The euro can be criticized and sold, but it should not be underestimated. According to ING, EUR/USD is undervalued by approximately 1%, so weak U.S. labor market data will allow the major currency pair to counterattack. A rate cut in federal funds from 4% to 3.75% in December will again become the baseline scenario for the markets. As a result, the regional currency will finish 2025 at $1.18.

In its latest forecasts for GDP and inflation, the European Central Bank noted that the main risks to the Eurozone economy still include high uncertainty, elevated U.S. tariffs, and a strong euro. However, these factors can start to be viewed from a different perspective. The mention of uncertainty by European companies has fallen below the five-year average. The peak of import tariffs is behind, and they may only decrease. Finally, the regional currency is hardly considered strong, as EUR/USD has been trading in the 1.15-1.175 range for several months now.

Dynamics of Mentions of Uncertainty by European Companies

The U.S. stock market has been ahead for quite some time. Investors have been buying U.S. stock indices due to artificial intelligence technologies and expectations of a Federal Reserve rate cut by the end of 2025. However, the risk of an AI bubble now seems to be the most serious issue, and the central bank may not ease monetary policy.

Investors require diversification, and the European stock market offers an excellent opportunity. Corporate profits and expected earnings are increasing. Uncertainty is declining, the ECB's rates are low compared to those in the U.S., and the economy is about to accelerate under the influence of Germany's fiscal stimulus.

Dynamics of Expected Earnings Per Share

The flow of capital from the U.S. to the EU provides a strong case for buying EUR/USD. However, the major currency pair must first undergo a stress test from the minutes of the October FOMC meeting and the employment statistics for September in the U.S. Bloomberg experts predict an increase in non-farm payrolls from 22,000 to 50,000. Can this be considered progress? Hardly, especially since the October data is unavailable, and the Fed will be unable to assess the dynamics.

It is precisely the central bank's intention to be cautious, given the data vacuum, that allows the futures market to assign less than a 50% chance of easing monetary policy in December. This extends a helping hand to EUR/USD bears. But for how long?

The medium-term prospects for the major currency pair remain bullish. In early 2026, the issue of White House pressure on the Fed to lower rates will resurface. Additionally, the recently concluded longest shutdown in history will lead to a slowdown in GDP growth.

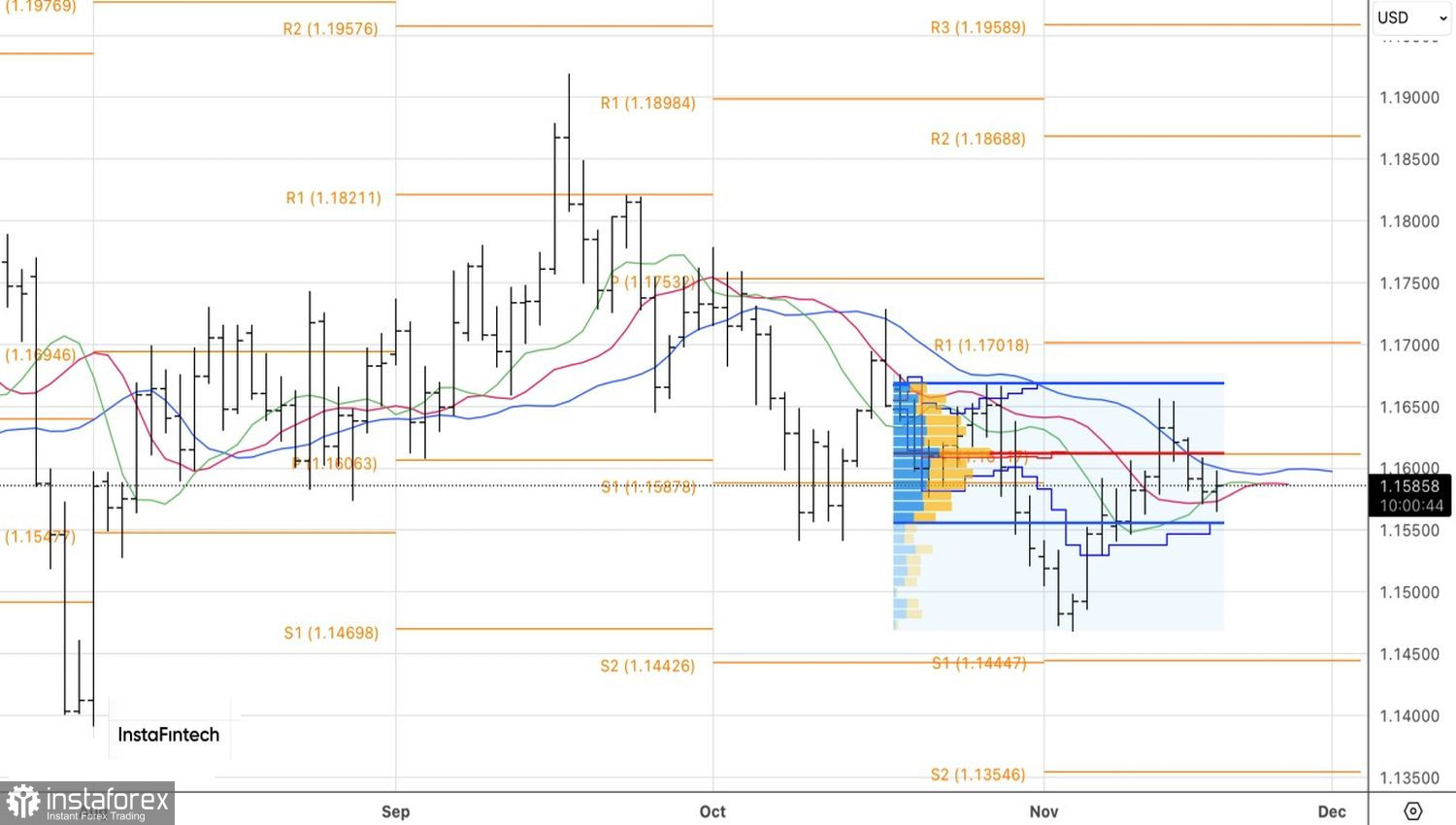

Technically, on the daily chart, the inability of bears to overcome dynamic resistances in the form of red and green moving averages indicates their weakness. Buy positions become relevant on a breakout of the pivot level at 1.0605 and the fair value at 1.1610.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română