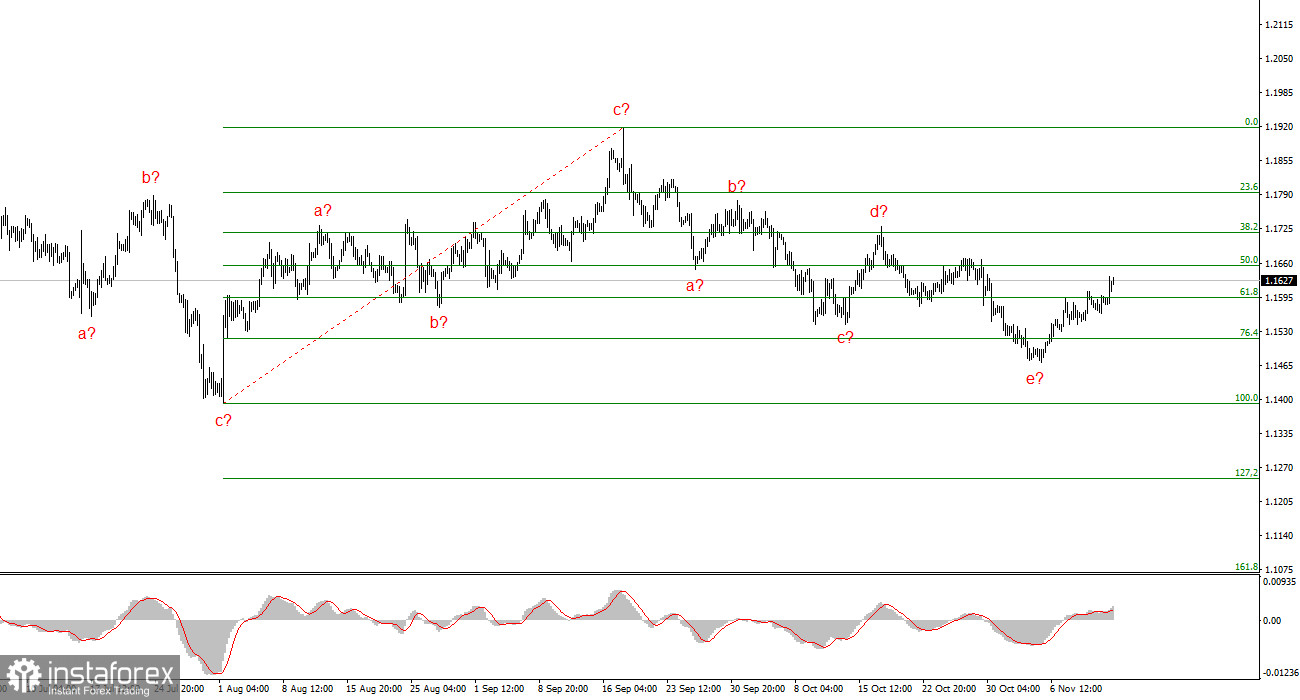

The wave pattern on the 4-hour chart for EUR/USD has transformed — unfortunately, not for the better. There is currently no reason to talk about the cancellation of the upward trend segment that began in January 2025, but the wave structure since July 1 has become much more complex and elongated. In my view, the instrument is in the process of forming corrective wave 4, which has taken on an irregular form. However, the most recent five-wave corrective structure suggests that the current phase of the instrument's decline may be coming to an end.

The formation of the upward trend section continues, and the news background overall continues to favor anything but the dollar. The trade war launched by Donald Trump continues. The standoff between the president and the Federal Reserve continues. The market's "dovish" expectations regarding Fed rates remain high, especially for 2026. The U.S. government remains in shutdown. The labor market is "cooling." I believe that the recent strengthening of the dollar is, to some extent, a paradox. But paradoxes do happen in the markets.

