Many economists continue to highlight the weakness in the labor market and do not believe in its recovery. There could have been no recovery in September, as the Federal Reserve only resumed monetary policy easing on September 17. In October, America was overwhelmed by a government shutdown, and there may be no data for that month at all. Even if the Bureau of Statistics somehow manages to compile reports, how accurate will they be?

Additionally, at least six Fed officials drew the market participants' attention to inflation last week. Let's do the same. Inflation in America reached its low of 2.3% year-on-year in April of this year, right when Trump first imposed tariffs. Since then, inflation has continued to rise, reaching 3% in September. Some economists expected a faster increase in consumer prices, and I am among them. However, inflation is rising neither too quickly nor so quickly as to be ignored.

When will the next inflation report be released? Looking at event calendars, they currently show the date as December 10. In other words, the Consumer Price Index for October will be released on December 10. What else is scheduled for December 10? The last FOMC meeting of the year. Based on this, the FOMC will have to decide in haste, and they might even be late for the meeting with colleagues to ensure they have time to obtain and analyze the new consumer price data.

In my previous review, I mentioned that it would only be possible to start making more or less reliable forecasts at the beginning of the following month, once labor market data becomes available. However, if at least half of the FOMC officials have spoken in recent weeks about inflation rather than the labor market, then this indicator will determine the Fed's decision. So, what possible rate forecasts can be made if the inflation report is released just hours before the FOMC meeting?

Therefore, I would like to reiterate that any forecast regarding the Fed's decision in December is mere guesswork. The market, economists, and analysts have every right to speculate and make projections, but these should be viewed with the understanding that they may change five more times in the next three weeks.

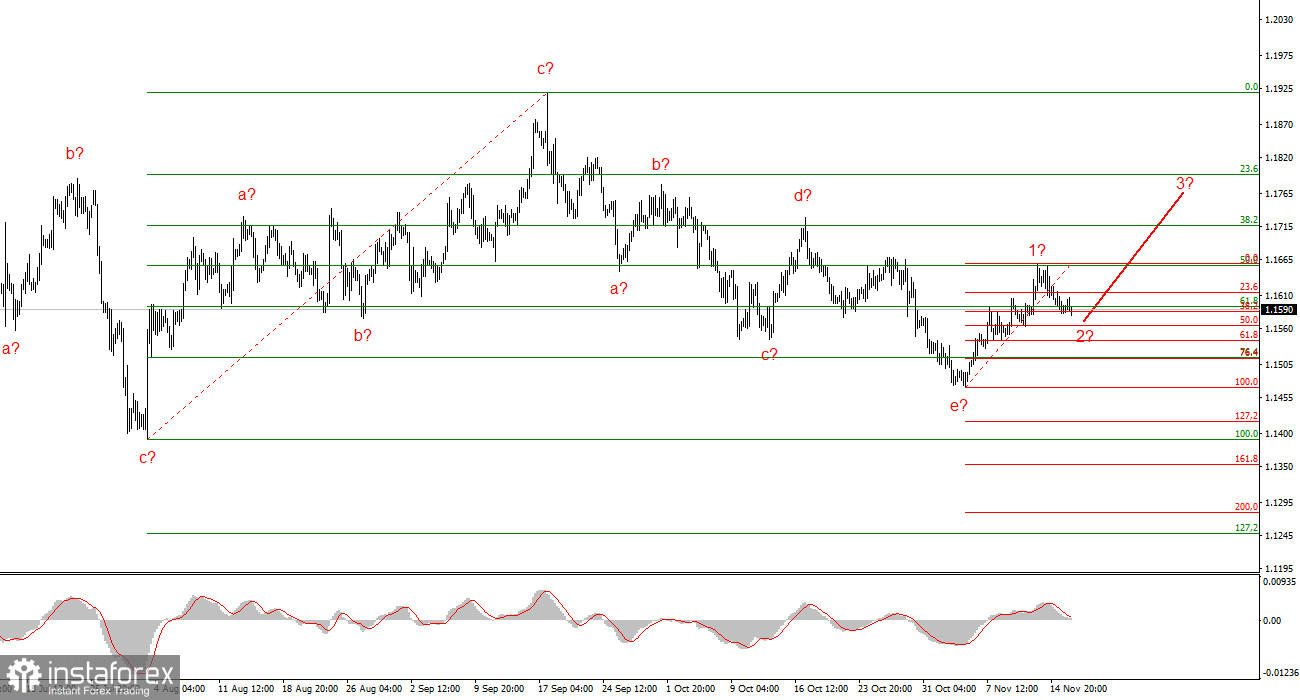

Wave Structure for EUR/USD:

Based on the analysis conducted on EUR/USD, the instrument continues to build an upward section of the trend. In recent months, the market has paused, but Donald Trump's policies and the Fed's remain significant factors in the U.S. dollar's future decline. The targets for the current segment of the trend may stretch all the way to the 25-figure. A building upward wave sequence may begin now. I expect that from the area of 1.1541 – 1.1587, the third wave of this set will start forming, which may be either an impulse wave or a corrective wave. In any case, in the coming days, I am considering buying with targets around 1.1740.

