Bitcoin can have it all: Wall Street's backing, favorable political winds, and a steady influx of institutional capital. But if no one wants to buy it, it has no choice but to fall. The drop of BTC/USD below $100,000 has amplified fears that the token may be sliding toward a new crypto winter. The deeper the bear market becomes, the more aggressively digital assets are unloaded—not only by crypto whales, but also by the retail crowd.

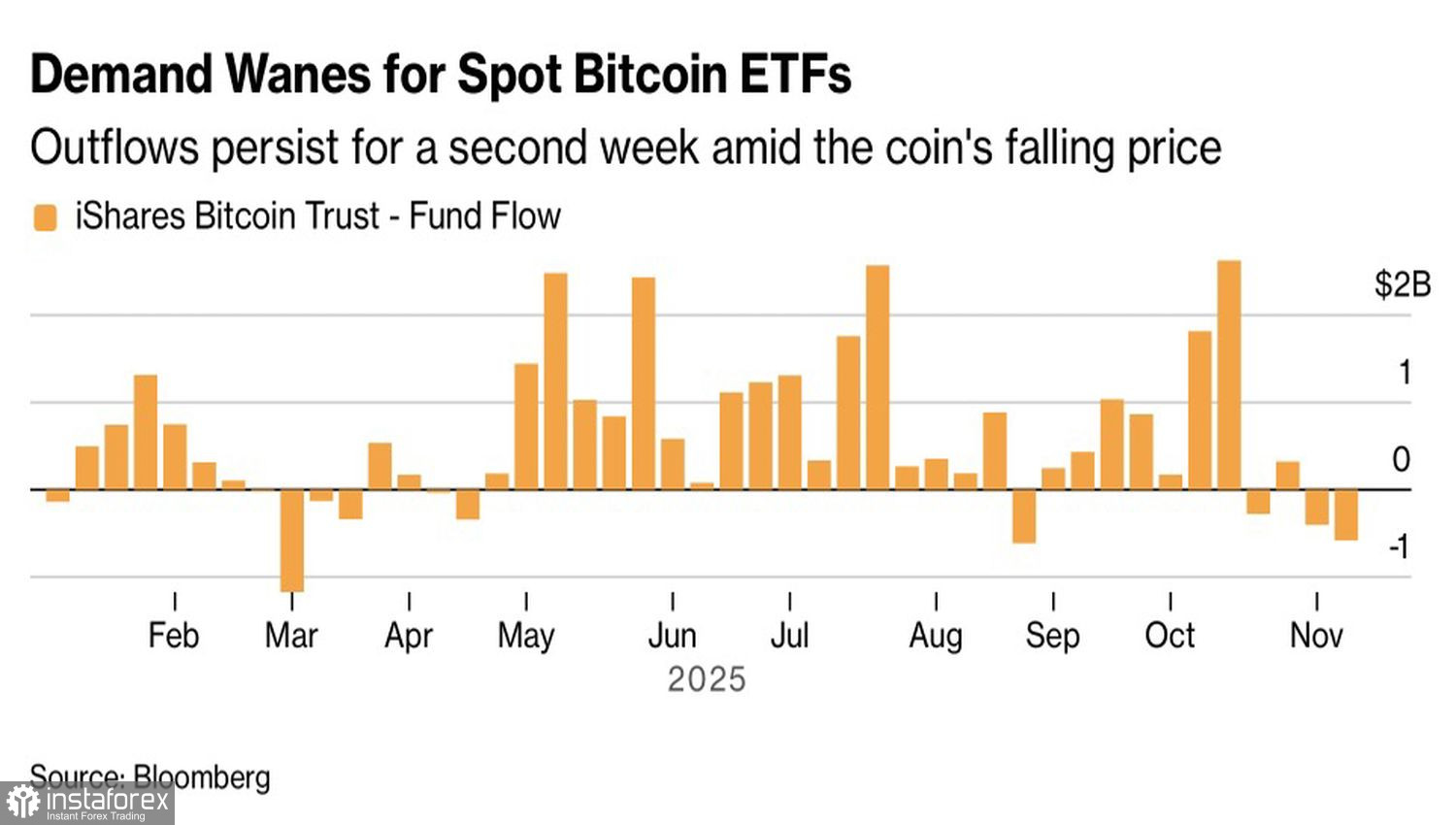

Despite losing $600 billion in market capitalization since its record high in October, Bitcoin is still up 40% since Donald Trump's victory in the presidential election and 5% year-to-date. The problem is that investors have no clear explanation for why BTC/USD is collapsing. Yes, outflows from ETFs and pressure on corporate crypto treasuries are weighing on the market. But these are secondary effects. Without a price decline in the underlying asset, such troubles would not have emerged in the first place.

Capital flows in Bitcoin ETFs

Seeking answers, traders are looking back at history. They recall that Bitcoin halving—when mining rewards are cut in half—has typically triggered a sharp rally followed by a severe correction. Investors do not want to get caught in the trap where BTC/USD crashes by 50% or more, so they prefer to sell early. This, in turn, accelerates the decline.

