I will rely mainly on Scenarios #1 and #2.

Buy Signal

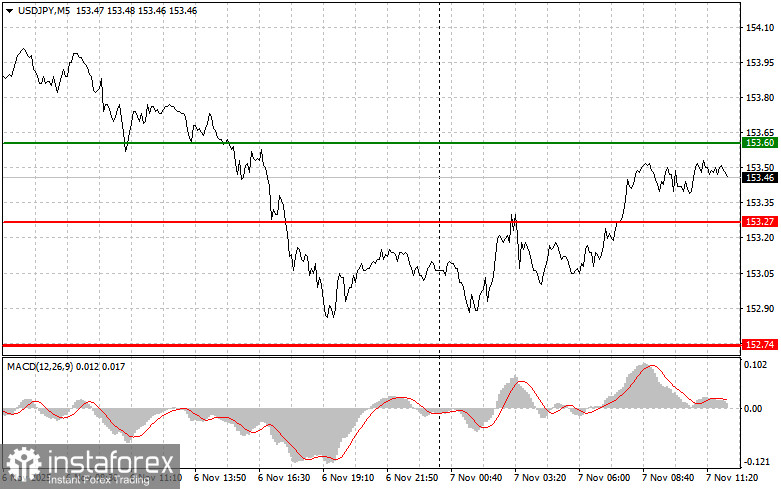

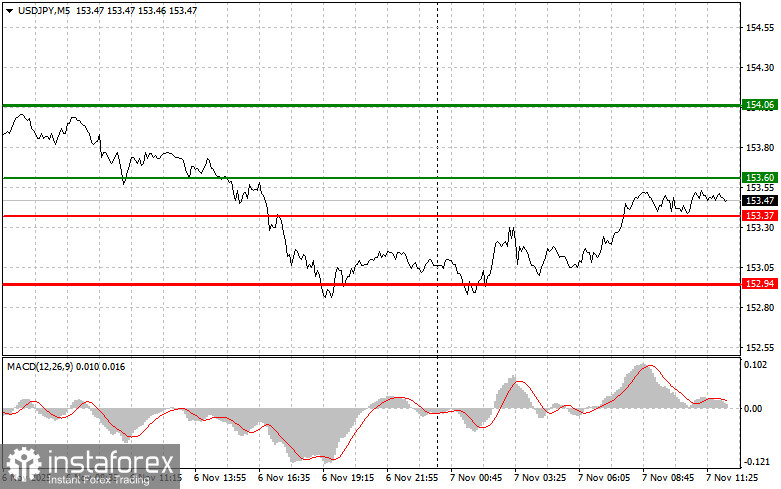

Scenario #1: I plan to buy USD/JPY today at around 153.60 (green line on the chart), targeting 154.06 (thicker green line). Around 154.06, I will close my buy positions and open sell positions in the opposite direction, expecting a 30–35 point pullback. A rise in the pair can only be expected after strong U.S. data.Important! Before buying, make sure the MACD indicator is above the zero line and just beginning to rise from it.

Scenario #2: I also plan to buy USD/JPY in case of two consecutive tests of the 153.37 level while the MACD is in the oversold zone. This will limit the pair's downward potential and trigger a market reversal upward. A rise toward 153.60 and 154.06 can then be expected.

Sell Signal

Scenario #1: I plan to sell USD/JPY after it breaks below 153.37 (red line on the chart), which should lead to a quick drop in the pair. The key target for sellers will be 152.94, where I will close short positions and open long positions in the opposite direction (expecting a 20–25 point rebound). Selling pressure on the pair will return if dovish comments come from Fed officials.Important! Before selling, make sure the MACD indicator is below the zero line and just beginning to move down from it.

Scenario #2: I also plan to sell USD/JPY in case of two consecutive tests of the 153.60 level while the MACD is in the overbought zone. This will limit the pair's upward potential and cause a reversal downward. A decline toward 153.37 and 152.94 can then be expected.

Chart Explanation

- Thin green line – entry price at which the trading instrument can be bought

- Thick green line – suggested Take Profit level or area to manually fix profit, as further growth above this level is unlikely

- Thin red line – entry price at which the trading instrument can be sold

- Thick red line – suggested Take Profit level or area to manually fix profit, as further decline below this level is unlikely

- MACD indicator – when entering the market, it is important to consider overbought and oversold zones

Important Note

Beginner Forex traders should be extremely cautious when deciding when to enter the market. Before major fundamental reports are released, it's best to stay out of the market to avoid sudden volatility.

If you choose to trade during news releases, always use stop-loss orders to minimize losses. Without stop-losses, you can lose your entire deposit very quickly — especially if you don't apply money management principles and trade with large volumes.

And remember: successful trading requires a clear trading plan, like the one outlined above. Making spontaneous trading decisions based on current market conditions is an inherently losing strategy for intraday traders.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română