Yesterday, stock indices closed lower. The S&P 500 fell by 0.92%, while the Nasdaq 100 dropped by 0.84%. The Dow Jones Industrial Average decreased by 1.18%.

Shares were sold off throughout the day, and Bitcoin hit a seven-month low as investors retreated from more risk-sensitive sectors of the market ahead of a week filled with important news, including Nvidia Corp.'s earnings report and a critical jobs report from the United States.

The global stock index nearly fell to a one-month low, while Asian indices decreased by 2.1%, dropping below the 50-day moving average for the first time since April of this year. Some investors perceive this movement as a bearish signal. Futures contracts for the S&P 500, Nasdaq 100, and European stocks also showed further declines.

As investors reduced risks, bonds rose, leading to a decline in the yield on 10-year Treasury bonds to 4.11%.

The decline in cryptocurrencies and the outflow of capital from tech stocks reflect growing concerns about the prospects for the global economy. Expectations of a more aggressive US Federal Reserve policy aimed at curbing inflation are prompting investors to reconsider strategies and reduce risk positions. Uncertainty regarding economic growth rates, along with geopolitical risks, is exacerbating the situation, forcing market participants to proceed with caution. The earnings report from Nvidia Corp., a leader in graphics processing and AI, will be an important indicator of the health of the tech sector. Optimistic results could support the market, while disappointment may amplify negative sentiment.

Equally significant will be the US jobs report, which will provide insights into the labor market. Strong figures could push the Fed to maintain interest rates further, pressuring stocks and cryptocurrencies. Conversely, weak data could signal a slowdown in economic growth and trigger recession concerns.

The steep sell-off of the S&P 500 index continued on Monday. The index closed below the 50-day moving average for the first time in 139 sessions. Economists are raising alarms, heightening concerns that the recent decline could develop into a full-scale correction of at least 10%. The Nasdaq Composite Index is also showing some "unpleasant" signals. Most companies within the index are trading at 52-week lows, indicating underlying market weakness and making further growth unlikely.

Yesterday, Fed Vice Chair Philip Jefferson stated that, in his view, the risks to the labor market are skewed to the downside but warned policymakers to proceed cautiously. Fed Chair Christopher Waller expressed support for a rate cut in December, citing weak employment. Currently, traders estimate the probability of a rate cut next month at around 40%.

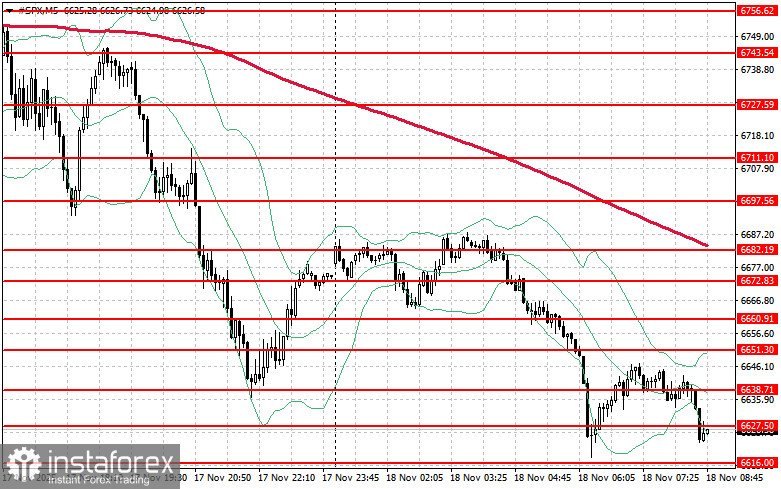

Regarding the technical picture of the S&P 500, the main task for buyers today will be to overcome the nearest resistance level of $6,627. This would help the index gain ground and open the possibility for a move to a new level of $6,638. Another priority for bulls will be to maintain control over $6,651, which would strengthen buyers' positions. In the event of a downturn amid reduced risk appetite, buyers must assert themselves around $6,616. A break below would quickly push the trading instrument back to $6,603 and open the path to $6,590.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română