The new week promises new challenges for the British pound. The UK will be the country where several important reports are released, potentially altering the market's perceptions of the Bank of England's monetary policy. The key report of the week will undoubtedly be the inflation report. It is worth recalling that the consumer price index in Britain has been rising for over a year, but the previous report showed a "status quo," and the new report may indicate a slowdown to 3.6%–3.7% year-on-year. The BoE stated at its last meeting that it expects inflation to slow over the coming years and to return to the 2% target. Therefore, if inflation resumes its movement toward the target, it could serve as a basis for the BoE to conduct another round of easing in monetary policy.

The vote on the rate in the MPC committee at the beginning of November ended with a narrow margin for the "loyalists." If the next inflation report (for October) shows a slowdown, there may be more "doves" at the December meeting. This would mean that the interest rate could be lowered for the fourth time in 2025. The question is whether the market has already priced in this event.

We have observed a more extended corrective wave structure than it might have been. Over the past 5–6 weeks, the instrument has been declining. Sometimes there were valid reasons for this, but not always. Consequently, the market might have already priced in the BoE's future decision, especially since predicting it is not difficult. In this case, a decline in October inflation and a rise in "dovish" market sentiment may not lead to a decline in the British currency. However, the market will clearly have reasons to sell the pound.

On Friday, the UK will release data on business activity in the services and manufacturing sectors for November, as well as a report on retail sales. It is likely that these figures will not be encouraging, as the economic statistics from Britain have disappointed throughout this week.

Wave Picture for EUR/USD:

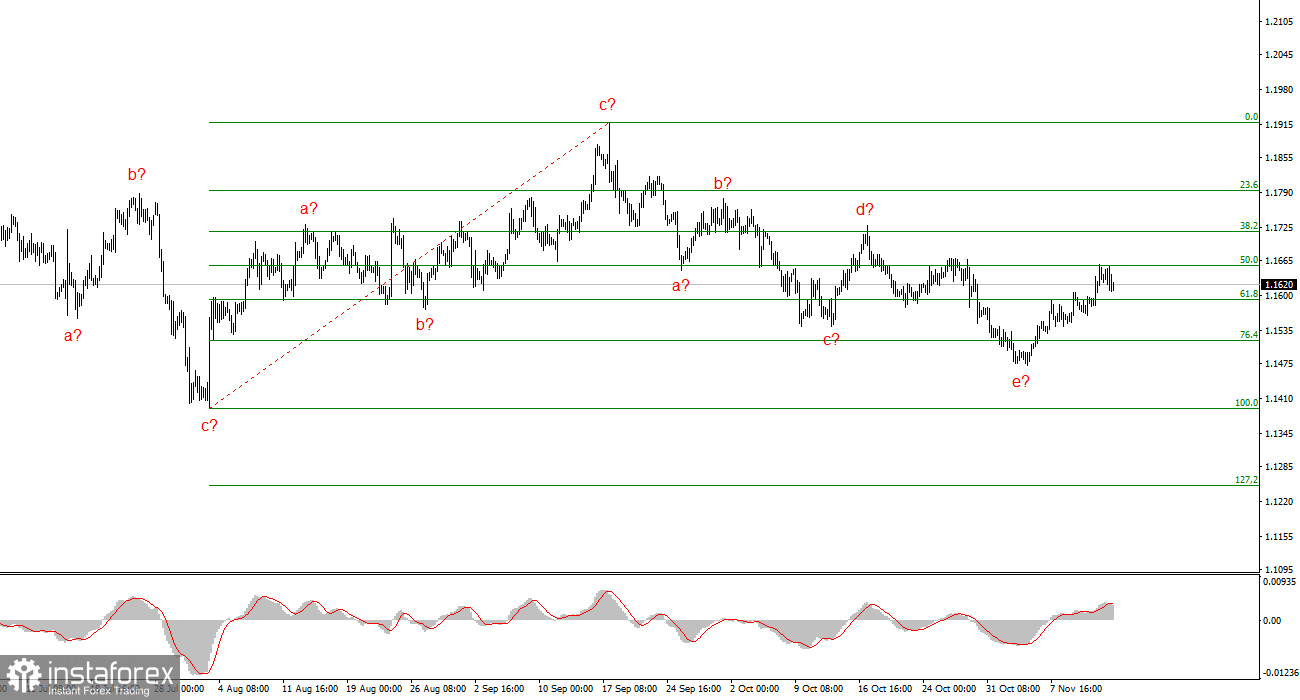

Based on my analysis of EUR/USD, the instrument continues to develop a bullish segment of the trend. In recent months, the market has paused, but Donald Trump's policies and the Federal Reserve remain significant factors that may lead to a decline in the U.S. dollar in the future. The targets for the current segment of the trend could reach the 25 figure. Currently, we are in the construction of corrective wave 4, which is taking a very complex and extended form. Its last internal structure— a-b-c-d-e is presumed to be complete. If this is indeed the case, I expect the instrument to rise with targets around annual highs or near them.

Wave Picture for GBP/USD:

The wave picture for GBP/USD has changed. We continue to deal with a bullish, impulsive segment of the trend, but its internal wave structure has become complex. Wave 4 has taken on a three-wave form, resulting in a very elongated structure. The downward corrective structure a-b-c-d-e in 4 is presumed to be complete. If this is indeed the case, I anticipate that the main wave structure will resume its build-up, with initial targets around the 38 and 40 figures. The key is that the news background needs to be at least a little better than it was this week.

Key Principles of My Analysis:

- Wave structures should be simple and clear. Complex structures are difficult to trade, as they often lead to changes.

- If there's uncertainty in the market, it's better not to enter it.

- There is never 100% certainty in market direction. Always remember to use protective stop-loss orders.

- Wave analysis can be combined with other forms of analysis and trading strategies.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română