With questions about the Federal Reserve's future actions seemingly resolved, the focus now shifts to what to expect from the US dollar amid shifting expectations for monetary policy. This week, the market's sentiment towards easing in December has become more "hawkish." Now, about half of the participants in the futures market expect the interest rate to remain at 4%. Consequently, "neutral" market sentiments have strengthened, which should support demand for the US currency, just as the end of the shutdown did.

The American currency had been steadily appreciating until the point when the shutdown was lifted, and the market began to doubt a third rate cut by the end of the year. I can reiterate that the news background currently has no significance for the currency market. Likely, the market has simply stopped reacting to individual events and news, considering the overall picture instead. And what is this picture?

Many economists expect a significant slowdown in the US economy following the growth surge in the second quarter. Many believe that economic growth will decelerate to 1% in the first quarter of 2026. The labor market will continue to remain in a "cooling" state as the Fed persists in its struggle against rising inflation, and Donald Trump has yet to establish control over the FOMC committee. Meanwhile, the ongoing global trade war will continue to impact American consumers, investments, and household spending. The extremely high level of uncertainty in the US economy will deter investors from investing in the real sector.

As a result, while the US economy may show positive results on paper under Trump, this is not always the case and varies by sector. At the beginning of next year, the economy could very well face another "shutdown," as Democrats and Republicans, who voted for the funding bill this week, have only signed a temporary truce. The Democrats continue to stand firm—insisting that all social and healthcare programs for low-income groups must be preserved. To unblock government and public service operations, they agreed to make concessions, but in December, it will be the Republicans who will need to yield. Meanwhile, Trump still wants his "One Big Beautiful Bill" to remain intact.

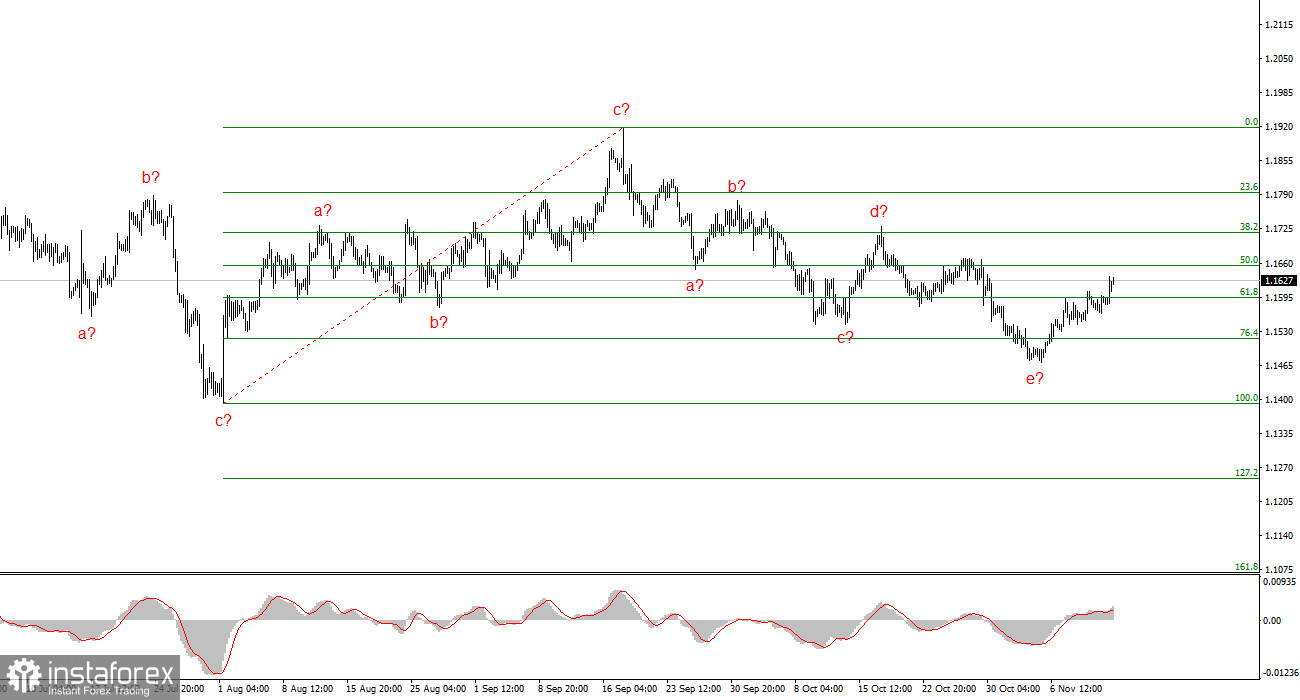

Wave Analysis of EUR/USD:

