Internally, the Federal Reserve continues to debate whether to prioritize the labor market or inflation. All governors are clearly divided into two camps: supporters of Trump's ideas and demands, and independent policymakers. The supporters of the US president call for an easing of monetary policy, arguing that excessively high rates will hinder economic growth and further "cool" the labor market. Independent policymakers remind that inflation has been rising in recent months, and the central bank has been striving to bring it back to 2% for several years.

Currently, there are only three supporters: Stephen Miran, Michelle Bowman, and Christopher Waller. The independent camp comprises nine members, excluding governors who do not yet have voting rights. It is also crucial to note what the independent governors of the FOMC committee do NOT say. The collapse in the labor market has been driven by actions, decisions, and policies of Donald Trump, who has been imposing and raising tariffs throughout 2025 and has initiated a crackdown on illegal immigrants. While illegal immigration is a problem, in recent months, documents have been revoked even for those legally present in the US. All these individuals represent the country's workforce, created by migrants. Thus, these policymakers hint to market participants that Trump himself should resolve the problems he himself caused.

The Fed is primarily responsible for low inflation and cannot simultaneously address two issues, one of which was created by the head of state. Therefore, I maintain my view that any easing of monetary policy will proceed slowly, if it occurs at all. We will not see any "super-dovish" actions from the Fed until Trump replaces all the independent governors with those who are loyal to him. Theoretically, this could happen next year, but 2025 has shown that removing a member of the FOMC is not straightforward.

The situation with Lisa Cook and the sudden departure of Adriana Kugler demonstrated to the other governors what to expect from the US president. Forewarned is forearmed. To dismiss an FOMC member, very strong reasons and evidence of actions that violate the law, Fed ethics, or policy rules are needed. A single social media post alleging the wrongdoing of a particular official and their subsequent dismissal is insufficient. Consequently, Trump will have to navigate through significant challenges if he genuinely wishes to fire at least 2-3 more "hawks." Until that happens, the Fed will continue to base its decisions on inflation. In the most favorable scenario for Trump, it will balance between two objectives: full employment and price stability.

Wave Analysis of EUR/USD:

Based on the conducted analysis of EUR/USD, I conclude that the instrument continues to develop an upward trend segment. The market has paused in recent months, but Donald Trump's policies and the Fed's actions remain significant factors in the future decline of the American currency. The targets for the current trend segment may reach the 25-figure mark. Currently, the formation of corrective wave 4 is underway, which has taken on a very complex and elongated appearance. Its latest internal structure, a-b-c-d-e, is nearing completion or may already be finished. Therefore, I'm reconsidering long positions now with targets positioned around the 19 figure.

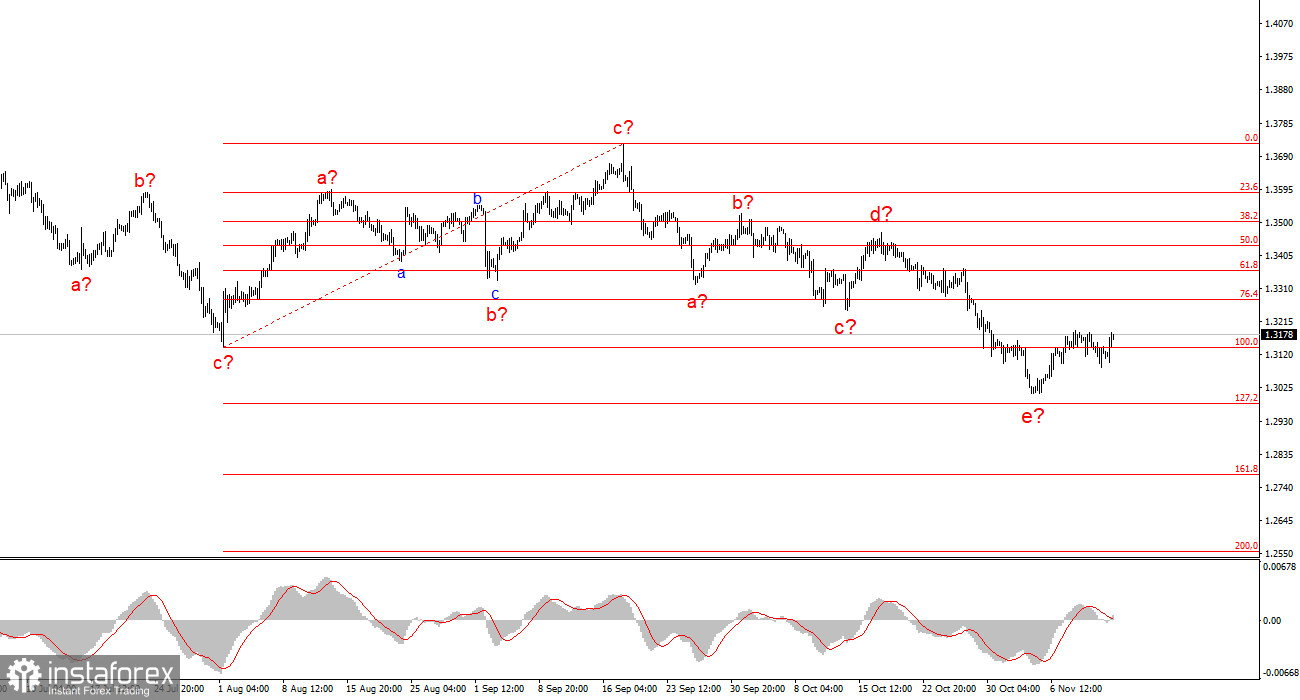

Wave Analysis of GBP/USD:

The wave structure of the GBP/USD instrument has changed. We are still dealing with an upward, impulsive trend segment, but its internal wave structure is becoming more complex. Wave 4 has taken on a three-wave form, resulting in a very elongated structure. The downward corrective structure a-b-c-d-e in c within 4 is presumed to be close to completion. I expect the main wave structure to resume development with initial targets around the 38 and 40 figures.

Key Principles of My Analysis:

- Wave structures should be simple and understandable. Complex structures are difficult to trade and often result in changes.

- If there is no confidence in market movements, it is better not to enter the market.

- There is never 100% certainty in the direction of movement, nor will there ever be. Remember to use protective Stop Loss orders.

- Wave analysis can be combined with other types of analysis and trading strategies.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română