Before the weekend, the USD/JPY pair regained some of its earlier losses, rising to levels close to twelve-month highs amid a strengthening dollar.

Market sentiment in the U.S. improved after the temporary government shutdown was partially resolved, though cautious sentiment persists amid uncertainty over the release of delayed economic data following the record-long government shutdown.

\

\

According to U.S. Labor Secretary Lori Chavez-DeRemer, the situation regarding the release of inflation data remains uncertain, as the Bureau of Labor Statistics has been unable to fully gather data on the Consumer Price Index (CPI) for October. This report may never be published. However, the September report has been compiled but still needs to be processed, so it will be published in the upcoming week.

Regarding monetary policy, expectations for a Federal Reserve interest rate cut have decreased, as several Fed officials have confirmed their commitment to fighting inflation. Specifically, according to the CME FedWatch tool, the likelihood of a rate cut in December has decreased to about 43% (down from 49% a month ago), indicating a continued tighter policy stance.

Kansas City Fed President Jeffrey Schmid noted that monetary policy should be based on demand growth, adding that current measures are "moderately restrictive" and fully align with objectives. In choosing policy, he focuses on the overall inflation level.

In Japan, the yen remains under pressure amid new signals from the government team led by Prime Minister Satsuki Takaito, who indicated intentions to pursue a more aggressive fiscal policy. Combined with the Bank of Japan's cautious approach to tightening monetary policy, this keeps the currency in a state of uncertain tension.

According to Japan's Finance Minister Sotaki Kayamba, the negative consequences of a weak yen are becoming more apparent, and the government will continue to closely monitor currency fluctuations, ready to intervene if necessary.

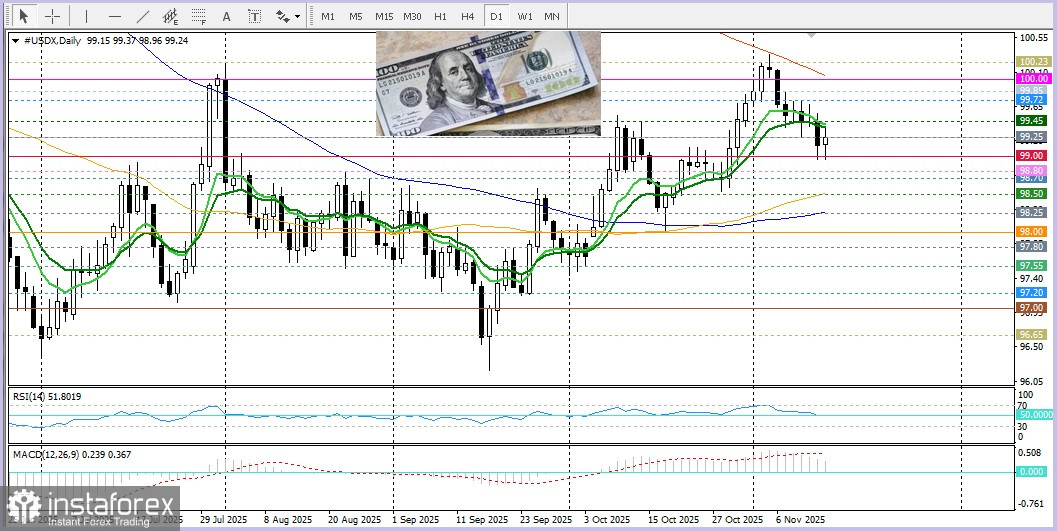

From a technical perspective, the breakout above 154.50 last week was seen as a key trigger for bulls. Additionally, oscillators on the daily chart remain in positive territory and are far from overbought zones. However, failures to break the psychological level of 155.00 require caution before planning to open long positions.

On the other hand, a decline in the pair can be viewed as a buying opportunity, subject to the round level at 154.00. However, a convincing breakthrough of this level would trigger technical sales, pushing the USD/JPY pair down to the support level of 153.65, on the path to the round level of 153.00. A drop below this level would shift the probabilities in favor of bears.

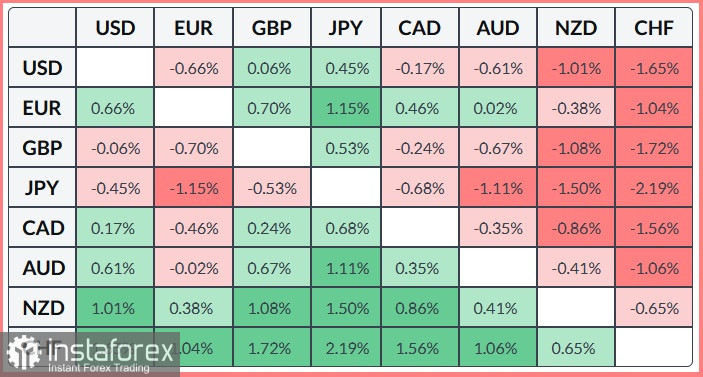

The table below shows the percentage change in the value of the Japanese yen against major currencies over the past week. The Japanese yen demonstrated the greatest strength against the U.S. dollar.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română