Analysis of Trades and Trading Tips for the Euro

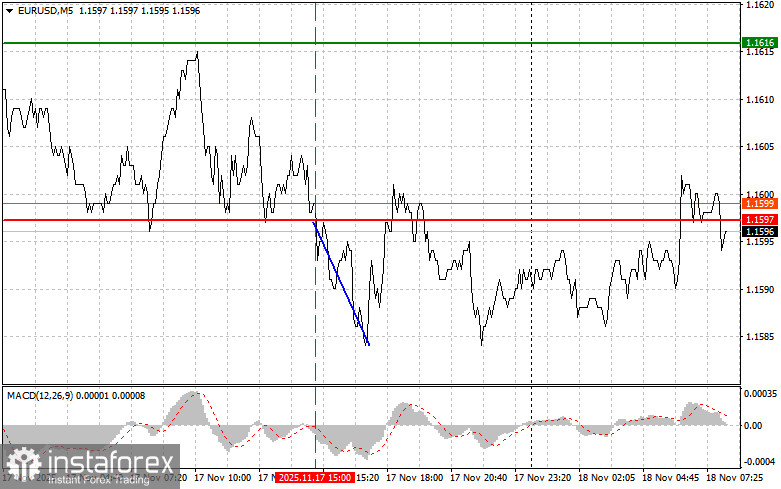

The test of the price at 1.1597 occurred when the MACD indicator was starting to move down from the zero mark, confirming the correct entry point for selling the euro. As a result, the decline was only about 10 pips.

Yesterday's positive results for the Empire Manufacturing Index in the States, which exceeded economists' forecasts by more than two times, along with comments from Federal Reserve representatives regarding their further approach to monetary policy easing, supported the U.S. dollar. However, the future dynamics of the dollar will likely depend on U.S. macroeconomic data, which everyone is eagerly awaiting.

The absence of economic reports from the Eurozone today sadly suggests that the EUR/USD pair will trade within a narrow range. Trading volumes are also likely to remain modest, as major market players will wait for the release of more significant economic indicators. In such an uncertain situation, where fundamental drivers are absent, technical analysis becomes particularly important. However, even in a calm market, sudden shocks cannot be ruled out. Unforeseen political statements, geopolitical events, or even unverified information can cause sharp, albeit short-term, fluctuations in the exchange rate.

Regarding the intraday strategy, I will primarily rely on the execution of Scenario #1 and Scenario #2.

Buy Scenarios

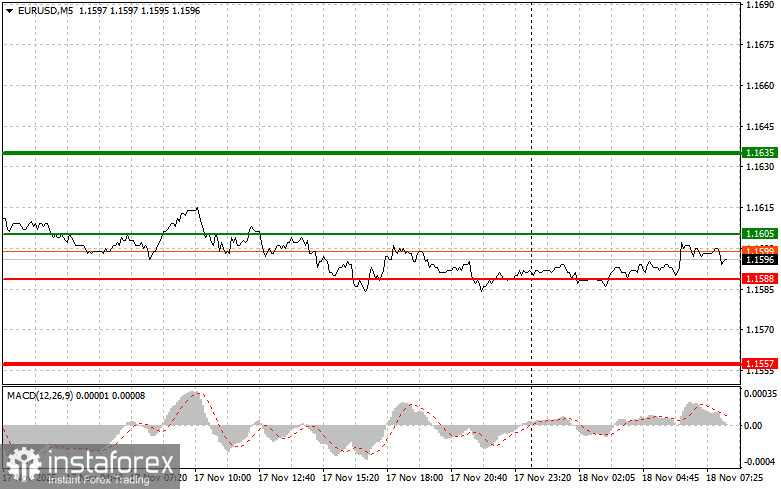

- Scenario #1: Today, you can buy euros at a price around 1.1605 (green line on the chart), with a target of 1.1635. At 1.1635, I plan to exit the market and sell the euro back, anticipating a move of 30-35 pips from the entry point. One can expect the euro to rise within the uptrend. Important! Before buying, ensure the MACD indicator is above the zero mark and just beginning an upward move from it.

- Scenario #2: I also plan to buy euros today if there are two consecutive tests of 1.1588 when the MACD indicator is in the oversold area. This will limit the pair's downward potential and lead to a reversal of the market upward. A rise can be expected to the opposite levels of 1.1605 and 1.1635.

Sell Scenarios

- Scenario #1: I plan to sell euros after reaching the level of 1.1588 (red line on the chart). The target will be 1.1557, where I plan to exit the market and immediately buy back (anticipating a 20-25-pip move in the opposite direction from the level). Pressure on the pair will return upon breaching important support levels. Important! Before selling, ensure that the MACD indicator is below the zero mark and is just beginning its downward movement from it.

- Scenario #2: I also plan to sell euros today if there are two consecutive tests of 1.1605 when the MACD indicator is in the overbought area. This will limit the pair's upward potential and lead to a reversal of the market downward. A decline can be expected to the opposite levels of 1.1588 and 1.1557.

What the Chart Shows:

- Thin Green Line: Entry price for buying the trading instrument.

- Thick Green Line: Estimated price where Take Profit can be set or where profit can be secured, as further increases above this level are unlikely.

- Thin Red Line: Entry price for selling the trading instrument.

- Thick Red Line: Estimated price where Take Profit can be set or where profit can be secured, as further decreases below this level are unlikely.

- MACD Indicator: When entering the market, it is important to be guided by the overbought and oversold zones.

Important: Beginner traders in the Forex market must be very cautious when making trading entry decisions. It is best to remain out of the market before the release of important fundamental reports to avoid getting caught in sharp price fluctuations. If you decide to trade during news releases, always set stop orders to minimize losses. Without setting stop orders, you can quickly lose your entire deposit, especially if you do not use money management and trade with large volumes.

And remember that successful trading requires having a clear trading plan, similar to the one I presented above. Spontaneous trading decisions based on the current market situation are inherently a losing strategy for intraday traders.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română