The euro, pound, and other risky assets continued to rise against the U.S. dollar. Confusion among the U.S. Federal Reserve, with significantly differing statements from policymakers, has put pressure on the dollar. Growing uncertainty about the monetary policy trajectory, combined with contradictory statements from members of the Open Market Committee, undermines traders' confidence in the stability of the U.S. currency.

On one hand, there are increasing calls for further tight monetary policy to finally curb inflation, which, although slowing, remains above the target level of 2%. On the other hand, the camp advocating rate cuts is gaining strength, pointing to negative consequences for economic growth and the labor market.

Today, in the first half of the day, the euro may continue to rise, but strong data on Eurozone GDP growth, employment levels, and the external trade balance are needed to support this. Optimistic GDP figures demonstrating resilient growth in the Eurozone economy will catalyze further strengthening of the euro. Positive changes in employment levels will also play a role. A decrease in unemployment and an increase in the number of employed will create a favorable environment for rising consumer spending and business activity, which, in turn, will support the euro. A positive external trade balance reflecting higher exports than imports will be another factor contributing to the euro's growth.

As for the pound, there are no reports today for the UK, so all attention will be on Rachel Reeves' further plans for shaping the country's budget for the next financial year. Her statements about refusing to raise taxes yesterday surprised many, further confusing traders. The situation is complicated by the fact that the Conservative government is under increasing pressure from the opposition and the public. Economic difficulties, inflation, and the rising cost of living undermine trust in the ruling party. Reeves, while presenting the budget, will need to strike a balance between stimulating economic growth and reducing public debt.

If the data aligns with economists' expectations, it is better to act based on the Mean Reversion strategy. If the data is significantly above or below economists' expectations, it is best to use the Momentum strategy.

Momentum Strategy (Breakout):

For the EURUSD Pair

- Buying on a breakout above 1.1655 may lead to an increase in the euro to around 1.1678 and 1.1703

- A sell on a breakout below 1.1631 may lead to a decline in the euro to around 1.1607 and 1.1582

For the GBPUSD Pair

- Buying on a breakout above 1.3172 may lead to an increase in the pound to around 1.3211 and 1.3244

- Sell on a breakout below 1.3130 may lead to a decline in the pound to around 1.3086 and 1.3052

For the USDJPY Pair

- Buying on a breakout above 154.68 may lead to an increase in the dollar to around 155.15 and 155.54

- A sell on a breakout below 154.40 may lead to a decline in the dollar to around 154.00 and 153.77

Mean Reversion Strategy (Retracement):

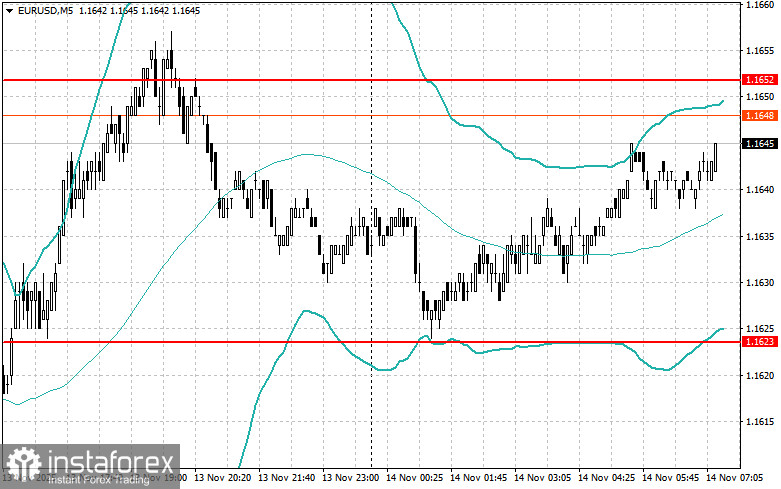

For the EURUSD Pair

- I will look for sells after a failed breakout above 1.1652 on a return below this level

- I will look for buys after a failed breakout below 1.1623 on a return to this level

