As a result of last Friday, stock indices closed mixed. The S&P 500 increased by 0.13%, while the Nasdaq 100 fell by 0.21%. The industrial Dow Jones strengthened by 0.16%.

The indices rose while Treasury bonds declined, as hopes for an agreement to end the longest government shutdown in US history boosted sentiment after a week of instability during which investors grappled with concerns over high valuations in the AI sector. Investors reacted with relief to news of progress in the negotiations, believing that the resumption of government operations would help avoid negative economic impacts that could exacerbate recession risks. Optimism over the prospect of stability drove stocks up, particularly in macro-sensitive sectors such as industrials and finance.

At the same time, Treasury bonds faced pressure as investors shifted their focus from safe assets to riskier ones. The rise in bond yields reflects confidence that the US government will avert default on its obligations and that inflation will remain under control. However, the euphoria resulting from news of a possible agreement has not completely dispelled fears of overvaluation in the tech sector. Many experts believe that numerous tech companies are overvalued and that further market correction may be inevitable.

The MSCI Asia Pacific Index rose by nearly 1%. Futures contracts on US and European indices also surged after a group of moderate Democrats broke from their party leaders and voted for the agreement to end the record shutdown.

Gold, silver, copper, soybeans, commodities, and cryptocurrencies strengthened their positions, while the yield on 10-year Treasury bonds increased by nearly four basis points to 4.14%.

The end of the economic shutdown will provide investors with greater clarity regarding key economic data such as employment and inflation, which will help clarify the Federal Reserve's position on interest rates. While hopes for a deal may provide some relief, markets remain wary after the sharp sell-off in tech stocks last week intensified concerns about overvaluation.

The Senate voted 60–40 in favor of a procedural measure to advance the bill, but a final vote has yet to be scheduled. The House of Representatives must also approve the bill before it reaches President Donald Trump's desk. It remains unclear how quickly the shutdown can be resolved. For a swift conclusion, consent from all members of the Senate is required. Any senator can initiate several days of procedural delays.

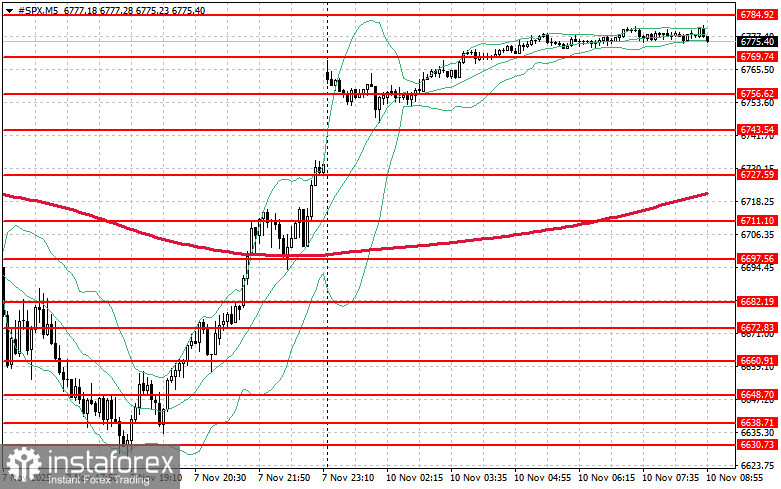

Technical picture of the S&P 500:

The primary objective for buyers today will be to overcome the nearest resistance at $6,784. This breakthrough would indicate potential growth and open the possibility for a move to the new level of $6,801. Equally important for bulls will be to maintain control over $6,819, which would strengthen their position. In the event of a downward movement due to decreased risk appetite, buyers must assert themselves around $6,769. A break below this level would quickly push the trading instrument back to $6,756 and open the path to $6,743.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română