Stephen Jen, head of the London investment fund Eurizon SLJ Capital and author of the "Dollar Smile Theory," believes that the U.S. currency will lose an additional 13.5% of its value on top of the 7% it has already lost. This pertains specifically to the dollar index. Against the euro, the dollar has declined by 13% in 2025. Consequently, the dollar's losses over the next three years could be much more pronounced.

This economic theory explains the cycles of growth and decline of the U.S. dollar. Jen asserts that the U.S. dollar strengthens in two scenarios: when the U.S. economy is extremely strong or when it is in a deep recession. During periods of moderate economic growth in the U.S., the dollar typically weakens.

The theory posits that during periods of strong economic growth, the dollar rises due to an influx of investments driven by investor optimism and confidence in the future of the American economy. Conversely, during recessions, the dollar strengthens due to its status as a "safe haven," attracting investors seeking reliable assets to preserve their capital amid high uncertainty and financial crises. When U.S. economic growth is weak and other countries surpass the U.S., demand for the dollar declines.

Interestingly, while Deutsche Bank forecasts an economic crisis in 2026, Jen believes that the global economy will accelerate in the coming years, which could backfire on the dollar. However, this factor is not the only one that matters. Jen highlights the same factors contributing to the decline of the dollar that many other analysts (myself included) have noted: the utterly unpredictable trade policy of Donald Trump and the anticipated significant easing of monetary policy by the Federal Reserve (especially in comparison to the European Central Bank). Jen also points out that market activity declined in October due to the shutdown, even as the dollar had its second-best month in 2025.

The fund manager also reminds us that Trump needs a "weak" dollar, as it helps reduce costs for American industry and enhances the export attractiveness of U.S. goods. As seen, Jen has listed all the factors contributing to the future decline of the dollar that I frequently discuss.

In summary, the outlook for the dollar's trajectory remains pessimistic, driven by economic and political uncertainties that could weigh heavily on its value in the coming years.

Wave Picture for EUR/USD:

Based on my analysis of EUR/USD, the instrument continues to develop a bullish segment of the trend. In recent months, the market has paused, but Trump's policies and the Fed remain significant factors in the U.S. dollar's future decline. The targets for the current segment of the trend could reach the 25 figure. Currently, we are in the process of constructing corrective wave 4, which is taking a very complex and extended form. Its last internal structure— a-b-c-d-e is presumed to be complete. If this is indeed the case, I expect the instrument to rise with targets around annual highs.

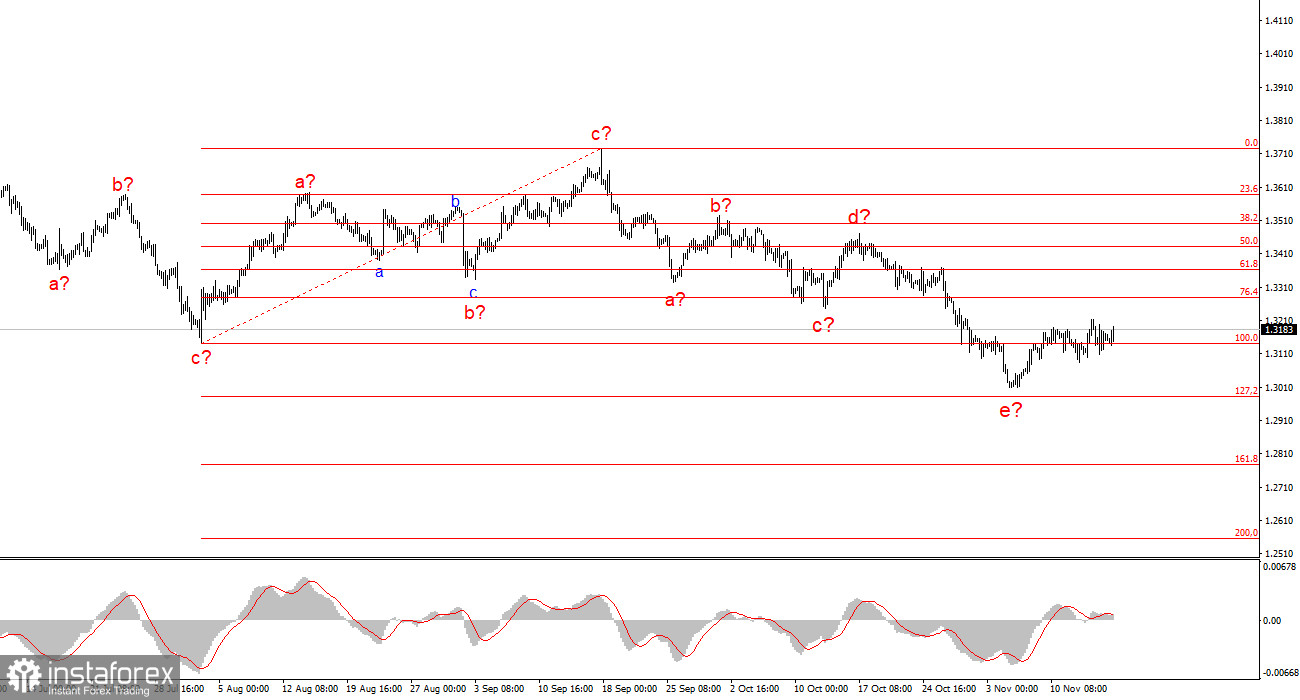

Wave Picture for GBP/USD:

The wave picture for GBP/USD has changed. We continue to deal with a bullish, impulsive segment of the trend, but its internal wave structure has become complex. Wave 4 has taken on a three-wave form, resulting in an elongated structure. The downward corrective structure a-b-c-d-e in wave 4 is presumed to be complete. If this is indeed the case, I anticipate the main wave structure will resume its development, with initial targets around the 38 and 40 levels. The key is that the news backdrop should be slightly better than it was this week.

Key Principles of My Analysis:

- Wave structures should be simple and understandable. Complex structures are difficult to trade and often lead to changes.

- If there's market uncertainty, it is better not to enter.

- There is never 100% certainty in market direction. Always remember to use protective stop-loss orders.

- Wave analysis can be combined with other forms of analysis and trading strategies.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română