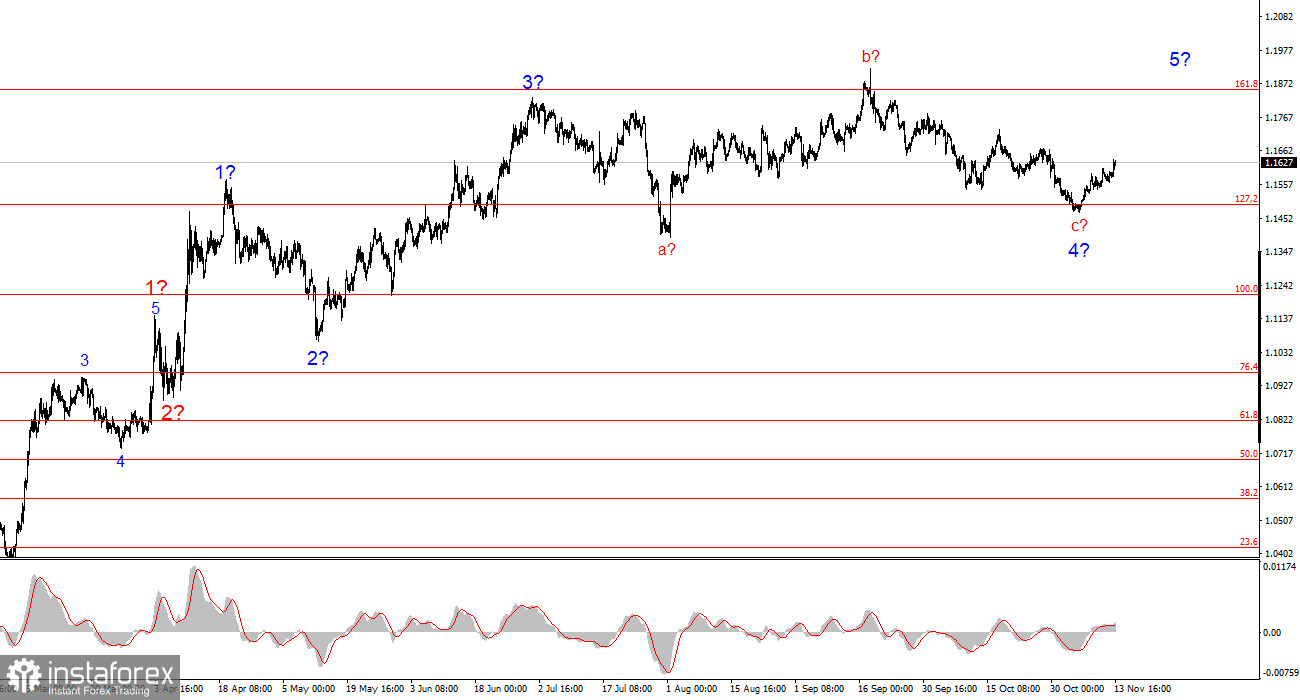

In my opinion, the upward trend section is not yet complete, and its targets may extend up to the 1.25 level. The a-b-c-d-e wave series looks complete; therefore, I expect the instrument to rise from its current positions in any case.

The EUR/USD pair rose by 35 basis points on Thursday. The market's trading range was again relatively narrow, but it was still sufficient for the euro to have been appreciating for more than a week now. As we have already determined, wave analysis suggests that only further growth should be expected from the instrument. But what does the news background tell us?

The news background tells us only one thing — to ignore it. Few can recall the kind of confusion that is currently observed in the markets. The U.S. stock market is growing despite the trade war, despite the Fed's monetary easing, and despite the ongoing shutdown. In the currency market, demand for the U.S. dollar increased for about six weeks while the shutdown persisted — and as soon as it ended, demand started to fall. Everything has become mixed up, and it is now extremely difficult to say what is "red" and what is "black." However, in such situations, market participants must be able to distinguish the truly significant factors, news, and events — to "separate the wheat from the chaff," so to speak.

It became clear several weeks ago that the market was ignoring the news flow, when the U.S. dollar repeatedly strengthened under rather contradictory circumstances. Therefore, now that the shutdown has ended, I am not concerned about the dollar's decline. According to the wave structure, everything is developing according to the most likely scenario.

General Conclusions

Based on the EUR/USD analysis, I conclude that the instrument continues to build an upward trend. Over the past few months, the market has taken a pause, but the policies of Donald Trump and the Federal Reserve remain major factors that could contribute to the dollar's decline in the future. The targets of the current trend phase may extend up to the 1.25 level. At present, a complex and extended corrective wave 4 is still unfolding. Its latest internal structure — the a-b-c-d-e series — is close to completion, or already complete. Therefore, I once again consider buying opportunities with targets around the 1.19 level.

At a smaller scale, the entire upward trend section is clearly visible. The wave pattern is not the most standard, as the corrective waves differ in size. For example, the larger wave 2 is smaller than the internal wave 2 within wave 3. However, this does happen. I would like to remind you that it's better to identify clear structures on the charts rather than trying to label every single wave. The current upward structure leaves no doubt.

The Core Principles of My Analysis:

- Wave structures should be simple and clear. Complex patterns are difficult to trade and often indicate a change.

- If you are uncertain about what is happening in the market, it's better to stay out of it.

- There can never be 100% certainty about the market's direction. Always remember to use protective Stop Loss orders.

- Wave analysis can and should be combined with other forms of analysis and trading strategies.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română