The euro, pound, and Japanese yen have all fallen against the dollar.

On Wednesday, the U.S. released the minutes from the October FOMC meeting, where many Federal Reserve officials indicated that it would likely be appropriate to keep interest rates unchanged until the end of 2025. This led to active dollar purchases and a weakening of various risk assets. However, this decision may be revisited depending on incoming economic data, particularly the November and December reports on inflation and employment. If inflation continues to decline along with the labor market, the Fed may reconsider lowering interest rates, which would weaken the dollar.

Today, we will see the Producer Price Index (PPI) for Germany, the monthly Bundesbank report, and the Eurozone Consumer Confidence Index. The German PPI reflects production inflation and can signal potential changes in consumer prices. However, significant deviations from economists' predictions are not expected. The Bundesbank's monthly report traditionally provides a detailed analysis of the current economic situation in Germany, making it a valuable source of information for economists and financiers regarding the largest economy in the Eurozone. The Eurozone Consumer Confidence Index is also an important gauge of consumer sentiment.

For the pound, today will bring only the CBI Industrial Order Expectations report, which will provide a fresh picture of the UK manufacturing sector. Analysts forecast a slight improvement; however, it is essential to keep in mind that a single indicator cannot serve as a reliable predictor for long-term forecasts. Traders should exercise caution and consider a wide range of factors in their decision-making—especially in light of recent confusion surrounding the UK budget, which will be presented in less than a week.

If the data matches economists' expectations, the Mean Reversion strategy will be the best approach. If the figures significantly exceed or fall short of expectations, the Momentum strategy should be used.

Momentum Strategy (Breakout):

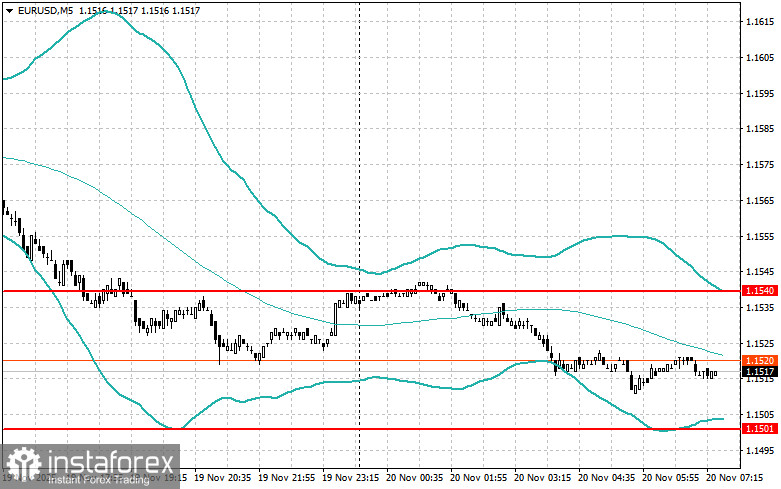

For EUR/USD

- Buy on a breakout at 1.1521, which could lead to a rise in the euro toward 1.1541 and 1.1564.

- Sell on a breakout below 1.1500, which could lead to a decline toward 1.1480 and 1.1460.

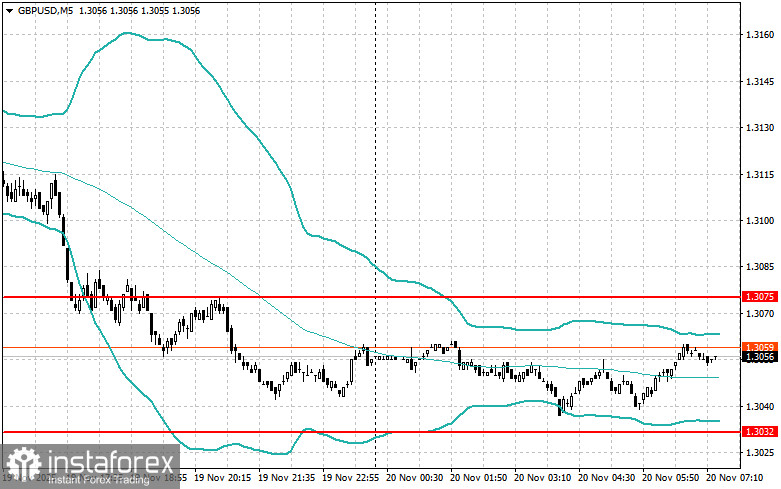

For GBP/USD

- Buy on a breakout at 1.3065, which could lead to a rise in the pound toward 1.3075 and 1.3100.

