The only event on Monday was the first step toward establishing a temporary truce between Democrats and Republicans aimed at ending the record U.S. "shutdown." This lengthy phrasing describes what transpired on the first day of the week. Many market participants were quick to celebrate this event, but it is not entirely clear what they now expect from the dollar. If they expect a new increase in value, how can they explain its strengthening over the past month and a half? Will the dollar rise on the "shutdown," and then again on the completion of the "shutdown"?

However, as more information emerged from open sources, it became clearer that the end of the temporary government shutdown might also be temporary. In other words, a compromise between Democrats and Republicans was reached under the following conditions: Democrats would vote to extend funding for 3 months (and not all of them even approved of this deal), while Republicans committed to negotiate to maintain the levels of social and medical programs for the American population (particularly for low-income groups that Trump decided to cut funding for).

Accordingly, it is not difficult to imagine an alternative scenario. In December, new negotiations will take place between Democrats and Republicans; Trump's party may refuse the Democrats' demands, leading to another government shutdown after the temporary truce expires, for an unknown duration. As shown by the "shutdown" in 2025, it is not fearful to either Republicans or Democrats. Trump takes a principled position – no concessions to enemies. Democrats understand that the more controversial decisions Trump makes, the lower his political ratings fall. Trump is nearly 80 years old and in his second term, which means he has a strong chance of victory in the next elections. Therefore, they have only to wait for the elections and throw obstacles in the way of the current White House administration.

I would also note that with the most principled opponent on the world stage – China – Trump has also only managed to conclude a temporary truce. The parties agreed not to impose new tariffs, not to raise old ones, and not to introduce new restrictions and sanctions for a period of one year. What will happen in a year is an open question. What will happen with Trump's tariffs is also uncertain, as last week the U.S. Supreme Court held initial hearings on the issue and, despite the "Republican composition," remained skeptical, finding no mention of "tariffs" in the 1974 Emergency Powers Act. In my view, the news basis for the U.S. currency remains extremely weak.

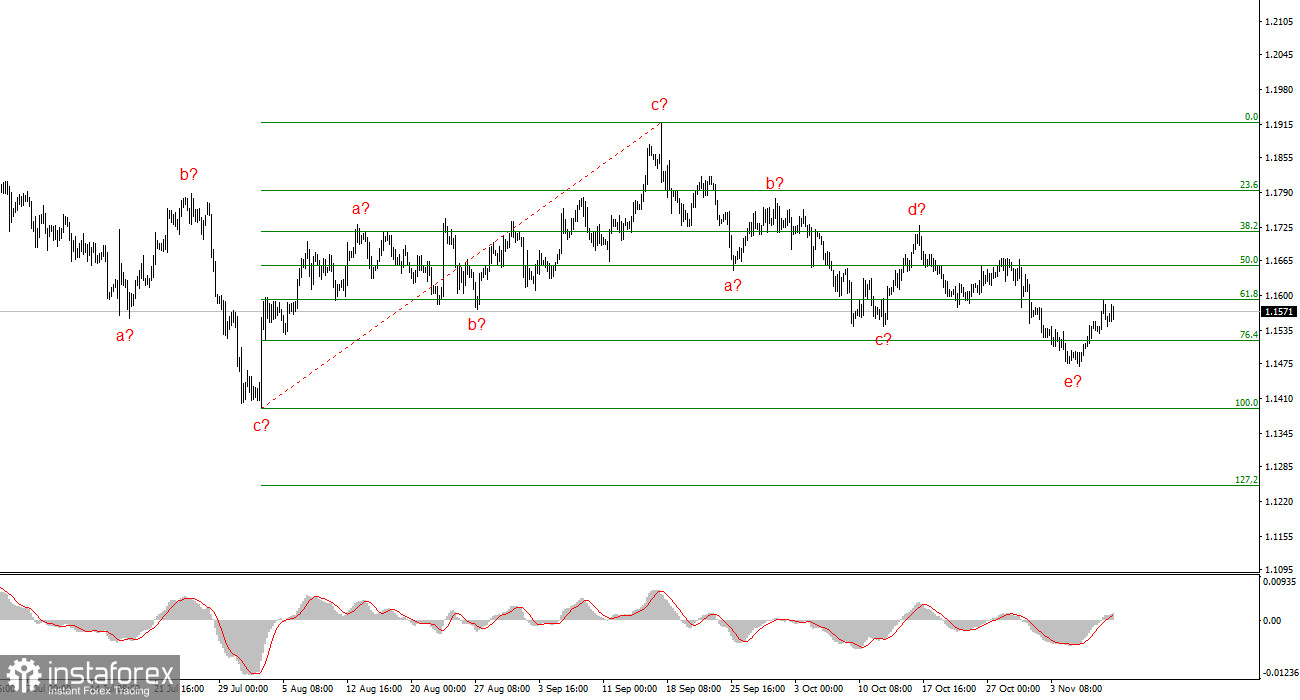

Wave Analysis for EUR/USD:

Based on the conducted analysis of EUR/USD, I conclude that the instrument continues to build an upward section of the trend. Over the past few months, the market has paused, but Donald Trump's policies and the Federal Reserve remain significant factors in the future decline of the American currency. The targets of the current trend section may extend to the 25th figure. At present, construction of correction wave 4 is ongoing, taking on a very complex, elongated shape. Its latest internal structure – a-b-c-d-e – is close to completion or has already been completed. Therefore, I am once again considering buying with targets positioned around the 19th figure.

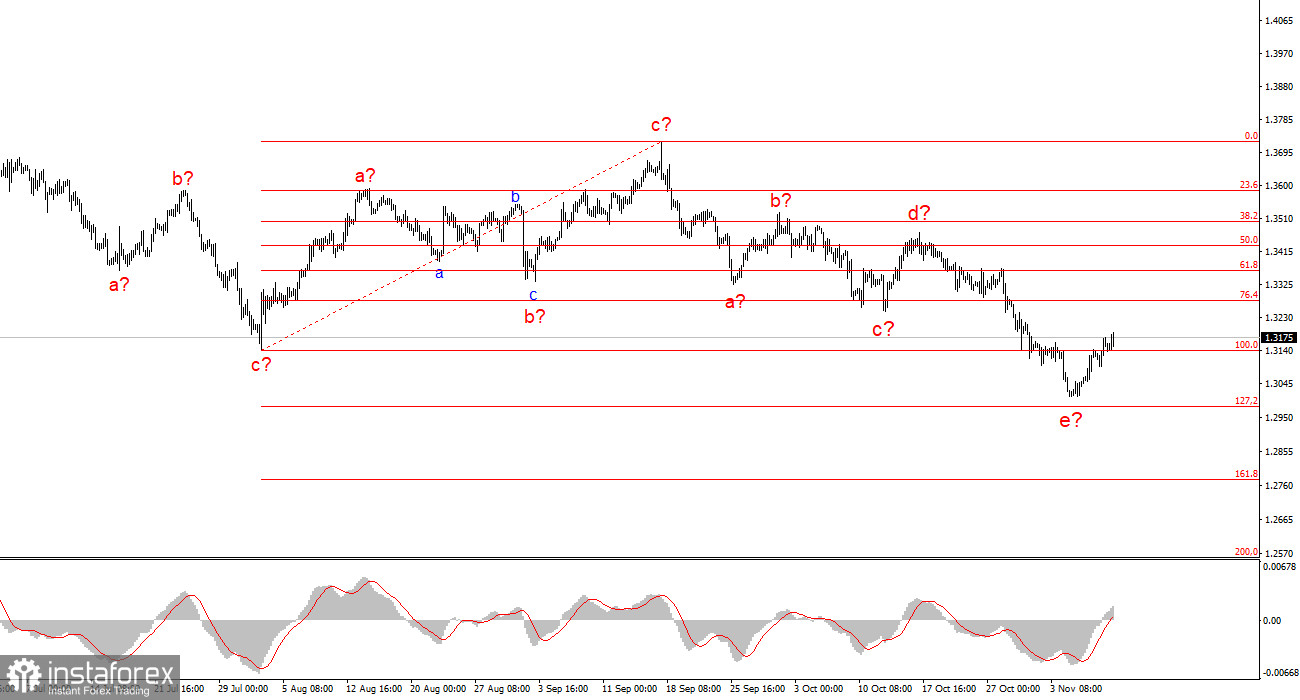

Wave Analysis for GBP/USD:

The wave picture for the GBP/USD instrument has changed. We continue to deal with an upward, impulsive section of the trend, but its internal wave structure is becoming more complex. Wave 4 has taken a three-wave form, and its structure is becoming very elongated. The bearish corrective structure a-b-c-d-e in c in 4 is presumably approaching completion. I expect the primary wave structure to resume its build with initial targets around the 38 and 40 figures.

Key Principles of My Analysis:

- Wave structures should be simple and understandable. Complex structures are difficult to trade successfully and often lead to changes.

- If there is no confidence in what is happening in the market, it is better not to enter it.

- There is never 100% certainty in the direction of movement. Always remember to use protective stop-loss orders.

- Wave analysis can be combined with other types of analysis and trading strategies.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română