Stephen Miran, a key "protege" of Donald Trump within the Federal Reserve, stated on Friday that the central bank must reduce the interest rate by 50 basis points in December. He warned that failure to do so would lead to an economic slowdown. Miran does not take into account that the economy could be slowing not because of the Fed's inaction, but because of the White House's new immigration and trade policies. It would be more logical to slightly adjust the policies themselves rather than demand that the Fed tries to sit on two chairs at once.

It is worth remembering that the Fed continues to oscillate between two fires. To prevent the labor market from "cooling," a reduction in interest rates is necessary. However, inflation is rising, and to curb it, the rate needs to be maintained at its current level, or even a tightening of monetary policy is required. It is impossible to achieve both objectives simultaneously. The Fed is currently taking a position of balancing between the two goals. Neither will be achieved, but now the central bank needs to avoid a complete failure in achieving either.

In other words, if the Fed continues to ease policy and manages to restore the labor market, inflation will skyrocket, leading to failure. If the Fed does not conduct new rounds of easing, the labor market will continue to decline, leading to failure as well. However, the president's administration is unconcerned about the inflation rate. Trump would be quite agreeable to high economic growth rates even with high inflation. The main thing is that everything looks good on paper, and the rising costs for Americans (due to tariffs and inflation) can be countered by Americans working not 12 hours a day, but 13.

Miran also indicated that the Fed is acting too slowly and risks falling behind schedule. It is important to recall that Jerome Powell has repeatedly stated to the world that the Fed has no set schedule. Decisions are made from meeting to meeting based on incoming economic information. It is difficult to understand what schedule Miran is referring to. It is likely some personal schedule. Therefore, in my opinion, there is currently no split of opinions within the FOMC committee. There are three of Donald Trump's proteges who vote for a rate cut at the behest of the White House, and the other governors who are trying to balance between the two mandates of the central bank.

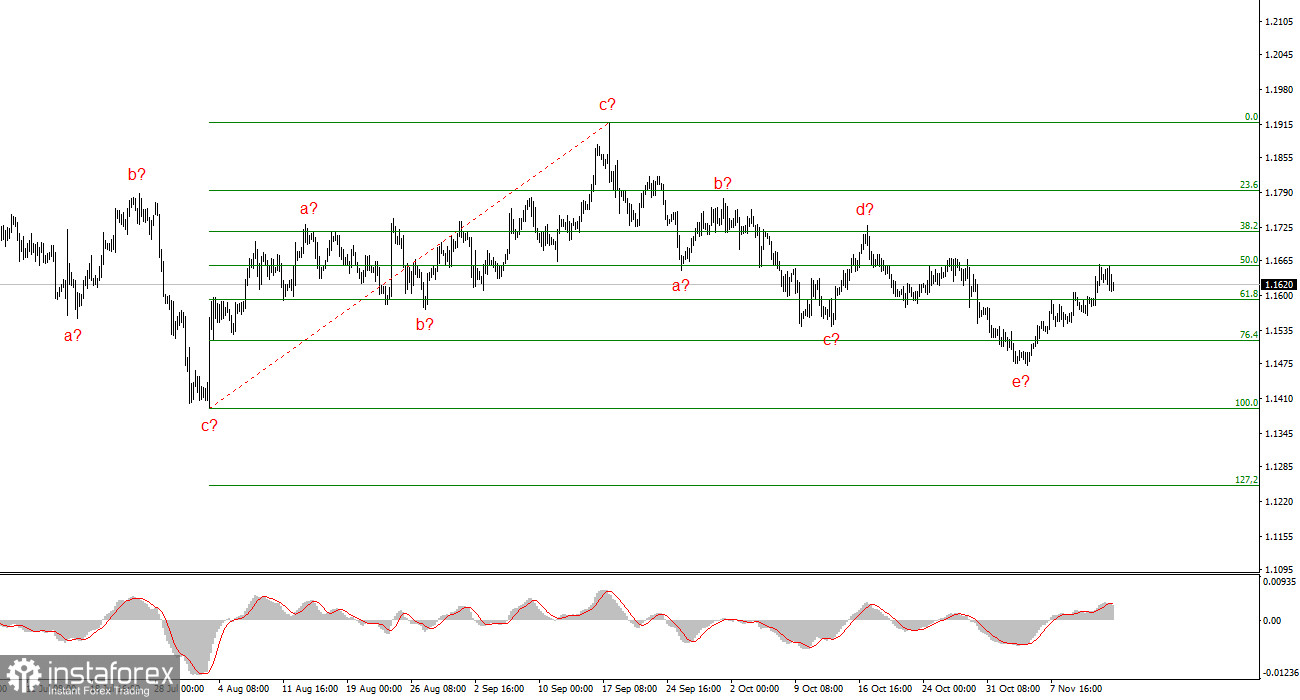

Wave Picture for EUR/USD:

Based on my analysis of EUR/USD, the instrument continues to develop a bullish segment of the trend. In recent months, the market has paused, but Donald Trump's policies and the Federal Reserve remain significant factors that may lead to a decline in the U.S. dollar in the future. The targets for the current segment of the trend could reach the 25 figure. Currently, we are in the construction of corrective wave 4, which is taking a very complex and extended form. Its last internal structure— a-b-c-d-e is presumed to be complete. If this is indeed the case, I expect the instrument to rise with targets around annual highs or near them.

Wave Picture for GBP/USD:

The wave picture for GBP/USD has changed. We continue to deal with a bullish, impulsive segment of the trend, but its internal wave structure has become complex. Wave 4 has taken on a three-wave form, resulting in a very elongated structure. The downward corrective structure a-b-c-d-e in 4 is presumed to be complete. If this is indeed the case, I anticipate that the main wave structure will resume its build-up, with initial targets around the 38 and 40 figures. The key is that the news background needs to be at least a little better than it was this week.

Key Principles of My Analysis:

- Wave structures should be simple and clear. Complex structures are difficult to trade, as they often lead to changes.

- If there's uncertainty in the market, it's better not to enter it.

- There is never 100% certainty in market direction. Always remember to use protective stop-loss orders.

- Wave analysis can be combined with other forms of analysis and trading strategies.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română