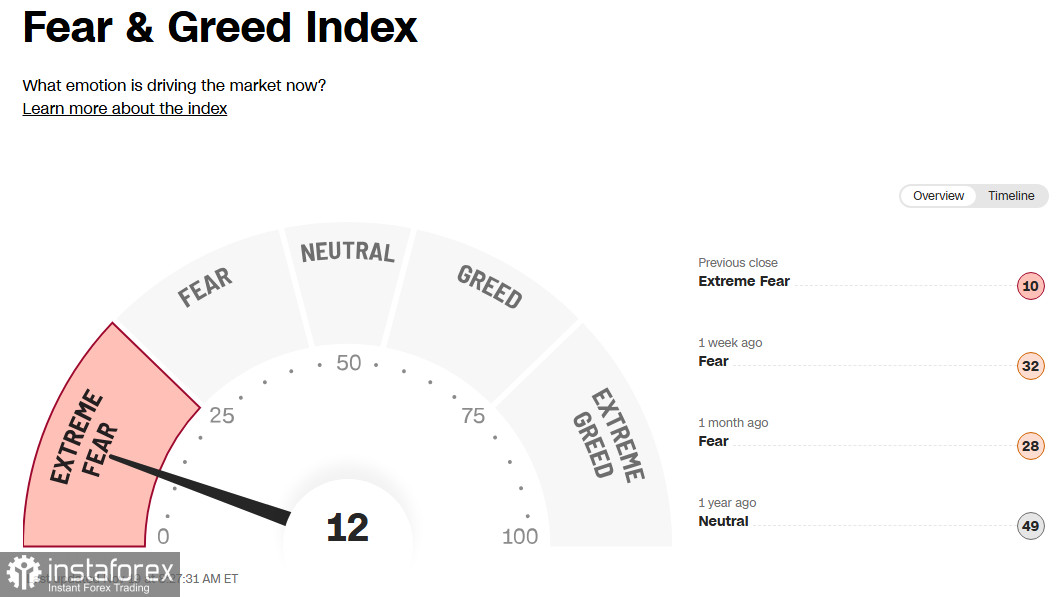

The modern cryptocurrency market continues to be extremely volatile and susceptible to global economic factors. The main concern for investors lies in the uncertainty surrounding the future direction of monetary policy by the US Federal Reserve. Recent statements from Fed Chair Jerome Powell indicate a possible continuation of a tight monetary policy, which creates additional risks for digital assets. The Fear&Greed index remains at an extreme level ("12" out of 100), reflecting a high level of anxiety among market participants.

Investors are fearful of potential economic shocks, such as a new escalation in trade conflicts between the US and China, the threat of recession, and high lay-off figures in the US. As of November 2025, American companies have cut 153,000 jobs, nearly double the figure from the previous month. This situation puts pressure on the value of most cryptocurrencies.

Support and resistance factors

Despite negative sentiment, some positive signals continue to emerge. For instance, the launch of the first spot ETF based on the XRP token by Canary Capital has attracted significant attention from traders. The first day of trading showed a substantial influx of capital ($58 million), highlighting the potential of new investment instruments in cryptocurrencies.

At the moment, the XRP/USD pair was trading near the mark of 2.1190, following the overall trend of distress and depression plaguing the entire cryptocurrency market.

The aforementioned initiative to launch the first spot ETF based on the XRP token has not yet been able to reverse the overall negative market trend. However, Ripple appears to be in a more favorable position compared to other popular altcoins and even Bitcoin amid the broader market decline.

Another positive factor is the willingness of the US Senate Banking Committee to review an important bill regulating the cryptocurrency market. This document aims to resolve inconsistencies between various government agencies, such as the SEC and CFTC, and establish clear frameworks for the regulation of digital assets. The passage of the law is expected to be a significant step forward for the industry and improve investor confidence.

Forecasts and growth opportunities

Cryptocurrency market experts generally agree that long-term growth for cryptocurrencies is inevitable.

Key support factors include:

- Halvings: The process of reducing Bitcoin mining will make mining more expensive and increase the asset's scarcity, contributing to price growth.

- Accumulation by governments and major funds: Many states and financial institutions are beginning to view Bitcoin as a means of diversifying risks and protecting against inflation. The US government's project to accumulate Bitcoin in order to partially offset the national debt, which amounts to trillions of dollars, serves as a unique indicator of growing interest from the government.

- Regulation: Legislative initiatives aimed at protecting investors and creating transparent trading conditions enhance confidence in the stability and reliability of the cryptocurrency sector.

Conclusion Thus, despite short-term difficulties and correction periods, long-term growth prospects remain optimistic. Investors are advised to closely monitor key economic indicators from the US and the actions of regulators, as well as take into account historical market trends.

Final thoughts An analysis of the current state of the cryptocurrency market shows that while markets face significant risks and declining investor confidence, there are meaningful factors capable of ensuring sustainable industry development. Regulatory changes, technological innovations, and growing demand for digital currency are forming a foundation for the future prosperity of the cryptocurrency space.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română