Based on the conducted analysis of EUR/USD, I conclude that the instrument continues to develop an upward trend segment. The market has paused in recent months, but Donald Trump's policies and the Fed's actions remain significant factors in the future decline of the American currency. The targets for the current trend segment may reach the 25-figure mark. Currently, the formation of corrective wave 4 is underway, which has taken on a very complex and elongated appearance. Its latest internal structure, a-b-c-d-e, is nearing completion or may already be finished. Therefore, I'm reconsidering long positions now with targets positioned around the 19 figure.

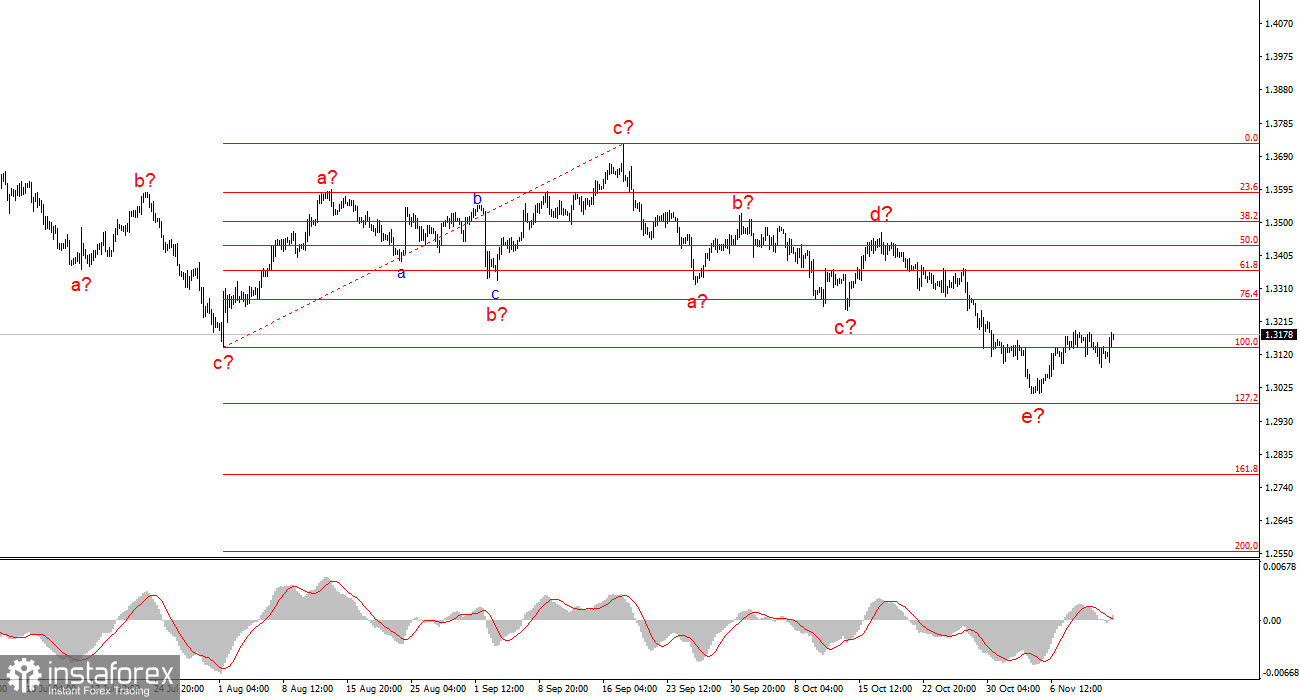

Wave Analysis of GBP/USD:

The wave structure of the GBP/USD instrument has changed. We are still dealing with an upward, impulsive trend segment, but its internal wave structure is becoming more complex. Wave 4 has taken on a three-wave form, resulting in a very elongated structure. The downward corrective structure a-b-c-d-e in c within 4 is presumed to be close to completion. I expect the main wave structure to resume development with initial targets around the 38 and 40 figures.

Key Principles of My Analysis:

- Wave structures should be simple and understandable. Complex structures are difficult to trade and often result in changes.

- If there is no confidence in market movements, it is better not to enter the market.

- There is never 100% certainty in the direction of movement, nor will there ever be. Remember to use protective Stop Loss orders.

- Wave analysis can be combined with other types of analysis and trading strategies.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română