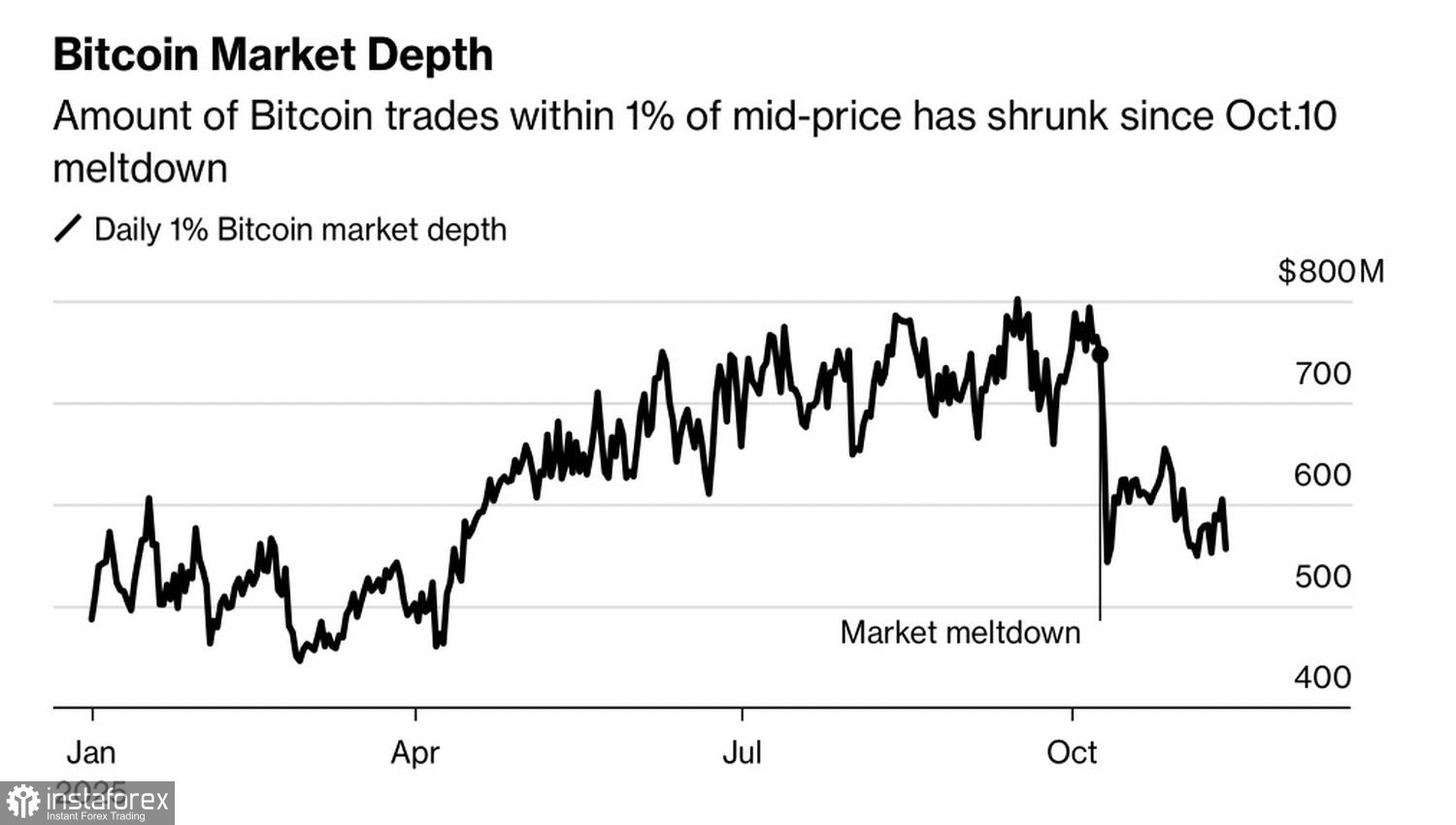

Data from the Deribit exchange shows that demand for put options with strike prices of $90,000 and $85,000 is significantly higher than interest in call options with strikes of $120,000 and $140,000. At the same time, overall crypto-market liquidity is deteriorating. Its capacity to absorb 1% sell orders has fallen by approximately 30% compared with its 2025 peak.

Crypto-market liquidity trends

Alongside fears of a 50% pullback and a prolonged crypto winter, market fatigue is adding to the pressure on BTC/USD. Institutional investors bought Bitcoin as a high-risk component of their portfolios. But its modest year-to-date performance relative to equities—let alone precious metals—has fueled disappointment. As a result, the share of digital assets in investment portfolios is shrinking, dragging prices down.

The downward trajectory of BTC/USD has the conditions to continue. Pessimism is spreading across financial markets. Investors are losing confidence that the Fed will cut interest rates in December, stock indices are tumbling, and global risk appetite is fading. Bitcoin has become the canary in the coal mine. Its sudden collapse signaled that greed is leaving the market. In its place, fear is taking hold.

From a technical standpoint, the daily BTC/USD chart shows a persistent downtrend. Bitcoin prices are diverging further from dynamic resistance levels represented by the exponential moving averages—evidence of strong bearish control. In this environment, it makes sense to use upward pullbacks to establish short positions with targets at 88,000 and 79,500.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română