The GBP/USD currency pair traded very calmly on Monday as well. It is not surprising since there were no significant events or reports scheduled for the first trading day of the week. Donald Trump did not announce new tariffs, and Federal Reserve representatives have already expressed their views on the December meeting. In short, without compelling reasons, the FOMC committee is not ready to vote for a third round of monetary policy easing. This includes everyone except for Stephen Miran, who is troubled by the U.S. labor market, for which there are currently no data.

It should also be noted that this week, macroeconomic data on the U.S. labor market, including job vacancies and unemployment, may resume publication. The Bureau of Statistics has resumed operations, and data may begin to flow into the market again in due course. However, it is currently difficult to say when this will happen. The market may be simply waiting for information.

The British pound sterling has only been declining for the past month and a half. While the European currency depreciated within a sideways channel, making its decline seem like mere market noise amid a long-term flat, the British pound has been falling with a sense of awareness of what is happening. To put it very briefly, about half of the pound's decline was provoked by one person – the UK's Chancellor of the Exchequer, Rachel Reeves. She began putting pressure on the pound last summer, breaking down in tears in Parliament during another meeting and facing a barrage of criticism over the strange financial budget for the upcoming year. As it later turned out, this marked the beginning of a lengthy saga related to the budget.

We do not particularly understand what is so terrible for the British currency and the British economy in a slight increase in taxes, and we remind you that taxes are increasing everywhere one way or another. For example, Trump in the U.S. imposed a huge number of tariffs on imported goods, and how are these not the same taxes but with a different name? Ultimately, it means that consumers will pay more, whether under the guise of taxes or tariffs – what difference does it make?

However, formally, the market did have grounds to sell the pound, but then began a series of ups and downs. Each new speech by Reeves discussing taxes or the budget caused the pound to plummet. Eventually, Reeves even started to back away from the idea of raising taxes, as the Labour government had indeed promised during the election campaign not to raise taxes. But even this statement was met with pound selling. Thus, regardless of what Reeves said publicly, the pound only suffers from it. If the Chancellor had spoken less frequently, the British currency would have avoided the sharp decline in October and November.

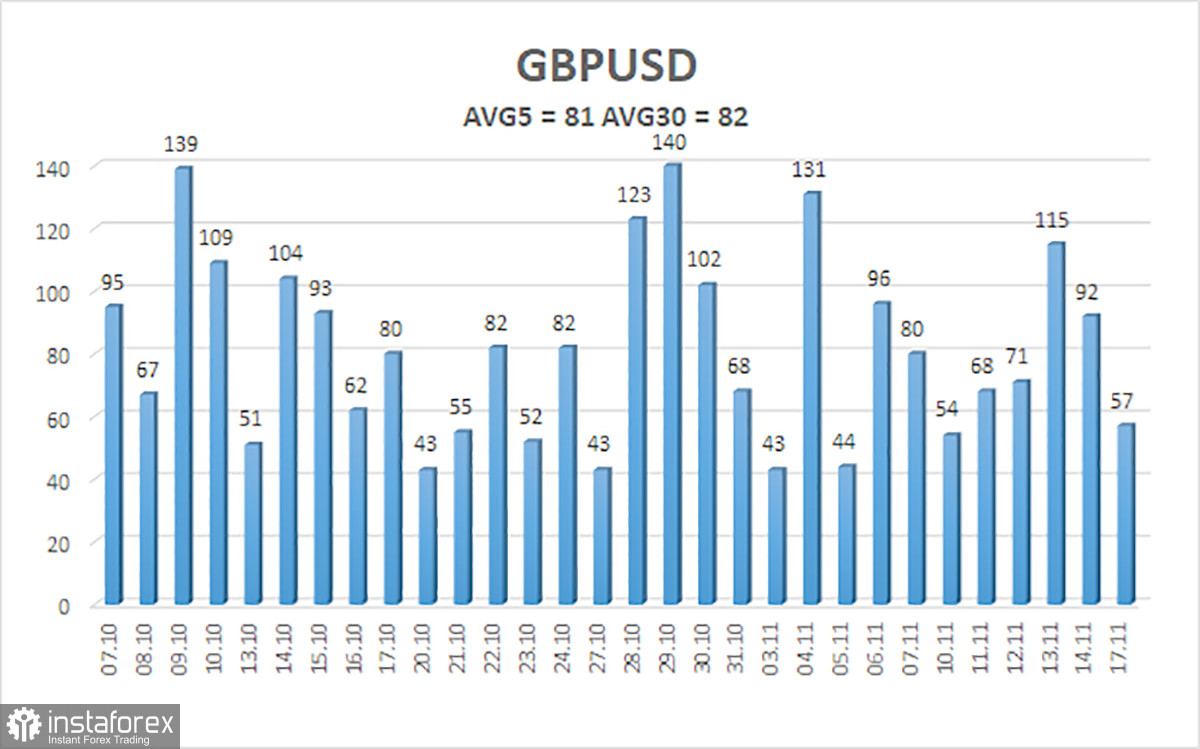

The average volatility of the GBP/USD pair over the last five trading days is 81 pips, which is considered "average" for this pair. Therefore, on Tuesday, November 18, we expect movement within the range bounded by the levels of 1.3089 and 1.3251. The higher channel of linear regression is directed downwards, but only due to technical correction on higher timeframes. The CCI indicator entered the oversold area four times, which warns of the resumption of the upward trend. Another "bullish" divergence has formed, from which the last round of growth began.

Nearest Support Levels:

- S1 – 1.3062

- S2 – 1.2939

- S3 – 1.2817

Nearest Resistance Levels:

- R1 – 1.3184

- R2 – 1.3306

- R3 – 1.3428

Trading Recommendations:

The GBP/USD currency pair is attempting to resume its 2025 upward trend, and its long-term prospects remain unchanged. Donald Trump's policy will continue to exert pressure on the dollar, so we do not expect the American currency to appreciate. Thus, long positions with targets of 1.3306 and 1.3428 remain relevant for the near future while the price is above the moving average. If the price is below the moving average line, small short positions can be considered with targets of 1.3089 and 1.3062 on technical grounds. From time to time, the U.S. currency shows corrections (in the global sense), but for a trend to strengthen, it needs real signs of a resolution to the trade war or other global positive factors.

Explanations for Illustrations:

- Linear regression channels help determine the current trend. If both are directed in the same way, it indicates that the trend is currently strong.

- The moving average line (settings 20,0, smoothed) defines the short-term trend and the direction in which trading should currently be conducted.

- Murray levels are target levels for movements and corrections.

- Volatility levels (red lines) represent the likely price channel in which the pair will spend the following days, based on current volatility indicators.

- The CCI indicator entering the oversold territory (below -250) or overbought territory (above +250) indicates that a trend reversal in the opposite direction is approaching.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română