- Sell on a breakout below 1.3035, which could lead to a decline toward 1.3000 and 1.2975.

For USD/JPY

- Buy on a breakout above 157.70, which could lead to a rise in the dollar toward 158.00 and 158.25.

- Sell on a breakout below 157.35, which could lead to a decline toward 157.00 and 156.65.

Mean Reversion Strategy (Retracement):

For EUR/USD

- Sell after a failed breakout above 1.1540, on a retracement below this level.

- Buy after a failed breakout below 1.1500, on a retracement back to this level.

For GBP/USD

- Sell after a failed breakout above 1.3075, on a retracement below this level.

- Buy after a failed breakout below 1.3032, on a retracement back to this level.

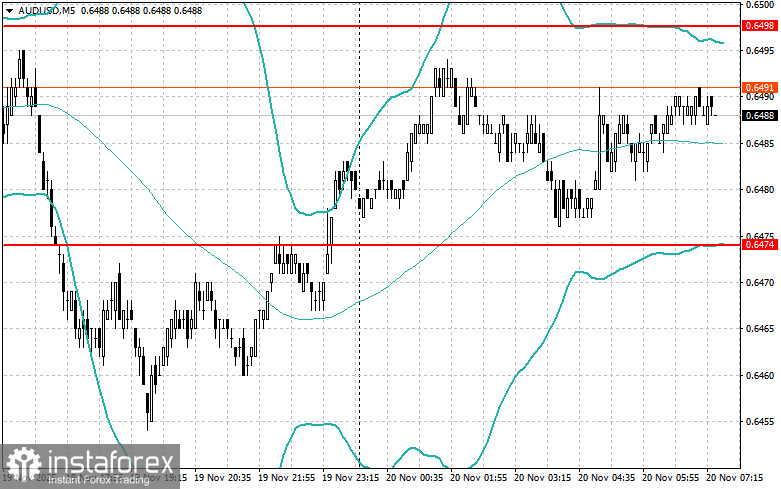

For AUD/USD

- Sell after a failed breakout above 0.6498, on a retracement below this level.

- Buy after a failed breakout below 0.6474, on a retracement back to this level.

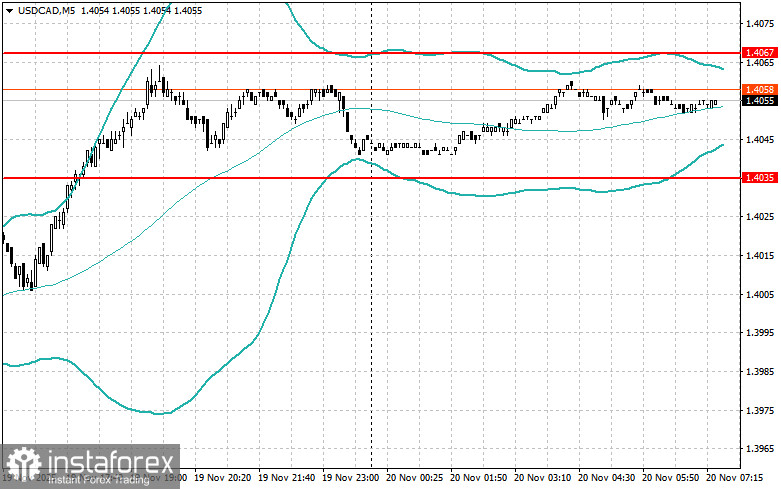

For USD/CAD

- Sell after a failed breakout above 1.4067, on a retracement below this level.

- Buy after a failed breakout below 1.4035, on a retracement back to this level.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română