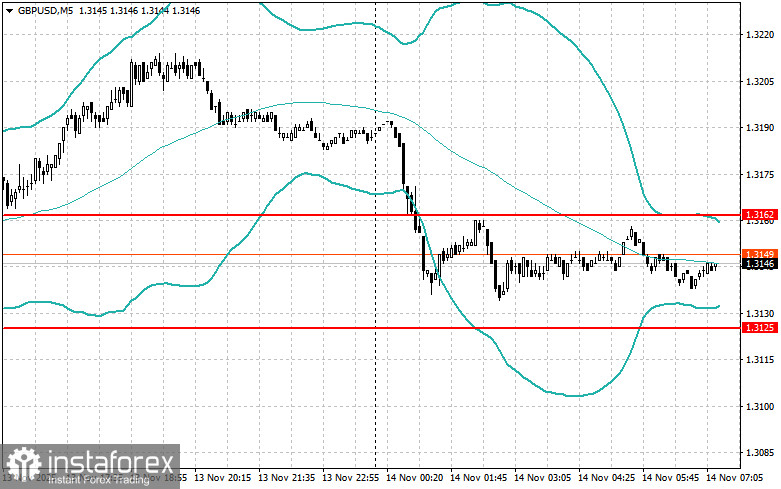

For the GBPUSD Pair

- I will look for sells after a failed breakout above 1.3162 on a return below this level

- I will look for buys after a failed breakout below 1.3125 on a return to this level

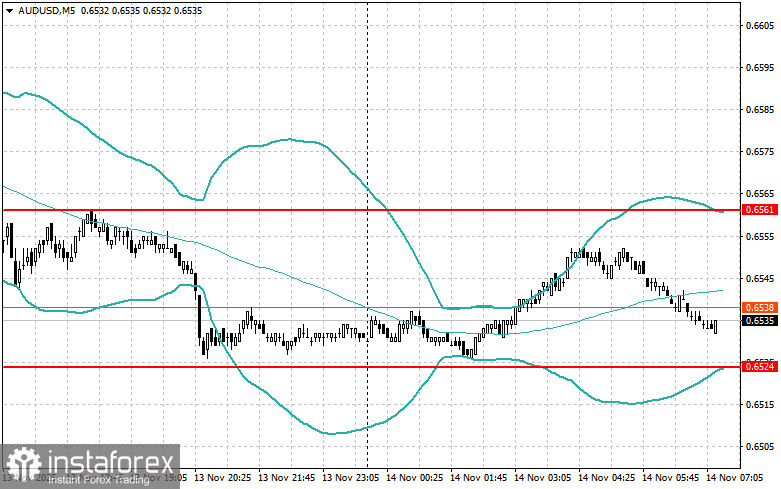

For the AUDUSD Pair

- I will look for sells after a failed breakout above 0.6561 on a return below this level

- I will look for buys after a failed breakout below 0.6524 on a return to this level

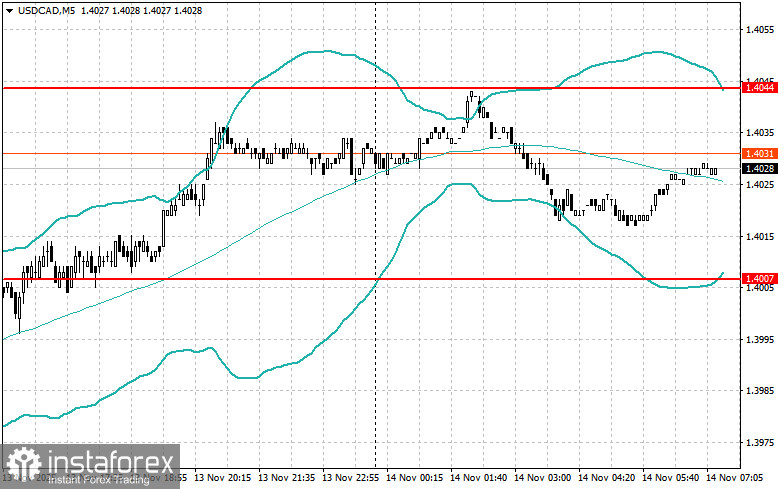

For the USDCAD Pair

- I will look for sells after a failed breakout above 1.4044 on a return below this level

- I will look for buys after a failed breakout below 1.4007 on a return to this level

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română