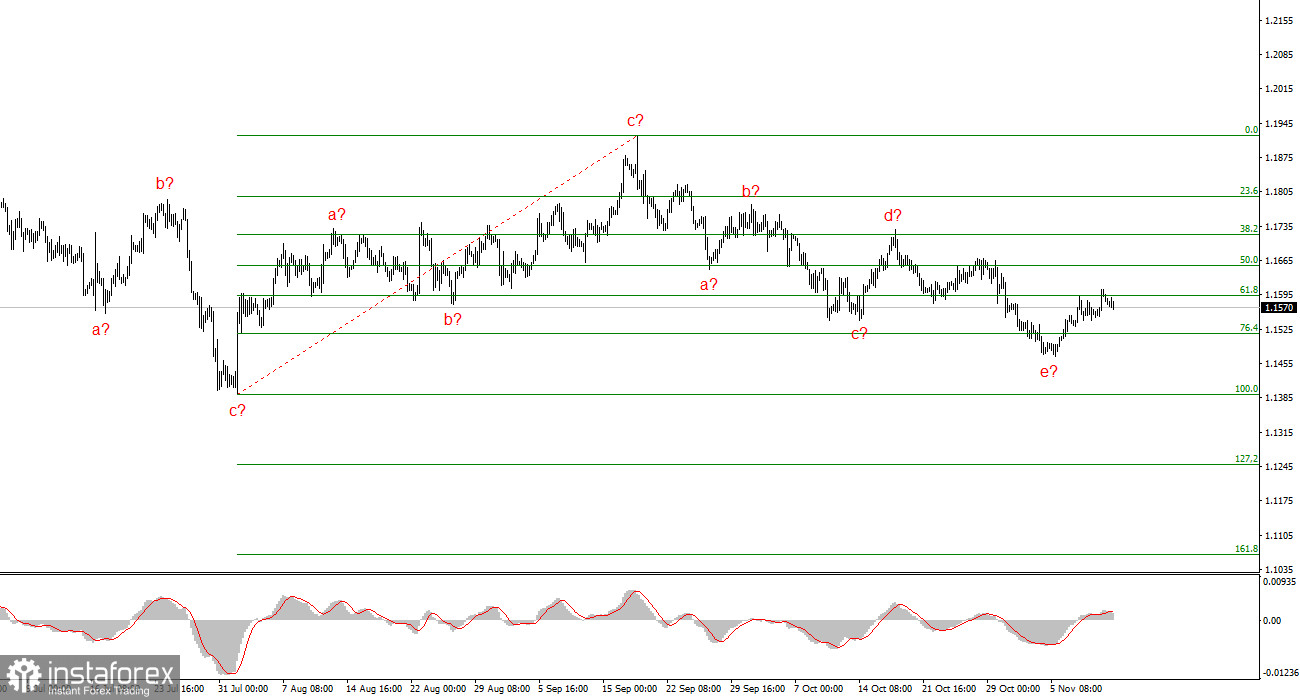

The 4-hour wave pattern for EUR/USD has transformed — unfortunately, not for the better. The upward trend segment that began in January 2025 is still intact, but the wave pattern since July 1 has become more complex and extended.

In my view, the pair is currently forming a corrective wave 4, which has taken on an unusual structure. However, the recent five-wave corrective formation suggests that the current downward phase may be ending.

The upward trend segment continues to develop, while the news background generally supports everything except the dollar. The trade war launched by Donald Trump is ongoing, as is the President's confrontation with the Federal Reserve. The market's dovish expectations for the Fed's interest rate policy remain high, especially looking ahead to 2026. Meanwhile, the U.S. government shutdown continues, and the labor market is cooling.

In my opinion, the dollar's recent strengthening is something of a paradox — but such paradoxes often occur in financial markets.

I believe the upward trend is not yet complete, with potential targets extending toward the 1.25 level. The a–b–c–d–e wave sequence appears complete, so I expect the pair to rise from current levels.

The EUR/USD rate edged lower on Wednesday. Once again, we see minimal price movement and little desire from the market to move decisively in either direction. This pattern has persisted for several months, with the pair essentially trading sideways, alternating between corrective wave sequences.

Thus, the market's lack of movement on Wednesday fits perfectly with the autumn sluggishness, especially given the absence of major news drivers.

The only notable release of the day was Germany's Consumer Price Index, which came in at 2.3% year-over-year in October, exactly as expected and unchanged from the preliminary estimate. The market largely ignored this report.

The U.S. shutdown is gradually nearing its end, but even that has failed to stir the FX market. The pair seems to have started forming a new upward wave sequence, though the euro's advance is weak, which is somewhat concerning.

At present, the market is in a state of complete uncertainty. It is accustomed to making decisions based on key U.S. macroeconomic reports — but none are being released. Even if the shutdown ends this week, the U.S. Bureau of Statistics will need time to collect and process data, which means that reports will lack timeliness and accuracy. Still, their eventual release may help "wake up" the market.

General Conclusions

Based on my analysis, EUR/USD continues to build an upward trend segment. Although the market has paused in recent months, Trump's policies and the Federal Reserve's stance remain strong long-term bearish factors for the dollar.

The targets for the current trend could extend toward the 1.25 level. The pair is still forming a complex and prolonged corrective wave 4, whose internal a–b–c–d–e structure is nearing completion or already complete. Therefore, I am once again considering long positions, with targets around the 1.19 level.

On a smaller scale, the entire upward segment of the trend is visible. The wave pattern is not entirely standard, since the corrective waves differ in size — for example, major wave 2 is smaller than wave 2 within wave 3 — but this is not unusual.

I would like to remind traders that it is best to focus on clear, easily identifiable structures rather than trying to label every minor wave. The overall bullish structure currently remains unquestionable.

Core Principles of My Analysis

- Wave structures should be simple and clear. Complex ones are difficult to interpret and often lead to revisions.

- If there is no confidence in what is happening on the market, it is better to stay out.

- There is never 100% certainty about the direction of movement — always use Stop Loss orders.

- Wave analysis can and should be combined with other types of analysis and trading strategies.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română