Analysis of Trades and Tips for Trading the Japanese Yen

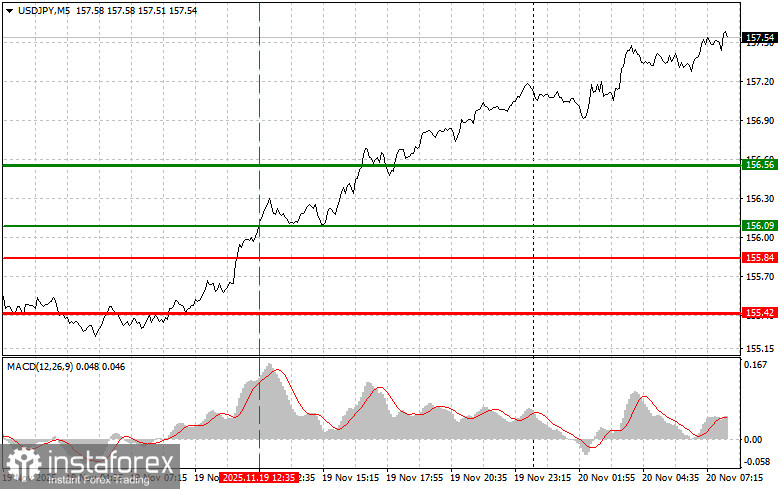

The price test at 156.09 occurred when the MACD indicator had moved significantly above the zero mark, which limited the pair's bullish potential. For this reason, I did not buy dollars and missed a good upward movement.

The Japanese yen fell to a 10-month low against the U.S. dollar following the release of the FOMC minutes from October. Traders saw clear indications that the Federal Reserve might pause rate changes later this year, which strengthened the dollar's position. As USD/JPY rose sharply, Bank of Japan board member Junko Koeda indicated the possibility of a rate hike at the December meeting, emphasizing the need for normalization, but the yen did not respond.

The market seemed to ignore the explicit signal, continuing to focus on global factors, particularly expectations for the Fed's policy. It is clear that for a substantial strengthening of the yen, more convincing evidence of the BoJ's readiness for aggressive normalization is needed, as well as a weakening of the U.S. dollar, which currently seems unlikely. Nevertheless, Koeda's comments highlight the growing pressure on the BoJ. Inflation in Japan consistently exceeds the target level of 2%, and the weakening yen adds to the pressure on households and businesses due to rising import prices. The question is whether the BoJ can find the optimal time and pace for raising rates to avoid negatively impacting economic growth. The upcoming December meeting will be a key indicator of the BoJ's future actions. If the central bank indeed decides to raise rates, this could trigger a sharp yen strengthening and a revaluation of assets denominated in yen. Otherwise, the market may interpret this as a sign of indecision and continue to ignore verbal interventions.

Regarding intraday strategies, I will mainly rely on implementing scenarios #1 and #2.

Buy Scenarios

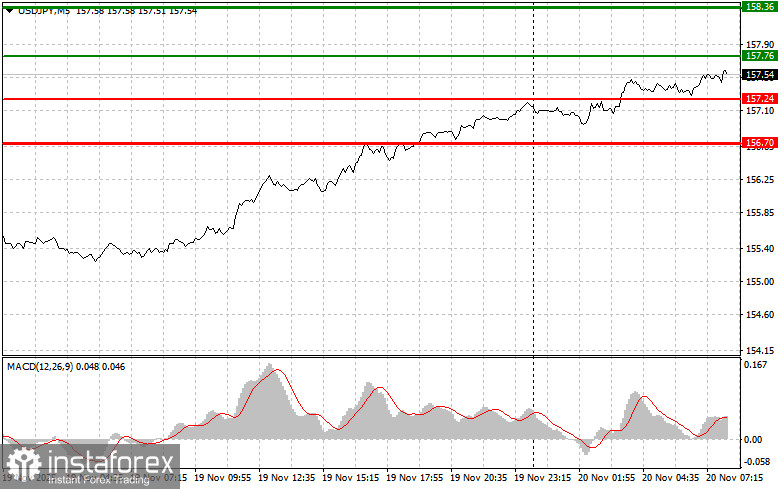

- Scenario #1: I plan to buy USD/JPY today when it reaches an entry point around 157.76 (green line on the chart), targeting a move to 158.36 (thicker green line on the chart). At 158.36, I plan to exit the long positions and open shorts in the opposite direction, targeting a move of 30-35 pips from the entry point. It is best to return to buying the pair on corrections and significant dips in USD/JPY. Important! Before buying, ensure the MACD indicator is above the zero mark and just beginning an upward move from it.

- Scenario #2: I also plan to buy USD/JPY today in the event of two consecutive tests of the price at 157.24 when the MACD indicator is in the oversold area. This will limit the downside potential of the pair and lead to an upward market reversal. Growth can be expected toward the opposite levels of 157.76 and 158.36.

Sell Scenarios

- Scenario #1: I plan to sell USD/JPY today only after it breaches 157.24 (red line on the chart), which will trigger a quick decline in the pair. The key target for sellers will be the 156.70 level, where I plan to exit shorts and open longs in the opposite direction (targeting a 20-25-pip move against the level). It is better to sell as high as possible. Important! Before selling, ensure the MACD indicator is below the zero mark and just starting its downward movement.

- Scenario #2: I also plan to sell USD/JPY today in the event of two consecutive tests of the price at 157.76 when the MACD indicator is in the overbought area. This will limit the upward potential of the pair and lead to a market reversal downward. A decline can be expected toward the opposite levels of 157.24 and 156.70.

What the Chart Shows:

- Thin Green Line: Entry price for buying the trading instrument.

- Thick Green Line: Estimated price where Take Profit can be set or where profit can be secured, as further increases above this level are unlikely.

- Thin Red Line: Entry price for selling the trading instrument.

- Thick Red Line: Estimated price where Take Profit can be set or where profit can be secured, as further decreases below this level are unlikely.

- MACD Indicator: When entering the market, it is important to be guided by the overbought and oversold zones.

Important: Beginner traders in the Forex market must be very cautious when making trading entry decisions. It is best to remain out of the market before the release of important fundamental reports to avoid getting caught in sharp price fluctuations. If you decide to trade during news releases, always set stop orders to minimize losses. Without setting stop orders, you can quickly lose your entire deposit, especially if you do not use money management and trade with large volumes.

And remember that successful trading requires having a clear trading plan, similar to the one I presented above. Spontaneous trading decisions based on the current market situation are inherently a losing strategy for intraday traders.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română