The price of gold closed the week within the same range, as Federal Reserve officials opened the possibility of a rate cut at the December meeting.

In the last three days before the weekend, the price of precious metals fluctuated as traders remained uncertain about future market moves. Statements from Fed officials and the release of new economic data indicate economic stability, a resilient labor market, but high prices.

Comments from John Williams and New York Fed President Stephen Miran were "dovish," increasing the likelihood of a 25 basis point rate cut in December. In contrast, Lorie Logan from the Dallas Fed and Susan Collins from the Boston Fed indicated the need to maintain a restrictive policy and freeze rates until the impact of existing measures is evaluated.

As a result, the probability of a rate cut in December rose to 71% from 31% earlier.

The U.S. economic report showed that business activity remains stable: the S&P Global PMI index fell from 52.5 to 51.9, slightly below expectations. In the services sector, the index rose from 54.8 to 55, exceeding predictions. The business activity index strengthened, and hopes for further rate cuts and the resumption of government operations bolstered investor sentiment.

The University of Michigan's consumer sentiment index rose slightly in November to 51, up from a preliminary reading of 50.3 but down from 53.6 a month earlier, remaining close to the record low seen in June 2022. Inflation expectations fell slightly— to 4.5% over one year (from 4.7%) and to 3.4% over five years (from 3.6%).

The U.S. Bureau of Labor Statistics (BLS) reported that new non-farm jobs increased by 119,000 in September, exceeding expectations of 50,000. The unemployment rate rose from 4.3% to 4.4%, still within forecasts.

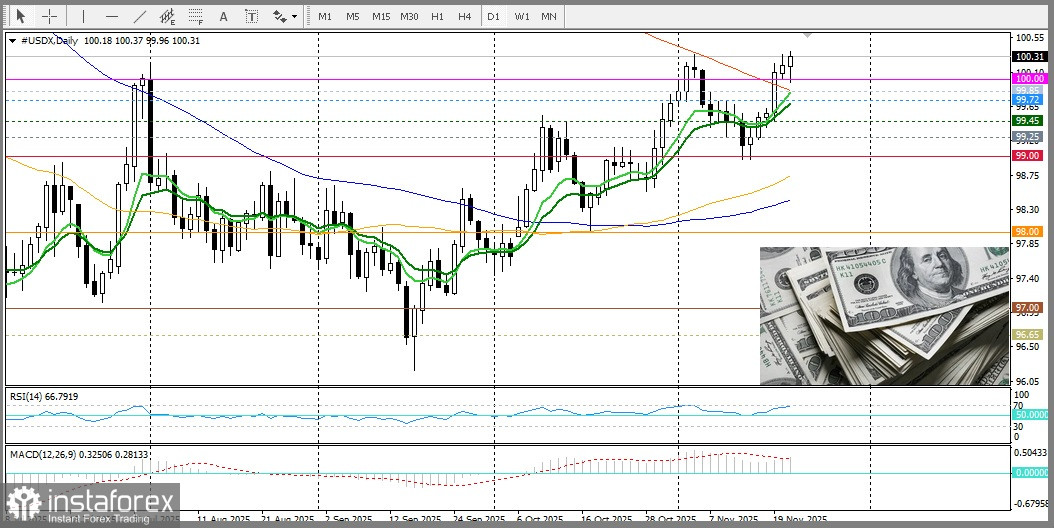

Against this backdrop of economic indicators, the U.S. dollar index (DXY) rose modestly by 0.07% to 100.36.

The yield on 10-year U.S. Treasury bonds remains stable at 4.08%, while real yields fell to 1.84%, which negatively correlates with gold prices.

Nevertheless, concerns about weakening economic dynamics amid the longest government shutdown in U.S. history, as well as ongoing geopolitical uncertainty stemming from the protracted Russia-Ukraine conflict, contribute to limiting further declines in the price of the precious metal.

From a technical perspective, bulls need to overcome the round $4100 level; the next stop would be $4150, after which gold will target the November high at $4250.

Failure to break above $4100 will lead to a decline to $4055, after which the price will accelerate to the $4020 level en route to the round figure of $4000.

Additionally, it's worth noting that oscillators on the daily chart are positive.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română