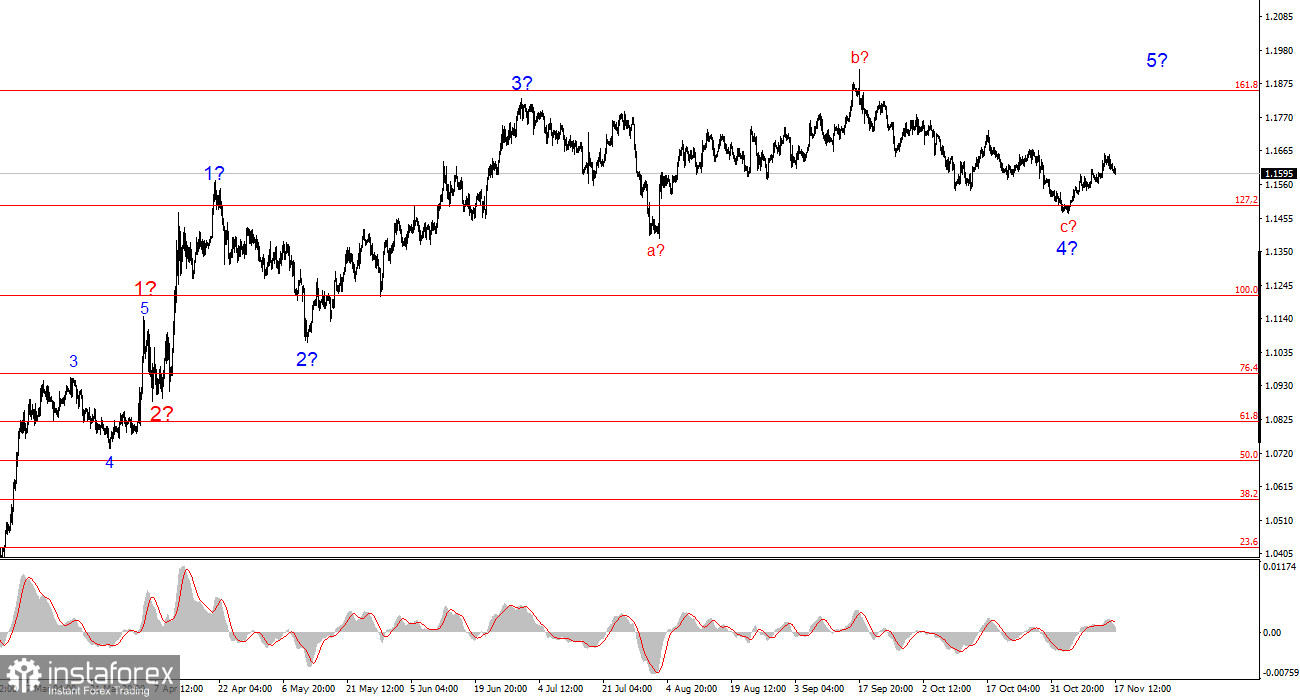

The wave pattern on the 4-hour chart for EUR/USD has changed, but overall remains quite clear. There is no indication that the upward trend segment that began in January 2025 has been canceled, but the wave structure has become significantly more complex since July 1 and has taken on a more extended form. In my view, the instrument is currently forming corrective wave 4, which has taken an unconventional shape. Within this wave, we observe only corrective structures, leaving no doubt that the decline is corrective in nature.

The construction of the upward trend segment continues, while the news background mostly does not support the dollar. The trade war initiated by Donald Trump continues. The president's confrontation with the Federal Reserve may escalate to a new level in 2026. Market expectations for "dovish" Fed policy remain high, especially for next year. The labor market is "cooling." There are no official statistics. I believe the recent strengthening of the dollar is, to some extent, a paradox. But markets do produce paradoxes.

In my view, the upward trend segment is not yet complete, and its targets extend up to the 1.25 level. The series of waves a-b-c-d-e appears complete; therefore, in the coming weeks, I expect the formation of a new upward wave sequence.

The EUR/USD rate declined by 20 basis points during Monday's session. A decline of this scale means nothing. If the market could remain completely flat today, it would have done so. The trading range and market activity in recent weeks have been very weak, and on days with no news at all, what else should one expect? Therefore, I am not concerned about the new strengthening of the U.S. dollar.

Of course, the corrective wave sequence that began on September 17 may become even more complex and extended, since any wave structure can do so at any moment. However, let me remind you: the simpler the structure, the easier it is to work with. That is why I try to identify simple three-wave corrections and five-wave impulse structures on the charts. At this point, we have already seen a complex five-wave correction, which is part of a simple three-wave correction—something that should not have happened at all.

Let me also remind you that the news background in recent months has not been favorable for the U.S. dollar, so the recent decline of the instrument could easily have not occurred—and no one would have been upset. However, the market continues to swing back and forth, clearly preparing for a new powerful movement. Given the current news environment, I personally have no doubts about what direction that movement will take.

General conclusions

Based on the EUR/USD analysis, I conclude that the instrument continues forming an upward trend segment. Over the past few months, the market has paused, but Donald Trump's policies and the Federal Reserve remain significant factors that may weaken the U.S. dollar in the future. The targets of the current trend segment may extend up to the 1.25 level. At the moment, corrective wave 4 is still developing and has taken a very complex and extended shape. Its most recent internal structure—a-b-c-d-e—is presumably complete. If this is indeed the case, I expect the instrument to rise toward targets located near yearly highs.

On the smaller scale, the entire upward trend segment is visible. The wave pattern is not the most standard, as the corrective waves differ in size. For example, the larger wave 2 is smaller than the inner wave 2 of wave 3. However, this also happens. Let me remind you that it is best to identify clear structures on the chart rather than trying to label every wave. At present, the upward structure is not in doubt.

The main principles of my analysis:

- Wave structures should be simple and clear. Complex structures are difficult to trade and often lead to changes.

- If you are not confident in what is happening in the market, it is better not to enter it.

- There can never be 100% certainty in market direction. Don't forget protective Stop Loss orders.

- Wave analysis can be combined with other types of analysis and trading strategies.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română