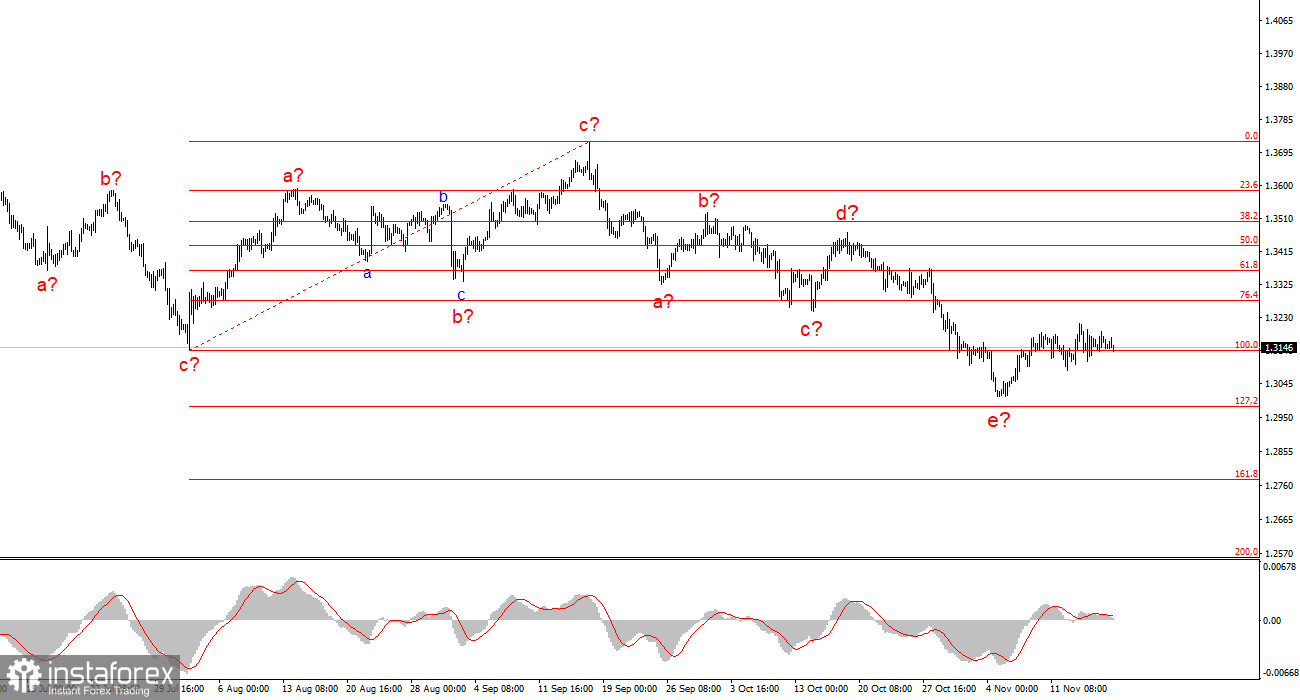

Wave Structure for GBP/USD:

The wave structure of the GBP/USD instrument has transformed. We continue to deal with an upward, impulsive section of the trend, but its internal wave structure has become complicated. Wave 4 has taken on a three-wave form, resulting in a very elongated structure. The downward corrective structure a-b-c-d-e in 4 is presumably complete. If this is indeed the case, I expect the main wave structure to resume its formation with initial targets around 38 and 40 figures. The key is that the news background should be at least a little better than last week.

Key Principles of My Analysis:

- Wave structures should be simple and understandable. Complex structures are challenging to trade, as they often lead to changes.

- If there is uncertainty in what is happening in the market, it's better not to enter it.

- There is and can never be 100% certainty in the direction of movement. Don't forget about protective Stop Loss orders.

- Wave analysis can be combined with other types of analysis and trading strategies.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română